How do Fmcg consumer products benefit in awesome international sport events

Olympics and all International sports events are a global stage for brands to showcase the latest styles and technical innovations.

The teams’ apparel choices may drive shopper traffic at a time when many sorts and wwekend fun lovers are more likely thinking about their final trip to the beach rather than a new Polo shirt or pair of running shorts.

Millennials are the most likely age group to be looking forward to a sports event, with a whopping 51% planning to watch live on TV.

The fact they’re as likely as boomers to say this means the Soccer audience this year still skews older, but millennials are flocking to it like never before. They’ll also be tuning in across multiple channels.

According to our GWI Sports dataset, those typically following or watching the Summer Olympics in the U.S. and UK skew older. In fact, boomers are usually the biggest fans with 7 in 10 of them expressing an interest in the Games, compared to 6 in 10 of millennials.

With half in the UK and 6 in 10 in the U.S. supporting all Kinds of sports it’s unlikely this love will hurt viewership rates.

This is because appetite for the event is high (45% are looking forward to it), but the general demand for live attendance isn’t.

Compared to their counterparts from other age groups, millennials are much more likely to engage with a brand if it sponsors their favorite team (36%) and to go on to purchase its products after (46%).

For sports apparel retailers, “the Olympics are the new fashion week runway,” says Simeon Siegel, retail analyst with Nomura.

Nike, the official sponsor for the United States Olympic Committee, has more than 100 Team USA products for sale, plus more specialized merchandise such as the jackets athletes will wear on the medal stand. Stores will have Olympics gear front-and-center as the games get underway. Under Armour launched a “country pride” collection that includes T-shirts with phrases such as “Home of the Brave” and sports bras emblazoned with “USA.”

Officially London 2012 gave the UK economy the boost it needed to come out of its double-dip recession. According to the Office of National Statistics (ONS), UK gross domestic product (GDP) grew by 1% in the three months from July to September – the biggest quarterly increase in four years. ONS also said that Olympic ticket sales added 0.2% to the quarter’s GDP.

However, even the ONS said that, beyond the effect of ticket sales, it was hard to put an exact figure on the Olympic effect, despite the fact that many have tried. Figures compiled by retail analysts at Nielsen suggest this effect had sparked a junk food binge, with sales of fizzy drinks, sweets and crisps rising 10% in value compared to the same period last year.

Officially London 2012 gave the UK economy the boost it needed to come out of its double-dip recession. According to the Office of National Statistics (ONS), UK gross domestic product (GDP) grew by 1% in the three months from July to September – the biggest quarterly increase in four years. ONS also said that Olympic ticket sales added 0.2% to the quarter’s GDP.

However, research conducted by SymphonyIRI Group for the period running up to and during the Olympics and Paralympics tests the theory that the Olympics had a big impact on such sales.

In fact, taken by category, volume sales of crisps and snacks (not including nuts), plus confectionery (including assortments) and carbonated drinks (excluding energy brands), were falling year-on-year (YoY) by 3% over the period six weeks before the Olympics.

Growth increased by 1.1% for the three weeks across the Olympics and then went into decline again for the six weeks following the Olympics, by -1.3%. So we have not turned into a nation of permanent convenience food junkies.

Winning Wimbledon could be worth as much as £15 million, perhaps even substantially more – the prize-money of £10.35m is just the start of the financial rewards for success on the grass

Players’ contracts with each sponsor can vary from low four figures to more than £16m a year

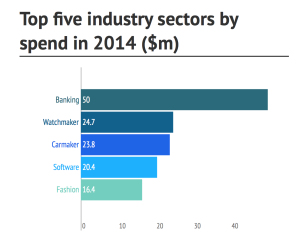

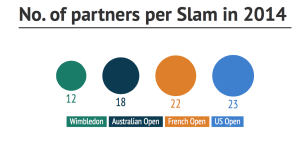

Tennis and the sponsorship revenue generation of the four Grand Slams

The four Grand Slams in tennis produced approximately $268 mio. in sponsorship income in 2014 (Sport Marketing Frontiers, 2014). The strong presence of tennis in the commercial sports landscape in the US and the ability to continuously innovate its sponsorship solutions is reflected in the fact that the US Open comes in as no. 1 measured on sponsorship revenues with approximately $89.5 mio.

