How skuwise audit tracking is important to pinpoint adjustments in fmcg product

The fast-moving-consumer-goods industry has a long history of generating reliable growth through mass brands. But the model that fueled industry success now faces great pressure as consumer behaviors shift and the channel landscape changes. To win in the coming decades, FMCGs need to reduce their reliance on mass brands and offline mass channels and embrace an agile operating model focused on brand relevance rather than synergies.

The FMCG market (fast-moving consumer goods) accounts for more than half of all consumer spending. For those who want to effectively sell in FMCG, it’s important to focus on the right key performance indicators and measure success.

A winning model for creating value

For many decades, the FMCG industry has enjoyed undeniable success. By 2010, the industry had created 23 of the world’s top 100 brands and had grown total return to shareholders (TRS) almost 15 percent a year for 45 years—performance second only to the materials industry.

The FMCG value-creation model

This success owed much to a widely used five-part model for creating value. Pioneered just after World War II, the model has seen little change since then. FMCG companies did the following:

Perfected mass-market brand building and product innovation. This capability achieved reliable growth and gross margins that are typically 25 percent above nonbranded players.

Built relationships with grocers and other mass retailers that provide advantaged access to consumers. By partnering on innovation and in-store execution and tightly aligning their supply chains, FMCG companies secured broad distribution as their partners grew. Small competitors lacked such access.

Entered developing markets early and actively cultivated their categories as consumers became wealthier. This proved a tremendous source of growth—generating 75 percent of revenue growth in the sector over the past decade.

Designed their operating models for consistent execution and cost reduction. Most have increased centralization in order to continue pushing costs down. This synergy-based model has kept general and administrative expenses at 4 to 6 percent of revenue.

Signs of stagnating success

But this long-successful model of value creation has lost considerable steam. Performance, especially top-line growth, is slipping in most subsegments. The household-products area, for example, has dropped from the sixth most profit-generating industry at the start of the century to the tenth, measured by economic profit. Food products, long the most challenging FMCG subsegment, fell from 21st place to 32nd. As a consequence, FMCG companies’ growth in TRS lagged the S&P 500 by three percentage points from 2012 to 2017. As recently as 2001–08, their TRS growth beat the S&P by 6 percent a year.

What Is a Stock Keeping Unit?

A stock-keeping unit (SKU) is a scannable bar code, most often seen printed on product labels in a retail store. The label allows vendors to automatically track the movement of inventory. The SKU is composed of an alphanumeric combination of eight-or-so characters. The characters are a code that track the price, product details, and the manufacturer. SKUs may also be applied to intangible but billable products, such as units of repair time in an auto body shop or warranties.

What is a Stock Keeping Unit (SKU)?

A Stock Keeping Unit or SKU is a number that is assigned to a product for the purpose of inventory management and ease of tracking. In other words, a stock keeping unit is a unique identifier assigned to each product for easier and more efficient record-keeping.

Why understanding SKUs can promptly improve your inventory management?

Don’t be confused anymore and make sure you know the basics of product codes and the best practices.

What is the meaning of SKUs?

SKU, pronounced as “skew”, is a special number that can transform how you organize your business products.

What is a SKU number?

SKU stands for Stock Keeping Unit. It is an internal product inventory coding that identifies all your product features (colour, size, etc.). These codes are unique to your company and allow you to keep track of your inventory easily.

How are SKUs set up?

Whether you create your code manually or use a SKU generator, your first task will be to list all the variants that define your product or any classification that is relevant to your business: type, brand, style, colour, size, gender, cost, material, season, stock location or supplier, origin, purchase date, expiration date, etc.

Let’s say you sell shoes. Here is an example of a list of different variants that you could consider before generating SKUs:

Style: sport shoes

Type: running shoes

Colour: pink grey

Season: spring/summer

Gender: woman

Size: 6

Stock Location: Warehouse 1

Creating SKUs is easy and companies of any size can afford to set them up. A few rules, however, should be followed.

Small businesses could easily simplify their inventory management and greatly benefit from SKUs.

The Importance of SKUs

Stock keeping units are highly important and commonly used by retail stores, warehouses, and product fulfillment centers. Stock keeping units have many key uses, such as the following:

Identifying a specific product

Tracking inventory to know how many of a specific product is available

Helping reconcile stock levels of products

Identifying shrinkage in inventory

Determining which products are the most profitable (through analysis)

Helping identify reorder point for products

Helping customers save time by enabling them to find products quickly

How Do SKUs Work?

A stock keeping unit is comprised of letters and numbers. The numbers and letters provide details about the product, such as the brand, model number, color, etc.

Each company follows its own way of creating SKUs for its products, and there is no incorrect way of making an SKU. With that being said, there are some best practices when constructing an SKU for a product.

Make each SKU unique. Never reuse an SKU and make sure each product comes with a unique SKU.

Keep SKUs short. Long SKUs may be difficult to read and may not work in some inventory management systems.

Do not use spaces or special characters. Creating an SKU with spaces or special characters can confuse people.

Do not use letters that can be mistaken with numbers. Refrain from using letters such as O and I, which can be mistaken for 0 and 1.

