Why new fmcg products give more margins to outlets to begin sales

The retail market in India is estimated to reach US$ 1.1 trillion by 2020 from US$ 840 billion in 2017, with modern trade expected to grow at 20 25% per annum, which is likely to boost revenue of FMCG companies. The FMCG market in India is expected to increase at a CAGR of 14.9% to reach US$ 220 billion by 2025, from US$ 110 billion in 2020. According to Nielsen, the Indian FMCG industry grew 9.4% in the January-March quarter of 2021, supported by consumption-led growth and value expansion from higher product prices, particularly for staples. The rural market registered an increase of 14.6% in the same quarter and metro markets recorded positive growth after two quarters. Final consumption expenditure increased at a CAGR of 5.2% during 2015-20. According to Fitch Solutions, real household spending is projected to increase 9.1% YoY in 2021, after contracting >9.3% in 2020 due to economic impact of the pandemic. The FMCG sector’s revenue growth will double from 5-6% in FY21 to 10-12% in FY22, according to CRISIL Ratings. Price increases across product categories will offset the impact of rising raw material prices, along with volume growth and resurgence in demand for discretionary items, are driving growth.

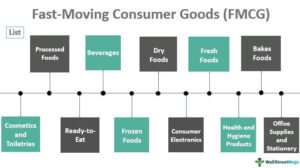

Fast-moving consumer goods (FMCG) sector is India’s fourth-largest sector with household and personal care accounting for 50% of FMCG sales in India. Growing awareness, easier access and changing lifestyles have been the key growth drivers for the sector. The urban segment (accounts for a revenue share of around 55%) is the largest contributor to the overall revenue generated by the FMCG sector in India. However, in the last few years, the FMCG market has grown at a faster pace in rural India compared to urban India. Semi-urban and rural segments are growing at a rapid pace and FMCG products account for 50% of the total rural spending.

The terms of trade are slowly tilting in favour of modern retail. Despite going through a correction phase, which saw many retailers shutting stores, modern trade is beginning to cash in on its scale and clout by seeking higher payouts from suppliers.

Consumer product companies have increased aggregate payouts by 200-300 basis points over last year, say retailers. These include incentives for timely payment, meeting certain volume targets, and marketing inputs.

As many companies supply directly to modern trade, they are willing to share the gains. Retailers say that margins from FMCG (fast moving consumer goods) companies have gone up from 14-15 per cent to 17-19 per cent as they jostle for shelf space with retailers’ private labels.

“Earlier, FMCG companies were servicing us through distributors and the terms of the trade were not favouring modern trade. Today, they are servicing us directly,” says the CEO of a mid-size retailer. Not many FMCG companies are willing to discuss their terms of trade with retailers.

Kishore Biyani, chairman of India’s largest retailer Future Group, says margins are growing in categories where modern trade accounts for 30-40 per cent of sales for that brand. These are categories like breakfast cereals, or shaving systems. “FMCG companies are realising the importance of modern trade in creating demand for new products,” says Biyani.

H K Press, vice-chairman, Godrej Consumer Products, says it’s logical for margins to go up as retailers expect more by way of other incentives for promotions, timely payment or volume discounts. “Pressure will always be there to keep creeping up,” he says.

FMCG companies say that as retailers acquire scale, they provide a value proposition: Organised scale, through-put, supply chain efficiency. “If I get certain supply chain efficiencies by supplying directly to organised retailers, I am willing to share the savings with them,” says a Hindustan Unilever executive.

Anand Raghuraman, partner and director, Boston Consulting Group, feels FMCG companies are increasing margins as trade is growing again, pushing the FMCG companies harder.

“FMCG companies are increasing margins so that they don’t lose premium shelf space to retailers’ private labels,” he said. These accounted for an additional 3-4 per cent of the sales value of retailers. Internationally, retailers earn margins of 24-25 per cent on consumer products, which includes logistics as retailers pick up supplies directly from suppliers. The CEO of a North India-based retailer says modern trade needs higher margins to operate, which would rise with volumes. In Brazil, retailers earn 21 per cent margin.

But it’s not that every FMCG company has increased margins for retailers across the board. With a spate of contracts up for renewal in January, some of them say they have not raised margins and nor is there a case for raising them, as retailers have failed to scale up and meet targets.

Besides, FMCG companies accuse retailers of pushing their own labels at the expense of their brands. “The margin pressure is going to increase, but a chain should help me sell a more profitable assortment. It cannot be a one-way traffic,” says the sales head of an FMCG company.