However,beyond the effect of ticket sales, it was hard to put an exact figure on the celebratory effect, despite the fact that many have tried. Figures compiled by retail analysts at Nielsen suggest this effect had sparked a junk food binge, with sales of fizzy drinks, sweets and crisps rising 10% in value compared to the same period last year.

Revenue Sources for IPL teams IPL Economy

There are several sources through which IPL generates its revenue. Some of the best and most important sources have been described below:

Media Rights

Media rights are the main and important source of revenue for any IPL team. For some teams, it is about 60% of their total revenue. BCCI sells Media rights or broadcasting rights to Channels. BCCI distributes revenue earned from media rights between teams after excluding their share from it. Sony Entertainment and Star India are two broadcasters who gained media rights of IPL in different seasons.

Official Sponsors- Rs 210 Crore

The list of official sponsors of IPL 2022 includes names like Dream11, Unacademy, Rupay, CRED, Upstox and Tata Safari. Collectively, these groups will pay Rs 210 crore as the official sponsor fee to the BCCI.

Umpire Sponsors- Rs 28 Crore

The umpire sponsors, PayTM, will pay Rs 28 crore for owning the rights to advertise.

Strategic Timeout Sponsor- Rs 30 Crore

CEAT, this year’s official strategic timeout sponsor will pay Rs 30 crore to BCCI.

In fact, taken by category, volume sales of crisps and snacks (not including nuts), plus confectionery (including assortments) and carbonated drinks (excluding energy brands), were falling year-on-year (YoY) by 3% over the period six weeks before the event.

Growth increased by 1.1% for the three weeks across the yearly event and then went into decline again for the six weeks following the Olympics, by -1.3%. So we have not turned into a nation of permanent convenience food junkies.

Average weekly volume sales of these products were -6% lower for the six weeks after the Games than in the six weeks before, although it could be argued that some of this effect was also seasonal.

The weather also had an incontrovertible impact on sales of all kinds of groceries, not just some convenience foods. This impact must also be factored into any assessment of how much of a boost the event delivered. .

SymphonyIRI weekly unit sales data from all outlets during this time showed top line trends varied much more in line with the weather than with the timing of London 2012, as it improved for the fortnight before and during the Olympics (when the sun came out) and then deteriorated again leading up to the Paralympics.

“Entertainers don’t get paid by the hour. They get paid, period. If Elton John does a concert, it could last one hour or four hours. It’s a done deal.”

Another economic facet of International Sports Events is endorsement/advertisement deals. Most of the top players and sometimes the not so top, but glamorous or good looking players (someone like Sachin Tendulkar Maradona Roger Federer Tiger woods Jordan or Kournikova) make a majority of their money from sponsorship deals.

Sponsorship on the rise as golf participation rates fall

“The attraction for companies is that, because of the handicapping system, anyone can play with anyone,” he says.

Nike’s £150m 10-year deal with Rory McIlroy was the most lucrative endorsement in British sport. Unlike football, where sponsorships can find a clash between club and player, in golf, as in tennis, Nike has full control of McIlroy’s image.

However, he remains behind Tiger Woods and Phil Mickelson in that year’s league table of annual sponsorship income.

However, even the ONS said that, beyond the effect of ticket sales, it was hard to put an exact figure on the Olympic effect, despite the fact that many have tried. Figures compiled by retail analysts at Nielsen suggest this effect had sparked a junk food binge, with sales of fizzy drinks, sweets and crisps rising 10% in value compared to the same period last year.

However, research conducted by SymphonyIRI Group for the period running up to and during the Olympics and Paralympics tests the theory that the Olympics had a big impact on such sales.