Example of Constructing an SKU

Let’s assume that we are in charge of assigning an SKU for a specific product: a pair of black Gucci jeans that is medium-sized.

We can construct an SKU for the product as follows: BLK-MED-G123-GUC

Where:

A dash is used to separate specific information about the product

BLK refers to the color of the product (Black)

MED refers to the size of the product (Medium)

G123 refers to the model number given by the manufacturer

GUC refers to the brand of the product

The SKU for the pair of jeans is a good example of a simple, unique, and short SKU that also shares vital information about the product.

Application of SKUs

Jeff is the owner of a small grocery store that sells a specific brand of bread in addition to 10 other brands of bread. Jeff thinks that since his store is small, there is no need to use stock keeping units on each individual brand.

One day, a customer walks into the store asking whether the store has a specific brand of bread. Jeff recognizes the brand name and tells the customer that they do carry that brand of bread and leads the customer to where the bread aisle is. He then sees the store is out of stock of that brand of bread and apologizes to the customer.

The following day, Jeff sets up a meeting with his inventory manager, who says: “We should come up with an SKU for every single product in our store – it is inefficient for me to have to manually check whether we are low on specific products every day. Without an inventory system that incorporates SKU, I have to manually subtract quantities that we have sold from our inventory system.”

Following the manager’s suggestion, Jeff employs a stock keeping unit for each specific product. With this setup, Jeff is now able to quickly check his computer system on every single product and their inventory levels.

Additional Resources

What are EAN, ISBN and ASIN?

Do these ring a bell? No, they are not one of the hottest new rap groups, but they can sure be useful to your business! Let’s quickly identify them to end your training on product codes basics and begin with your becoming an accomplished entrepreneur in labelling products!

- EAN/IAN: When selling products internationally, you may need to use a special 13-digit version of a UPC called an International Article Number (IAN) or European Article Number (EAN). If you need either of these for your products, you should visit the GS1 website to know how to buy some.

- ISBN (International Standard Book Number): It is a unique barcode identifying books only.

- ASIN (Amazon Standard Identification Number): It is a 10-letter digit to identify products sold on Amazon. For books only, the ASIN is the same as an ISBN.

CFI is the official provider of the Financial Modeling and Valuation Analyst (FMVA)™ certification program, designed to transform anyone into a world-class financial analyst. To keep learning and developing your knowledge of financial analysis, we highly recommend the additional CFI resources below:

KEY TAKEAWAYS

- A stock-keeping unit (SKU) is a scannable bar code to help vendors automatically track the movement of inventory.

- SKUs are also used for units of repair time units, services, and warranties.

- SKUs help vendors determine which products require reordering and provide sales data on a daily basis.

Understanding Stock Keeping Units (SKUs)

SKUs are used by stores, catalogs, e-commerce vendors, service providers, warehouses, and product fulfillment centers to track inventory levels. Scannable SKUs and a POS system mean that it is easy for managers to determine which products need to be restocked. When a customer buys an item at the point-of-sale (POS), the SKU is scanned and the POS system automatically removes the item from the inventory as well as recording other data such as the sale price. SKUs should not be confused with model numbers, although businesses may embed model numbers within SKUs.

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Stock_Keeping_Unit_SKU_May_2020-01-e9246575206c4bba9d4f22dd3272e963.jpg)

By adding SKUs to every product, store owners can easily track the quantity of available products. Owners can create threshold limits to let them know when new purchase orders must be made.

Businesses create different SKUs for its goods and services. For example, a store that sells shoes creates internal SKUs that show a product’s details, such as color, size, style, price, manufacturer, and brand. For example, the SKU for purple Ugg boots in the Bailey Bow style, size 6, may read “UGG-BB-PUR-06.”

The Importance of Stock Keeping Units

SKUs let shoppers compare characteristics of similar items. For example, when a shopper buys a specific DVD, online retailers might display similar movies purchased by other customers based on SKU information. This method may trigger additional purchases by the customer, thereby increasing a company’s revenue. SKUs also allow data to be collected on sales. For example, a store can see which items are selling well and which are not based on the scanned SKUs and the POS data.

Stock Keeping Units vs. Universal Product Codes

Because companies internally create SKUs to track inventory, the SKUs for identical products vary among businesses. Different SKUs help retailers design advertising campaigns without interference from other vendors.

For example, if a company provides the SKU to advertise a certain discounted refrigerator, shoppers cannot easily view the same refrigerator at other sellers based on the SKU alone. This stops competitors from matching advertised prices and poaching customers. In contrast, universal product codes (UPCs) are identical regardless of which business is selling the items.

Example of SKUs in the Modern World

SKUs are making the shopping experience more efficient than ever before. For example, when shoe shopping in the past, clerks would have had to visually scour the back stockroom and hunt for a specific model of shoes in your correct size. Today, many retailers are equipped with portable scanners enabling salespeople to check back-of-the-store inventory by simply scanning a floor sample. This is one of the many benefits of the modern-day SKU system.

Why Retail Audit is Crucial for FMCG’s Success?