Arvind Singhal, CEO of consultant Technopack, says it is unlikely that category leaders would have increased margins.

“Modern retail still accounts for 3-4 per cent of sales. It would account for Rs 250-300 crore of sales for a large company like Unilever and hardly offers traction. But, for every Unilever, there may be five other companies willing to offer higher margins,” said Singhal.

FMCG companies today are staring at a major disruption in their distribution model. Other than some basic technology interventions to track primary (sales from the FMCG company to their Distributors), and in some cases, secondary sales (sales from the Distributor to the Retailers), very little changed over the decades. Products go from brands’ manufacturing facilities to their Distribution Centre (DC), on to C&F agents in each state, on to the hundreds of Distributors (DB) in that state, and finally on to the retailers, where consumers/shoppers purchase them. The primary reason for the lack of change is the more or less static retail environment we have seen –close to 90% of retail even today is dominated by mom & pop outlets, or what we call General Trade (GT) in India, this was as high as 98% till a decade or so ago.

Looking at the evolution of FMCG Distribution in India since 1950, we can categorise it in the following categories:

Distribution 1.0: (1950 to 1980) This entails traditional distribution model elucidated above, and very little changed in the model.

Distribution 2.0: (1980 – 2000) This was the period of small tweaks, where a) Company Sales reps were transferred to the Distributor for better supervision and management, called Distributor Sales Reps (DBSRs). Moreover, some leading companies starting to divide the sales teams into category teams, still primarily serving the General Trade, to focus on each category & SKU. b) We also saw leading FMCG companies adopt technology to track primary sales at both the distributor and branch level.

Distribution 3.0: (2000 – 2018) This has been the period of major change, with

- Wider adoption of technology to track inventory & sales (primary and secondary) through the implementation of Dealer Management Systems (DMS) and Sales Force Automation (SFA)

- Launch and rapid growth of Modern Trade (MT) from 2000 onwards, followed by e-commerce in the last five years.

- FMCG companies outsourcing their Sales Reps to third parties to reduce complexity for GT coverage, while also deploying Sales promoters in-store to engage with end consumers/shoppers to improve the shopping experience.

- GST roll out in 2018, which for the first time allowed manufacturers to view India as ‘One Market’ and adapt their distribution networks accordingly, doing away with the C&F agents and consolidating distributors.

Today, however, the time tested FMCG Distribution model is seeing massive disruption, and this is likely to continue if we go by what has happened in other emerging markets like Central Eastern Europe, Russia, SE Asia & China. On the demand side, a lot of new retail channels are emerging that are disrupting “Where” and “How” shoppers are shopping. We have seen the growth of modern trade in the last decade, e-comm/online retail in the last 5 years, and now hyperlocal delivery models like “Click & Collect”, etc. As shoppers move to an “Omni” mode of shopping, expecting the products to be present “when” and “where” they shop, FMCG companies will need to adapt their distribution models to enable this.

On the supply side, factors like changing aspirations of distributors, changing role of modern trade as a distributor, increasing complexity of FMCG business due to increasing categories and skills, increasing competition for shelf space in GT, rise of private labels, and the rise of new distribution “aggregators”, are impacting the traditional distribution model.

Thus, distributor churn is increasing rapidly, and as per our research, this can range from 15-30% annually. It is also becoming increasing difficult to replace exiting distributors as the distributor community continues to shrink. This is likely to have a major impact on brands’ ability to increase (or even maintain their direct distribution or coverage.)

In addition, Sales Force turnover (across all levels, and especially at the field sales level) is also increasing, and our research shows that it can be as high as 30-40%, annually. This is due to stiff competition from new age business like e-comm delivery, food-tech companies, mobile phone retail, electronics and apparel retail (single and multi-brand outlets), QSRs, jewellery chains, MT chains, etc. This is making it very challenging for FMCG companies to recruit and retain salespeople, putting further pressure on their model and margins.

Finally, increasing channel conflict on pricing, discounts, and range between GT, e-comm and MT is increasing pricing and margin pressure on FMCG companies as they juggle their volume growth ambitions with prices and margins, while trying to build their “Omni” channel presence. While the end consumer may be benefitting in this conflict through lower prices, the pressure on margins across the value chain continues to grow.