In fact, taken by category, volume sales of crisps and snacks (not including nuts), plus confectionery (including assortments) and carbonated drinks (excluding energy brands), were falling year-on-year (YoY) by 3% over the period six weeks before t every event.

Sports events have not turned into a nation of permanent convenience food junkies.

Average weekly volume sales of these products were -6% lower for the six weeks after the Games than in the six weeks before, although it could be argued that some of this effect was also seasonal.

Total sales during the period peaked at 2.4% higher in the week that contained the hottest day of the year compared to figures during the same week from the previous year.

Seasonal sales trends become even clearer when looking at categories that are normally affected by weather, such as insect repellent, which showed a 14 point increase between the average volume trend before and during the event in line with rising temperatures.

The same effect can be seen for juices and squashes, first aid dressings, antiseptic creams and even olive oil for salads.

Men’s vitamins and minerals saw a 15 points rise in average volume trend before and during the Games, similarly there was an 8 point gain for topical analgesic products and smoking cessation products benefitted from a 5 point gain, perhaps as a result of consumers being inspired to get fit and do more physical exercise. Trends over this particular period in categories like these are hard to explain without a real ripple effect.

It was those brand owners who capitalised on official sponsorship deals that made tangible gains from marketing their strong association with the global event.

Take for example the television advertising campaign, Bedroom Olympics, from Durex. This brand grew sales of its Play lubricating jelly and its vibrator rings.

Cadbury, which was one of the official Olympic brands and the official treat provider, helped grow volume sales of confectionery assortments in major multiples by 45% YoY over the three weeks.

Promotional packs of Heroes chocolates. Its themed Olympic chocolate medallions: the Dairy Milk Bronzed Crème Crunch, Silvery Crème and Nuts for Gold have reached 2.4 million so far with a sales value of £2.3m, proving Olympic success.

Dairy milk Bronzed Crème Crunch, Silvery Crème and Nuts for Gold helped boost overall sales for Cadbury block chocolate, which grew by 8.1% in volume against the block chocolate market growth of just 1.4%. This gave Cadbury a volume share increase of 2.7% to almost 44% as value share grew by 3.6 points to just over 42%.

These increases could be attributed to huge promotions, but Cadbury was the only brand owner that specifically targeted the Olympics with its marketing and since total sugar confectionery

volume sales fell among major multiples by -3% over the same time period, it is more likely that sales trends moved in Cadburys favour helping it to steal market share from other sweet manufacturers.

While the Olympics may have had a positive effect for some brands, where they gained some competitive advantage, it remains to be seen if it brings long-term tangible returns on their investments.

Sales increases in some categories like convenience foods and confectionery over short periods like the Olympics does not a country of convenience food junkies make.

The Economics Behind Football Sponsorships

Cash is king

Last season, the Premier League earned £1.51 billion in sponsorship money, up from £1.09 billion in 2015/16. Broadcast revenue, or the money TV stations pay for distribution rights, was the Premier League’s largest source of income, accounting for £4 billion in total. While networks like as Sky and BT charge for access, they are able to spend so much for rights because the majority of their money is also generated by sponsorships and advertising. Matchday income accounted for only 6.1 percent of total revenue.

The 20cm by 10cm area on the front of Premier League jerseys is among the most costly real estate in the globe. Companies ranging from boilermakers to bookmakers are spending millions of dollars for their brand to be spread internationally over the course of the 38-week season.

The names on jerseys have obviously evolved throughout time. While it is clear that tobacco corporations have exited sports sponsorship, a more globalised game has brought in more worldwide sponsors.

Can Olympic Games be a driver of Fmcg Sales and increase retail value of sports nutrition across years?

Euromonitor International looked at the retail value sales of sports nutrition during the period of 2003-2015 to find out if there is a relationship between Summer Olympic years against a rising or declining demand for sports nutrition products. The rationale behind this simple analysis was to help identify if consumer motivation related to sports and fitness during and after an Olympic year influences purchasing patterns of sports nutrition products.