Retail auditors are those professionals that basically asses the stock at the retail outlets, in relation to company records and set requirements. They analyze everything about the company’s stock in a retail outlet. They provide information about the brand’s sales volume, the trending sales techniques, in store display effectiveness and overall stock management. Thus, retail auditors are important for any company but more so for FMCG companies which depend highly on retail stores for their product sales.

What key functionalities retail auditors perform:

- Assessment of the various stocks in all the retail stores allocated to them.

- Matching the stocks with the company’s records.

- Checking for any damage or wrong stock.

- Realizing any issue with a particular stock.

- Clearance of stock in a timely manner.

- Documenting and proper reporting.

- Informing and reporting to the higher authorities

Who shall perform this activity for FMCGs?

As we can see, these professionals need to be very efficient and good at their work. Hence, conducting interviews and hiring these professionals is a tedious task for any company. So what can companies do? They can seek services of a market Research companies that conduct interviews and takes care of the entire hiring process.

All they need to do is contact such companies and share their requirements. These research companies will carry out the retail auditing on their behalf. This is very effective and saves the company huge costs and the tedious process. Few companies like Ace Research not only perform retail audits for you but also facilitates your management with action oriented reports and in-depth analysis of whole activity thus, helping the company to perform retail audit’s hassle-free.

Types of information that brand retail auditors gather include:

- Sales volume

- Stock levels (shelf and back stock)

- Descriptions of in-store displays and promotional materials

- Competitor activity

- Planogram compliance (shelf location, number of facings present, number of SKUs present, missing/inaccurate shelf tags)

- Pricing

- In-store location of products

- Product damage

Importance of Retail Audit

The benefits of conducting retail audits are twofold. On the one hand, they serve as a tool for suppliers to ensure that retailers are complying with pre-established agreements on product placement, pricing, and promotion. On the other hand, they allow brands to accurately measure their success in the retail environment.

Types of Retail Audits

With so much variance in the information that can be recorded in a retail audit, it makes sense to segment audits by data type. Different audit forms should be used to reflect the respective data being collected at a given store visit. Examples of the types of retail audits that a supplier might employ are listed below.

Retail Market

In some cases, brands might simply want to know the placement, where their products are being stocked (or could potentially be stocked in the future). Retail auditors might document the following:

- Consumer sentiment towards the brand and its competitors

- Store appearance and location.

- Qualitative and quantitative information about other brands present in the store.

Merchandising Report

This type of store audit is primarily concerned with the brand’s performance. Retail auditors use merchandising reports to analyze:

- Inventory levels

- Stock outs

Margin by Product Category: Identify your most profitable products

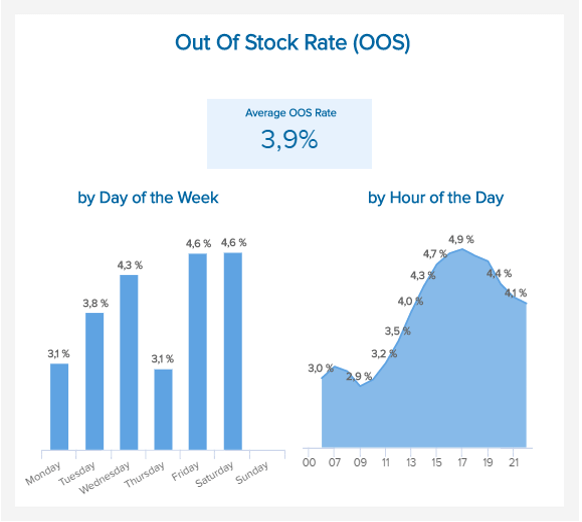

OUT OF STOCK RATE (OOS)

Measure your ability to meet customer demand

This FMCG KPI shows the moment of the day and of the week where your inventory is exhausted, and how much of it is unavailable. Managing your inventory is of course a must-do in the fast-moving consumer goods industry. You need to have an even-more accurate vision of your stocks because of the short sales cycle time and high demand: evaluating the Out of Stock Rate will give you a great advantage in terms of supply. You should also know that around 80% of the ‘stockouts’ are actually caused by defective shelves replenishment practices: implementing appropriate internal measures to refill your store’s sections will decrease the OOS rate. That way, you can easily avoid frustrated customers who in response tend to switch stores. You should also understand the reasons behind inventory stockouts so that you can address the causes more efficiently and avoid a situation to repeat itself over and over.

Performance Indicators

Studies for the FMCG industry usually show an average OOS rate of 8% – managing to keep your stockouts below this line is crucial.

- Condition of products

- Amount of available shelf space

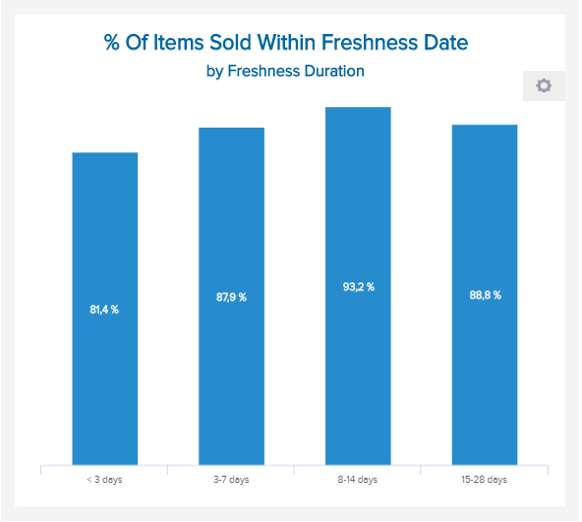

PERCENTAGE OF SOLD PRODUCTS WITHIN FRESHNESS DATE

How many products are sold before expiration?