Distribution 4.0 – Reimagining FMCG Distribution for 2030:

So, what could FMCG companies do as they plan for the next decade? If we fast forward to 2030, the overall retail in India is expected to double to $1.5 trillion from today’s $700bn, and while it is difficult to predict how large each retail channel will be, we can expect GT’s share in overall retail, though still dominant, to come down to 50% (from today’s 85-90%). In addition, many of GT/Kiranas in Metros and Tier 1 & 2 cities are expected to upgrade to look and feel more like MT, a trend that is already prevelant. MT will continue to grow and could have a share of 25-30% by 2030, driven by its expansion into Tier 1, 2 and 3 cities with different formats and sizes. E-comm could easily account for 15-20% of total retail by 2030 (our research shows that it accounts for almost 50% of retail in China today) driven by higher smartphone and internet penetration, growth of digital & mobile payments, and expanding logistics infrastructure.

So, given these changes in retail, how should FMCG companies plan their distribution for 2030. Two scenarios are likely to emerge:

Scenario one – with the distributor community shrinking, and the need for scale, technology, higher margins, speed, along with a need for better trained sales force, many brands are likely to move to larger distributors who have a multi-state or even national footprint. This is similar to what has happened in other developing countries, as well as in categories like aerated beverages market in India, where there are one or two distributors covering the entire market. This will shift the balance of power between brands and distributors, and is likely to call for a strategic partnership between them, with more negotiated Terms of Trade, Joint Business Planning, etc, to drive scale.

The second scenario, which is more likely, will be the game changer. It will require FMCG companies to give up the ownership of the distribution model, and partner with multiple players for the best market coverage between urban and rural markets, focusing their own efforts on marketing, branding and in-store merchandising to create best-in-class shopper experience ( “retailtainment”). In this scenario, they are likely to partner with aggregators, e-comm delivery companies, rural distribution companies, and distribution arms of modern trade to drive coverage.

Aggregators present a one-stop-solution for GT/Kiranas, by not only providing the entire basket of products, but also enabling them through sales training, technology (they provide them with Apps and Tablets to order online every day, doing away with the need for sales people), credit terms and financing options, and even investment to improve in-store merchandising and look & feel of the store. This is likely to make the day-to-day lives of the Kirana owners much simpler, as they can focus their time on selling, rather than having to deal with hundreds of salespeople for orders, payments, new product listings, inventory management.

Why Hindustan Unilever Ltd is the most valuable FMCG

While modern trade continues to be a big retail channel for selling FMCG products, it is also emerging as a major competitor to FMCG distribution, as most large B2B retailers have established their own sales and distribution networks to sell into General Trade/Kiranas, Horeca, Supermarkets, etc. This is starting to cause a major channel conflict between traditional Distributors and MT distribution arms, and while brands may benefit in the short term due to increased sales, the long-term impact is expected to further disrupt the distribution network. In addition, MT’s growing strength of distributing to the GT channel is likely to also allow them to sell more of their private label products through that channel, directly competing with established FMCG brands and creating a bigger fight for shelf space in GT.

Even though this may seem disruptive, it is likely to emerge as the most efficient model in the coming years, where disaggregation will lead to “disowning” a large of the distribution network, and lead to partnering with regional and national players to enable the most efficient and lowest ‘cost to serve’ distribution model for FMCG brands across all channels. This will allow brands to focus on creating the ‘pull’ and in-store customer/shopper experience (In China, approx. 25% of FMCG business is distributed by Aggregators) that consumers will demand in 2030, and let the partners do the distribution.

Makers of shampoo, soap, biscuits, chips and noodles are increasingly introducing family or ‘jumbo’ packs of their top-selling brands in supermarkets to push sales and profits by offering value deals in a high-inflation environment.

The big pack push, mostly a modern-trade phenomenon, help retailers get higher ticket sales and compete better against neighbourhood stores with value-for-money and bundling offers.

“This is the best time to do mega packs…with the slowdown and consumers seeking value, it makes immense sense,” said Devendra Chawla, CEO at Food Bazaar, food retail chain of the country’s top retailer Future Group. “For companies, making big packs leads to saving in manufacturing, packaging and transportation costs, so they are able to pass on the economies of scale to consumers through value pricing and bundling,” he said.

Family packs now account for 75% of total sales at Big Bazaar and Food Bazaar outlets, up from 57% 18 months ago.

The group had launched large packs of its private brand Tasty Treat chips two years ago.