Microsoft among deals that helped NBA set record $1.46 billion in sponsorship revenue

Some teams are getting more than $15 million per year for jersey patches and that is close to the $30 million a naming rights sponsorship can bring in annually.

Companies favor insurance, retail and alcohol slots for NBA sponsorships. IEG estimates each of those categories has roughly 70 deals each. State Farm and Verizon are among the “most involved brands” as each company has 20-plus agreements across the league and its teams.

Olympic Games: Who are FMCG Winners And Losers? Who sponsors the Olympics? How do Fmcg brand sponsor International sport events and Olympics?

“International TV rights and streaming have helped to stimulate interest in sports across the globe, and the spiralling value of TV rights and sponsorship deals means that sports revenues are consistently increasing. At the same time, sports watching is becoming more diverse, with consumers not only watching on TV but also on small screens – desktops, laptops, tablets and smartphones. Multi screen watching is also on the rise, with viewers watching two games simultaneously or following social media or commentary on a game while watching it.”

Sports events can boost tourism, sales of food and beverages, and sportswear, among other industries. For example, inbound arrivals to Rio de Janeiro grew by 56 percent in 2014, when the city hosted the FIFA World Cup. Brazil’s beer sales also spiked on that same year. In the UK, the year of the Olympics saw the beginning of the recovery of sportswear sales, which continued in the following years.

With Rio de Janeiro hosting the Olympic games, Euromonitor International’s research team takes a look at how the games will impact different industries in Brazil, Latin America, and beyond. Researchers analyse the impacts of the games in different FMCG industries.

Consumer Electronics: Capitalising On “The Smartphone Olympics”

In what has already been dubbed the Smartphone Olympics, sports fans are set to have one eye on the TV screen, and the other on their mobile devices. With 42 events set to overlap each other, more consumers will feel compelled to use their smartphones and tablets to check sporting results. As the Olympics will focus the world’s attention on mobile digital apps, global media outlets are customising their offerings to increase viewing of TV coverage.

Wee Teck Loo, Head of Consumer Electronics, explains: “Companies lay out millions to be sponsors of major sporting events like the Olympics or the World Cup in the hope of brand exposure and, ultimately, driving sales of their products and services. While sales of consumer electronics are projected to remain lacklustre, companies are still fighting to be associated with major sporting events. Companies like Samsung and Panasonic are still enjoying brand exposure and engaging with consumers. Ultimately, capturing mind share

will be critical when the economic situation improves, which will, in turn, drive sales for these companies after the Olympics has ended.”

Apparel and Footwear: Who Is Faster, Higher, Stronger: Nike or Adidas?

High-profile sponsorship deals and savvy marketing campaigns are guaranteed to improve global brand awareness and consumer engagement. Nike is the official sportswear sponsor for Rio 2016, enabling the brand to truly exploit its already existing association with the event. Adidas, on the other hand, has decided to funnel its budget into devising creative campaigns and, most importantly, product innovation, a wise move given the ambiguous returns on sponsorship.

The deciding factor in who takes home the gold is going to be heavily influenced by creative use of social media. Although social media was important during 2012, it is now arguably the most crucial platform for brands to showcase their participation. This bodes well for Nike. As one of the most instagrammed brands in the world, Nike already boasts over 50 million followers on Instagram, in comparison to Adidas, which has yet to pass the 10 million mark. Facebook, however, appears to level out the playing field, with both brands almost on a par in terms of “Likes”. Developing creative content for social media will go a long way in appealing to the core millennial demographic and encouraging consumer engagement.”

Consumer Health: Sport Nutrition Popularity Could Benefit From Mega Events

According to Euromonitor International, sports nutrition has seen a meteoric rise in the past five years by jumping 56 percent in global retail value from 2010 to 2015, reaching

Global figures reveal an apparent positive impact on demand as related to the summer Olympics of 2008 (China) and 2012 (London) and shown by jumps in retail value of 7% and 11% for the following years 2009 and 2013, respectively.