This FMCG KPI calculates the percentage of your inventory sold within the freshness date, depending on the type of product. On the illustration aside, we see that only 81,4% of the freshest products needing to be sold within 3 days, are actually sold. Where is that coming from? Actually, you will always face a trade-off between the availability of your products on the shelves, and their expiration date. Indeed, if you want to have 100% of your products sold, that means that your store will have to deal with shelf unavailability at some point – and this is why many discounters who have such strategy cannot provide you with anything you want on a Saturday evening, one hour before closure.

Performance Indicators

Align your metric’s target with the strategy of your store and what has the priority: availability at any time, or selling the inventory within due date.

- Units ordered

DELIVERED ON-TIME & IN-FULL (OTIF)

Do you receive your exact orders on-time?

The OTIF measures the delivery performance within a supply chain: On-Time, In-Full delivery. It measures several levels of delivery: if the right product was delivered to the quality standards agreed upon, in the quantity ordered, at the place agreed on, and at the time expected by the customer – often with a tolerance range predefined. As a supermarket, you can use this FCMG KPI to compare the performance of your suppliers: how often do they provide you with what you want, when you need it. It is usually calculated as a percentage according to the following formula: OTIF = (number of deliveries “OTIF” ÷ total deliveries)*100. The “OTIF” deliveries used to calculate this percentage should answer a couple of requirements: they have a delivery date, they measure the date and hour of said delivery, archive it in the system, and maintain a track record of the reasons behind an order not “OTIF”.

Performance Indicators

Implement the right measures so as to keep your OTIF rate above 90% for a well-performing supply chain.

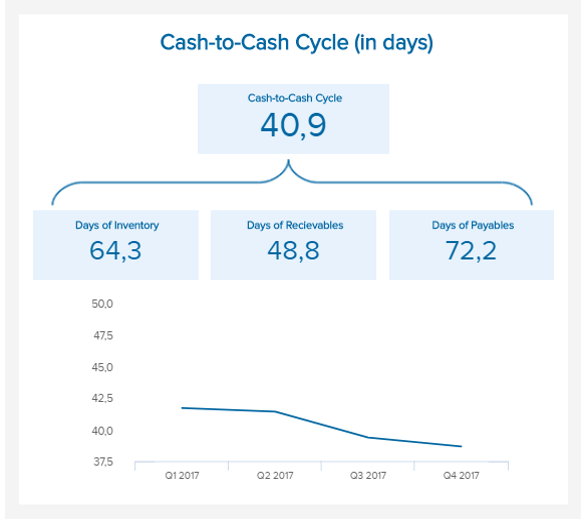

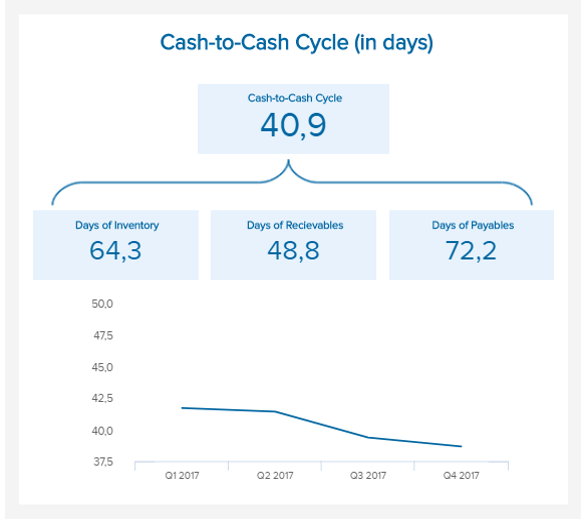

CASH-TO-CASH CYCLE TIME

Analyze and monitor how long you need to convert resources into cash flows

This FMCG KPI combines 3 ratios: the days of inventory (DOI), the days of payables (DOP), and the days of receivables (DOR). It represents the time period needed between the moment a business pays cash to its suppliers, and receives cash from its customers. It is also referred to as “cash conversion cycle”, and is useful when you need to determine the amount of cash needed to fund ongoing operations. For fast moving goods, estimating the financing requirements is crucial for smooth operations. The formula used to calculate the cash-to-cash cycle is the following: Cash-to-Cash Cycle = DOI + DOP – DOR. A cycle of 40 days means that a business must support its expenses for 40 days – not more. This is a useful calculation for forecasting or trying to address an expensive debt for instance.