Stringent anti-doping regulation of sports nutrition is expected to remain as a significant challenge in the sponsorship and promotion of sports nutrition and dietary supplements related to the Olympic Games. Firms selling products recognised by Olympic governing bodies of sports are slowly opening doors and building market opportunities for higher quality and safer products that even some of the top elite athletes in the world can trust.

How Fundamental Objectives Of OLYMPIC MARKETING Help The Fmcg Industry? How much money does Olympics make? How is Olympics Funded?

- The IOC coordinates Olympic marketing programmes with the

following objectives:

• To generate revenue to be distributed throughout the entire Olympic Movement– including the OCOGs, the National Olympic Committees (NOCs) and their continental associations, the International Federations (IFs) and other recognised international sports organisations – and to provide financial support for sport in emerging nations.

• To build on the successful activities developed by each Organising Committee for the Olympic Games (OCOG) and thereby eliminate the need to recreate the marketing structure with each Olympic Games.

• To ensure that the Olympic Games can be experienced by the maximum

number of people throughout the world principally via broadcast coverage.

• To protect and promote the equity that is inherent in the Olympic image and ideals.

• To control and limit the commercialisation of the Olympic Games.

• To create and maintain long-term marketing programmes.

• To enlist the support of Olympic marketing partners in the promotion

of the Olympic ideals.

The Olympic Movement generates revenue through several programmes.

The IOC manages broadcast partnerships, the TOP worldwide sponsorship programme and the IOC official supplier and licensing programme. In addition the NOCs, OCOGs and IFs generate revenue through their own respective commercial programmes.

The following chart provides details of the total revenue generated from broadcast

partnerships and the TOP programme during the past six Olympiads.

OLYMPIC MARKETING REVENUE GENERATION.

IOC Revenue from Broadcast and TOP Programme: The Past Six Olympiads*

Source (in USD millions) 1993-1996 1997-2000 2001-2004 2005-2008 2009-2012 2013-2016

Broadcast 1,251 1,845 2,232 2,570 3,850 4,157

TOP Programme 279 579 663 866 950 1,003

Total 1,530 2,424 2,895 3,436 4,800 5,160

Where Olympic marketing revenue comes from

Domestic sponsorship Ticketing Licensing within the host country Managed by the Organising Committees for the Olympic Games (OCOGs), under the direction of the IOC Managed by the IOC In addition, the NOCs and IFs generate revenue through

their own commercial programmes.

• NOCs to help them support their athletes at national and local levels

• IFs to run and promote their sports globally

• Individual athletes and coaches, via Olympic Solidarity funding

• The Organising Committee of each Olympic Games

• Other Olympic Movement and sport organisations to promote worldwide development of sport

• IOC activities, projects and programmes aimed at supporting the staging of the Games and promoting the worldwide development of sport and the Olympic Movement IOC revenue sources (2013-2016) Where IOC revenues go

• IOC activities to develop sport and operations of the following.

IOC Salt Lake City 2002 $552m

Turin 2006 $561m

Vancouver 2010 $775m

Sochi 2014 $833m

Pyeong Chang 2018 $887m

IOC contributions to support the Olympic Winter Games1

73% Broadcast rights 18% TOP programme marketing rights

5% Other revenue

4% Other rights

$509m Olympic Solidarity

budget for 2017-

2020 (in USD), representing the NOCs’ share of Olympic broadcasting rights

21 World programmes

5 Continental programmes

Olympic Solidarity Available to all NOCs worldwide

In addition to these programmes, which aim to support athletes, coaches,

administrators and promote the Olympic values, was an assistance programme to help the NOCs participate in the Olympic Winter Games PyeongChang 2018

1The IOC contribution supports the staging of the Summer and Winter editions of the Games. This includes direct contributions to the OCOGs (through the share of the television broadcasting rights and TOP rights), considerable costs that previously had been borne by the OCOG, such as the host broadcast operation, and various forms of Games support to the OCOG, including through its “Transfer of Knowledge” programmes.