- General shelf appearance

CASH-TO-CASH CYCLE TIME

Analyze and monitor how long you need to convert resources into cash flows

This FMCG KPI combines 3 ratios: the days of inventory (DOI), the days of payables (DOP), and the days of receivables (DOR). It represents the time period needed between the moment a business pays cash to its suppliers, and receives cash from its customers. It is also referred to as “cash conversion cycle”, and is useful when you need to determine the amount of cash needed to fund ongoing operations. For fast moving goods, estimating the financing requirements is crucial for smooth operations. The formula used to calculate the cash-to-cash cycle is the following: Cash-to-Cash Cycle = DOI + DOP – DOR. A cycle of 40 days means that a business must support its expenses for 40 days – not more. This is a useful calculation for forecasting or trying to address an expensive debt for instance.

Performance Indicators

The shorter the cycle, the better it is for a company’s operations. A short cycle means that a business can operate with less cash tied up in operations.

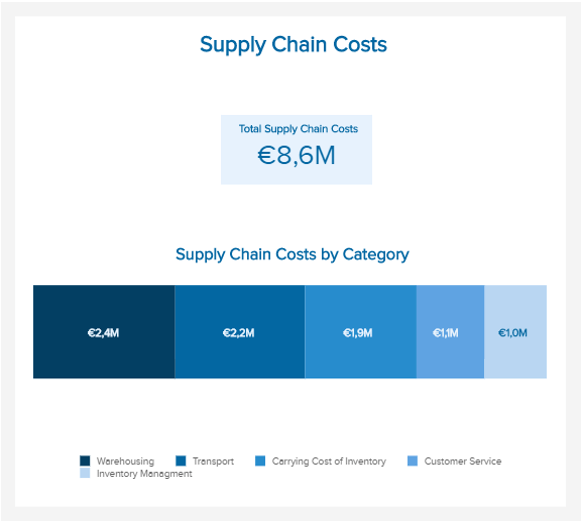

SUPPLY CHAIN COSTS

How much does your supply chain require?

The Total Costs of Supply Chain gather all the costs associated with the supply chain management: planning, sourcing, delivering, managing returns, labor, etc. Reducing supply chain costs can notably increase the profits, without needing to increase sales. The supply chain costs have a strong correlation with the carrying costs of inventory: to reduce the total costs, many companies have used strategies to reduce inventory safely. However, you have to be careful and assess the impact of cost reductions on the supply chain as a whole: cutting on one part can result in increasing costs elsewhere, which is a waste of time and energy. Analyze carefully all the changes incurred by a certain cost saving, to avoid such situation.

Performance Indicators

Perform a benchmark within your specific sector, and compare your supply chain costs to those of your competitors.

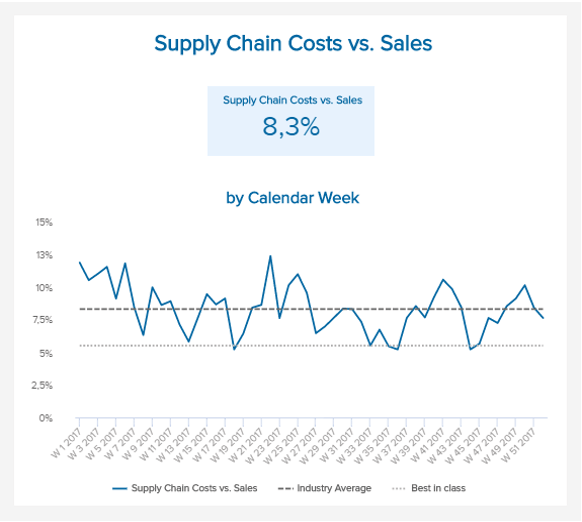

SUPPLY CHAIN COSTS VS SALES

Compare your supply chain costs against the sales

Directly linked to the previous FMCG KPI, calculating your supply chain costs as a portion of sales will give you an understanding of how much you are spending relatively to the whole. By doing such a spend analysis, you can identify where you could do savings. As stated above, savings are a good thing if made soundly: cutting costs here that increase the operations there is a useless hassle. There are many benchmarks out there comparing the costs of supply chain to the sales (as a percentage), but you can also perform your own with specific competitors. In any case, comparing your ratio to your industry average is a best practice, as it will show where you stand and if you can do better.

Performance Indicators

The industry average for ambient, non-frozen food and beverages companies is of 7,6%. You should aim at maintaining your ratio below that value.

Promotional Report

If a brand is holding a sale or other type of special promotion, it is important to track its success so as to know, how it’s performing in the short-term and how to improve in the future.

- The type of promotion being used (tasting, demo, price reduction, etc.)

- The duration of the promotion

- The featured products

- In-store position

- Sales results

- General effectiveness of the promotion.

Competitor Survey

One audit that brands shouldn’t overlook is the competitor survey, which can reveal invaluable insight into how your brand stacks up against others in its category.

- Who your direct and indirect competitors are in the store

- Competitors’ pricing strategies

- How many facings competitors have on the shelf. Is your brand being significantly overshadowed?

- Where competitors’ products are located in the store.

- Any promotions competitors are running

Steps in the Audit Process

After realizing the inherent value of retail audits, how can your company guarantee that it’s executing them properly? Consider the following procedure to help your team make the most of every store visit.

- Articulate your goals

Determine the main objectives of your retail audit. Are you primarily concerned with monitoring competitor activity? Or do you care about how quickly your products are moving off the shelf?

- Design audit criteria

Select the exact questions you will be asking in the audit and the acceptable answer types. Will you use “yes/no” questions, have retail auditor’s write-in responses, or use a scale such as 1-5?

- Schedule Appointments

Once you know what you’re trying to gain from the retail audit, it’s time to make it happen. Aim for consistency in terms of who you send to which accounts. This way, individual retail auditors can become extremely knowledgeable about their stores and build a rapport with store management. Recognize that some retailers might want to be notified before retail auditors will be visiting their store. Also be mindful to schedule retail auditors for an appropriate number of audits as determined by their assigned territory.

- Gather data and photos

Make sure auditors collect data that directly corresponds to the goals and criteria you’ve laid out. Including photos in audits is a great way to depict exactly what’s happening in a store at any given time, and promotes accountability and compliance.

- Evaluate results.

Once audits are completed, organize your data in an easy editable format. Numerical values can be depicted graphically. Check to see how the results you’ve achieved stack up against your pre-determined KPIs.

- Implement changes.

After analyzing the findings, execute on what needs to be done in the short term. For example, you discover that a particular SKU is performing significantly worse than others, across several locations and you decide to pull it from shelves immediately.

- Repeat the process.

After conducting several retail audits, you’ll be able to make adjustments to your retail audit process as needed to tailor it to your company’s unique needs. Regularly conducting audits will allow your business to be as agile and rapidly adjust to the ever changing retail landscape.

Advantages of Retail Audit Software

Historically, businesses have used pen and paper for retail auditing, which presents a number of avoidable challenges, such as:

- Need to transcribe findings into a digital format after the fact

- Risk of losing or damaging paper

- Higher risk of human errors

- Delayed transmission of data from the field to decision-makers

To combat these issues, companies can make use of technology.

- Ability to easily collect data through digital forms.

You’ll want to be able to customize your survey questions to accommodate specific product families or retailers. Moreover, you’ll want customization of the allowed answer types. Ideally, some questions could be marked as “mandatory” so that brand retail auditors cannot submit the audit without filling in a response for those questions.

- Synchronization of data to brand managers in real-time.

The primary reason for using a technological solution as opposed to paper is so that managers can receive data from the audits immediately. The faster data is available for analysis, the faster changes can be implemented. To automate your process further, we offer a solution that readily transforms data into graphs and charts for easy visualization.

- Image capturing capabilities

Photos illustrate what words alone cannot express. They’re especially useful for revealing details about competitor packaging, shelf appearance, store tidiness, and promotional displays. Pictures are also great for depicting “before” and “after” scenarios.

- Barcode scanning

To save time during auditing, brand retail auditors can scan the UPC of a particular product using a smartphone camera, which in doing so will populate their screen with more detailed information about the product.

- Time stamping and/or geo-tagging

For organizational purposes, it’s helpful to know the precise location and time that an audit took place.

- Electronic signature capture

Getting a signature from a store manager lets your company know that the audit has been done.

A retail audit can help you evaluate the effectiveness of your overall retail execution strategy. However, the insights gained from retail audits are only as strong as the quality of the audits themselves.

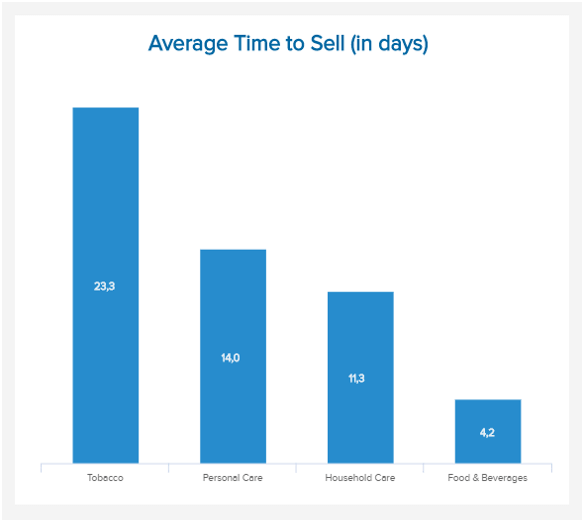

Summary of the core metrics impacting retailer profitability and success. GMROI because is an index of bottom line profitability contribution regardless of the product category. And in this age of declining prices and eroding gross margin %, stock turns becomes a major driver to increase GMROI by lowering average inventory.

Lost sales is difficult to calculate but can be estimated by the days a SKU is out of stock X the average or expected sales rate. Lost sales estimates is a good “counter balance” metric to gauge if you are trying to run too lean on inventory, especially for top selling SKUs.