The OCOGs also raise additional revenue through domestic commercial activities

facilitated by the authorised use of the Olympic marks together with the OCOGs’ symbols

Where Olympic marketing revenue comes from?

200+ The number of countries/territories broadcasting coverage of PyeongChang 2018.

$3.4m Every day the IOC distributes the equivalent of USD 3.4m to help athletes and sports organisations at all levels around the world.

90% The percentage of IOC revenues that are distributed to the wider sporting movement Olympic Solidarity at PyeongChang 2018.

268 Athletes from 60 NOCs supported by Olympic Scholarships competed in PyeongChang

$11m All participating NOCs benefited from the IOC subsidies for NOCs’ participation in the Olympic Games (totalling USD 11m)

13 Teams supported by Olympic Solidarity Scholarships from 10 NOCs.

14 The number of Worldwide Olympic Partners in the current TOP programme.

7.6% The percentage increase in IOC revenues from 2009-2012 to 2013-2016.

13 Medals (6 gold, 3 silver, 4 bronze) won by Olympic Scholarship recipients 57 Diplomas won by Olympic Scholarship recipients.

$5.7bn IOC’s total revenue for the 2013-2016 Olympiad.

How Fmcg Has Sponsored OLYMPIC Games Through HISTORY?

TOP: The Olympic Partners

The Olympic Partners (TOP) Programme is the worldwide sponsorship Programme managed by the IOC. The IOC created the TOP Programme in 1985 in order to develop a diversified revenue base for the Olympic Games and to establish long-term corporate partnerships that would benefit the Olympic Movement as a whole

. The TOP Programme operates on a four-year term – the Olympiad.

The TOP Programme supports the Organising Committees of the Olympic Games and Olympic Winter Games, the NOCs and the IOC.

The TOP Programme provides each Worldwide Olympic Partner with exclusive

global marketing rights and opportunities within a designated product or service

category. The global marketing rights include partnerships with the IOC, all active NOCs and their Olympic teams, and the two OCOGs and the Games of each Olympiad.

The TOP Partners may exercise these rights worldwide and may activate marketing initiatives with all the members of the Olympic Movement that participate in the TOP Programme.

Sponsorship in various forms has supported the Olympic Movement since the first modernOlympic Games in Athens in 1896. The following is a brief overview of key milestones and informative anecdotes from the history of sponsorship in the modern Olympic Games.

OLYMPIC SPONSORSHIP HISTORY

Athens 1896 Companies provide revenue through advertising during the Olympic Games.

Stockholm 1912 Approximately 10 Swedish companies purchase sole rights to take photographs and sell memorabilia of the Olympic Games.

Antwerp 1920 The official Olympic Games programme contains a great deal

of corporate advertising.

Paris 1924 Advertising signage appears within view of the Olympic Games venues for the first and only time in history.

Amsterdam 1928 Current TOP Partner Coca-Cola begins the longest continuous Olympic partnership. Concessionaires are granted rights to operate restaurants on stadium grounds.

Advertising continues in the official Olympic Games programme.

The IOC stipulates that posters and billboards may not be displayed on the stadium

grounds and buildings.

Lake Placid 1932 The OCOG solicits businesses to provide free merchandising and advertising tie-ins.

Many major department stores in the eastern US feature the Olympic Games

marks in window displays, and many national businesses use the Games as an

advertising theme.

Helsinki 1952 The first Olympic Games to launch an international marketing programme.

Companies from 11 countries make contributions of goods and services ranging

from food for the athletes to flowers for medallists.

Rome 1960 An extensive sponsor/supplier programme includes 46 companies that provide technical support and products such as perfume, chocolate, toothpaste and soap.

Tokyo 1964 250 companies develop marketing relationships with the Games.

The new “Olympia” cigarette brand generates more than USD 1 million in revenue

for the OCOG. (The tobacco sponsorship category is later banned.)