12 reasons why your small business can benefit from SKUs

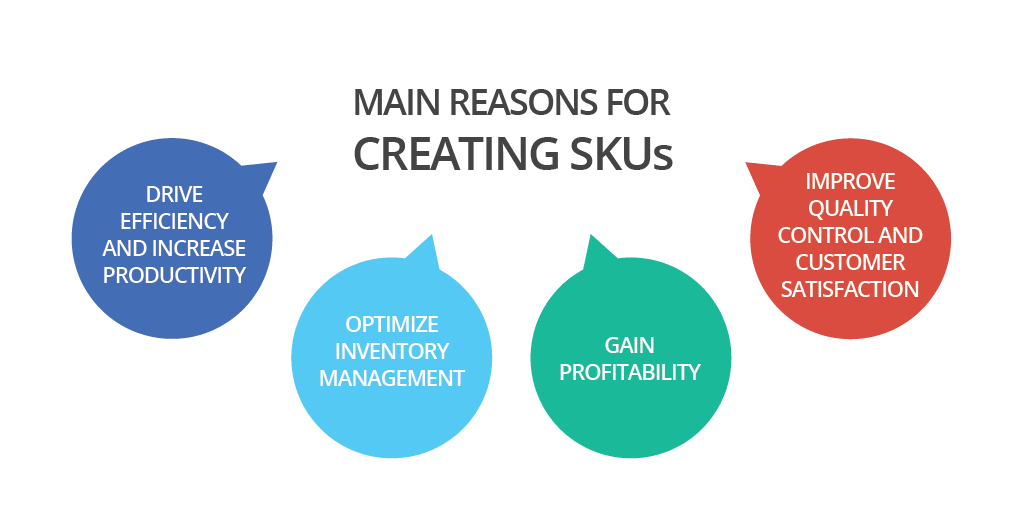

DRIVE EFFICIENCY AND INCREASE PRODUCTIVITY

1. Dramatically improve operations from sales to inventory management by making products easy to sort, find, search and reference from estimates, sales orders, shipping orders and invoices.

2. Always keep track of every item in real time.

OPTIMIZE INVENTORY MANAGEMENT

3. Shorten the account for every product in your inventory.

4. Avoid stock-outs by real-time identification of low stock or shrinkage.

5. Have better control of your supply chain, with an alert that signals when replenishment is necessary and allows you to set up reorder points.

6. Simplify inventory reconciliation.

7. Facilitate stock adjustment, by creating stock entry, stock removal, or stock movement between locations or update inventory.

8. Multi-location inventory allows you to sort your items in different locations, so they never get lost.

IMPROVE QUALITY CONTROL AND CUSTOMER SATISFACTION

9. Decrease the number of problems that occurs from human error, such as miswriting or mispicks.

10. Improve client satisfaction by giving a better transparency to product availability and by promptly sending orders.

GAIN PROFITABILITY

11. Better profit analysis is increased when you can define precisely what item/variant is the most profitable and build reports, in order to better plan your investments.

12. Protect your margin, so that consumers cannot easily compare products from one store to another and retailers don’t have to match the price.

How to set up your SKUs: dos and don’ts

- Use it internally only: Companies use SKUs mostly for internal purposes to track inventory, although customers can find information about many products by using the SKU number (invoices, catalogs, etc.).

- Choose a format and stick to it.

- Make it easy to understand: the letters and digits should have a meaning for the people within your business (i.e. S, M, L, XL).

- Keep codes short: between eight and 12 characters.

- Start with letter(s). It’s easier to read and identify.

- Use a combination of numbers or letters.

- Do not start with a zero or symbols that can be misread by humans or software.

- Never use the same SKU for different products.

- Avoid using a manufacturer’s SKU. They are often too long and if you change suppliers, it becomes meaningless to your business.

1. GMROI

This stands for Gross Margin Return on Investment, and it tells you the amount of money you got back (i.e. ROI) for every dollar you spent on inventory.

GMROI measures your profit return on the funds invested in your stock. It answers questions such as, “How many gross margin dollars did I make from my inventory investment?” or “For every dollar invested in inventory, how many dollars did I get back?”

The formula for figuring out your GMROI is: Gross Margin / Average Inventory Cost

So let’s say a retail store has a gross margin of Rs55,000 and an average inventory cost of Rs30,000. Its GMROI is 1.83, and that means the store earns Rs1.83 for every rupee in inventory.

Once you’ve determined the GMROI of your products, go a step further and work out how much profit you make as a proportion of your scarce resources. T

For example, if you have limited space in your warehouse what was the profit generated per square foot of storage space occupied? If you are short on cash, what was the profit generated per average value of stock held?

Knowing the answers to such questions will enable you to make better decisions when it comes to what products to stock up on or which items to discontinue.

2. Shrinkage

This refers to the difference between the amount of stock that you have on paper and the actual stock you have available. It’s a reduction in inventory that isn’t caused by legit sales. The common causes of shrinkage include employee theft, shoplifting, administrative errors, and supplier fraud.

The formula for shrinkage is: Ending Inventory Value – Physically Counted Inventory Value

Shrinkage can also be expressed as a percentage — i.e. Shrinkage % = Shrinkage / Sales x 100

According to a survey by the National Retail Federation, the average inventory shrink as a percentage of sales was 1.38% in 2015. It’s important to note that data varies from one retail sector to the next.

Specifically:

Grocery – 3.6%

Specialty men’s and women’s apparel – 1.2%

Discount, mass merchandise or supercenter retailers – 1.1%

Measure shrinkage in your own store and see how you stack up against other retailers. This should give you an indication of how well your store is doing when it comes to inventory accuracy.

3. Sell-through rate

Sell through is the percentage of units sold versus the number of units that were available to be sold.

To calculate for this metric, use the formula: Number of Units Sold / Beginning Inventory x 100

Let’s say a bookstore received 500 copies of a thriller novel from the publisher and sold 95 books after a month. The book’s sell-through percentage is 19%. In some cases, the unsold merchandise will be returned to the manufacturer (or in the bookstore’s case, the publisher). Some stores can also tack on a discount on the items to improve the sell-through percentage.

4. Stock turn

Also known as inventory turnover, stock turn is the number of times stock is sold through or used in a given time period. In most cases, the higher the stock turn, the better it is for your store because it means you’re selling a lot of merchandise without stocking too much inventory.

The stock turn formula is: Cost of Goods Sold / Average Inventory

Let’s say an apparel store’s average inventory is $25,000 and the cost of goods it sold in a 12-month period is $100,000. Its inventory turnover is 4.0, and this means that the store sold out of its inventory four times that year.

Having a high stock turn means you’re being efficient. As Bruce Clark, an associate professor at Northeastern University puts it, “We like big numbers here because that means we are efficient: we carry very little inventory to support a certain level of sales.”

How often should you look at stock turn? According to Clark, “conventionally this is always calculated annually: if we sell $1 million dollars in goods annually on an average inventory of $100K, our inventory turns = 10. This can be calculated for shorter time periods as well as long as the periods are consistent (monthly sales divided by monthly average). Businesses that are highly seasonal may want to look at shorter periods in particular, since inventory needs are very different in high seasons vs. low.”

5. Product performance

Your top and lowest performing products should always be top of mind, so track this metric regularly. Being fully aware of your of product performance means you can stay on top of stock orders, merchandising, and sales, among other things.

What products should stock up on? Which items need a promotional push? The only way to answer these questions is to know your product performance like the back of your hand.

Adam Watson, managing director at Hollywood Mirrors, says that product performance is something he constantly tracks.

“I look at my stock inventory every Monday morning, and the first thing I look at are my most profitable products. I apply the 80 / 20 rule or Pareto principle in that 20% of my product provide 80% of my profitability, so I focus on this 20% of products first.”

He adds, “I work out how long it takes to receive the product from a supplier, the amount I sell in a week and the amount I currently have in stock. I usually keep 30 days worth of product in stock as I have 30-day payment terms with suppliers, making this is ideal for cash flow.”

“Next, I look at dead inventory or slow movers that are overstocked. I then either improve my listing online or be more competitive on price.”

How to measure product performance: Tracking product performance should be fairly simple if your POS or retail management system has the right reporting capabilities (and most modern ones do!). Look at your product and sales reports, and pay attention to things like which products have the most and least sales counts, as well as which items are driving the highest and lowest revenues.

6. Lost sales

When we first published this post, retail expert Chris Petersen of Integrated Marketing Solutions left a comment advising retailers to track lost sales.

According to him, lost sales “can be estimated by the days a SKU is out of stock X the average or expected sales rate.

Lost sales estimates is a good “counterbalance” metric to gauge if you are trying to run too lean on inventory, especially for top-selling SKUs.

Make smarter decisions with the right inventory metrics

Curious as to how you can apply data into your decision-making? Here are a few examples:

Merchandising and marketing your products more effectively

Looking at data such sell-through and stock turn will help you get a clear picture of your top performing products as well as which items aren’t moving off the shelves fast enough. From there, you can make decisions on how to merchandise your products in-store and how to sell them.

Take a look at what T-We Tea, a San Francisco-based retailer that sells house-made teas and accessories, did with its products. They noticed that their low-margin items (such as tea accessories) were moving faster than their high-margin ones (house-made teas) so they opted to group them together at a slightly lower price. As a result, they were able to move products faster while maximizing profits at the same time.

Planning what items to order and when

Knowing how fast a style is moving or how much return you’re getting out of a product can help you plan out your inventory ordering.

For instance, if you discover that an item sells out every couple of months or so, then you can plan out how often you should be ordering that SKU. On the other hand, knowing your GMROI for different products can give you a better idea of which items are worth investing in, and how much you should spend on them.

Improving your processes

Measuring metrics such as shrinkage doesn’t just help you measure inventory losses, it can also give you valuable insights for improving your store procedures and security.

If your inventory discrepancies and losses are quite large, perhaps you need to set better user permissions that restrict employees from seeing information or performing tasks outside their job description.

You can also drill down on shrink by category or store area. Let’s say shrinkage is a lot higher in a particular department compared to the rest of the shop. Armed with this information, you can take a closer look at that department to figure out the reason behind high shrinkage. Are the items more prone to shoplifting? Are the products located in an area that can’t be monitored by your staff? The only way to find out is to look at the data and investigate.

Here’s another example: let’s say you discovered that administrative errors (e.g. pricing errors, mistakes in markups or markdowns) are causing major discrepancies in your inventory records. You can use that information to start improving how tasks are carried out in your stores. You can, for example, automate certain jobs to reduce human error.