Montreal 1976 With 628 sponsors and suppliers, domestic sponsorship generates USD 7 million for the OCOG.

Sarajevo 1984 The OCOG signs 447 foreign and domestic sponsorship agreements.

Los Angeles 1984 For the first time, the domestic sponsorship programme is divided into three categories. Each category is granted designated rights and product category exclusivity.

The marketing programme is limited to the host country and US companies.

Calgary 1988/Seoul 1988

The IOC creates The Olympic Partners (TOP) worldwide sponsorship programme,

in coordination with the OCOGs in Seoul and Calgary, as well as 159 NOCs.

TOP is based on the 1984 Los Angeles model of product category exclusivity.

Prior to the establishment of the TOP Programme, fewer than 10 NOCs in the world

had a source of marketing revenue.

The OCOGs launch independent marketing programmes.

For the first time, the IOC requires the OCOG to form a joint marketing programme

with the host country NOC.

Albertville 1992/Barcelona 1992 TOP grows from nine to 12 partners in the programme’s second generation. Lillehammer 1994 Broadcast and marketing programmes generate more than USD 500 million, breaking almost every major marketing record for an Olympic Winter Games.

Atlanta 1996 The Games are funded entirely via private sources.

Sydney 2000 The OCOG develops the most financially successful domestic sponsorship programme to date, generating more revenue (USD 492 million) than the domestic sponsorship programme of Atlanta 1996 in a host country marketplace 15 times smaller.

A new standard for brand protection through education, legislation and

advertising controls.

Salt Lake City 2002 The Olympic Properties of the United States (OPUS) sponsorship for 2002 breaks records for both Winter and Summer Games.

Athens 2004 In the smallest country to host the Olympic Games to date, Athens 2004 achieved its sponsorship revenue target two years before the Games and ultimately generated revenue from national and torch relay sponsorship that was 50% higher than initial estimates.

Turin 2006

Turin 2006 stands as the most lucrative and successful sponsorship programme

in Italian history. The programme accounted for 6.14% of the total sponsorship

spending in the market, which was significantly higher than previous Olympic Winter Games sponsorship programmes and represented nearly 1% of the total advertising spend in the Italian market, 35 times greater than that of Salt Lake City 2002.

Beijing 2008

The Beijing 2008 domestic sponsorship programme provided significant support to

the operational needs of the OCOG in revenue, goods and services, which

contributed towards the staging of the Olympic Games.

How Fmcg products recent trended in Tokyo Olympics?

For those looking to increase brand awareness and boost their image, for example, targeting Gen Z will be their best bet.

They’re the most likely age group to think about a brand more positively if it sponsors their favorite team (53%) and to spread the word to family and friends (44%).

Regardless of the age group you’ll be looking to reach during this year’s Olympics, the messaging you employ will be key.

For example, our data shows that positioning your brand as innovative will really stand out to a Gen Z Olympics fan (66% want brands to be innovative), while reliability will make millennials tick more (64%).

Key Factors

- The demand and anticipation for the Olympics is there even when the cheer won’t be.

- The lack of international fans is unlikely to hurt overall engagement.

- Traditional TV reigns supreme, but streaming and social will play a big role complementing it.

- Targeting the entertainment-hungry millennials will likely prove fruitful.

- Sponsorship works best with younger groups, but a one-size-fits-all approach isn’t going to cut it.

Top most festival Products FMCG consumers search today

World Wide Festive Trends Decoded What Indian festive consumers seek...

Read MoreHow right selection of FMCG Salesmen improves brand market share

How can FMCG Companies improve salesman’s technique in order to...

Read MoreHow most searched Fmcg sales and marketing words help newbie salesman

Why undestand FMCG sales management? Sales management is the process...

Read MoreHow Successful FMCG Salesman Starts his Day, a guide

How does one become a good sales executive in the...

Read More

Very interesting content, way to go!

Thank You! Sowmya.