On average, big packs are about 20-25% cheaper than regular packs, and they offer much higher profit margins than trial packs priced at 5 and 10, which are also high in demand, mostly in neighbourhood stores. “It’s on the big packs that companies make money. Gross margins at least 8%-10% higher on jumbo packs, compared to 5, 10 or 20 packs,” a top official of a modern retailer said.

Mayank Shah, group product manager at the country’s largest biscuit maker Parle Products.

Tips to Increase Your Profit Margins in Fmcg Products: 11 Strategies to Improve Profitability

What is the average profit margin in retail?

In our study of 13,000+ retailers, we found that the average gross profit margin in retail is 53.33%. Comparing the data across regions, we didn’t find a lot of variances in profit margins, though New Zealand takes the lead with 52.92% margins.

That said, differences in margins were much more pronounced when we compared the data across multiple industries. Beverage manufacturers, jewelry stores, and cosmetics had some of the highest profit margins, with 65.74%, 62.53%, and 58.14%, respectively. Meanwhile, alcoholic beverages, sporting goods stores, and electronics had some of the lowest margins at with 35.64%, 41.46%, and 43.29% respectively.

What is a good profit margin in retail?

Given the averages presented above, a “good” profit margin depends on your region and industry. Take a look at the above-mentioned benchmarks to gauge your performance against other retailers.

If you’re a sporting goods store whose gross profit margin is 50%, then you’d be above the industry average of 41.46%. However, that same profit margin of 50% is consider low for cosmetics stores whose margins are at 58%.

It’s also worth looking at net margins. Data from NYU Stern indicate that the pre-tax unadjusted operating margin in the retail sector ranges from 2.89% to 12.79% depending on the retailer.

Take a look at the following percentages and see how you compare:

- Retail (Automotive) – 6.43%

- Retail (Building Supply) – 12.79%

- Retail (Distributors) – 7.70%

- Retail (General) – 4.63%

- Retail (Grocery and Food) – 3.48%

- Retail (Online) – 5.74%

- Retail (Special Lines) – 2.89%

How to Increase Your Profit Margins

Now that you have a better idea of the amount of profit that retailers are taking in, it’s time to look at the specific ways that you can increase your profit margins.

Here are 10 things you can try:

1. Avoid markdowns by improving inventory visibility

Markdowns are notorious profit-killers, so avoid them whenever possible. How do you do that? Start by improving how you manage your inventory. You should always have a handle on the merchandise you have on hand, as well as what your fast and slow-movers are. This will help you make better decisions around purchasing, sales, and marketing, allowing you to sell more products and reduce the need for markdowns.

“One way to maximize margins which also has other significant benefits is to have 100% visibility of inventory. By doing so, this minimizes markdowns and thus margin erosion. Zara are a particularly good example of this,” says Andrew Busby, Founder & CEO at Retail Reflections.

ERP Tip

If you’re a ERP user, you can gain immense inventory visibility by looking at your reports. Vend’s Reporting capabilities allow you to closely monitor stock levels and inventory movements, so you can keep products moving.

With multiple channels and especially given the rapid rise of fast fashion — for example, ASOS adds around 5,000 new products each week to its website — giving the entire enterprise full, consistent visibility of product inventory means being agile and able to respond rapidly to shifting trends and constant changes in demand.”

Key takeaways:

- Improve your inventory management practices. Get a handle on your data and always know what you have on hand, what’s selling, and what’s not moving.

- Use those inventory insights to make decisions around purchasing, sales, and marketing.

2. Elevate your brand and increase the perceived value of your merchandise

It’s interesting to see that cosmetics retailers have some of the best margins in retail. According to experts, one reason behind this is the fact beauty and cosmetics brands excel at creating personal and emotional connections with customers.

Beauty is a category on fire…The price value equation is quite good, cosmetics make people feel better about themselves and foster strong customer loyalty, and the merchandising creates a sense of exploration…”

– Laura Heller, Editor, Retail Dive

She continues, “We ran a story earlier this year titled “Why beauty will continue to rule retail in 2018” that outlines some of the reasons behind this trend. The product category creates a kind of personal connection with shoppers, unlike many other consumer goods. The price value equation is quite good, cosmetics make people feel better about themselves and foster strong customer loyalty, and the merchandising creates a sense of exploration — something the off-price retailers have also done quite well. Depending on the brand, packaging, and marketing attached, the profit on each small item can be really high.”

Chris Guillot, Instructional Designer of Merchant Math and Founder of Merchant Method, offers a similar view, saying that “cosmetics brands do a great job with brand management, playing to their customer base at an emotional level — status and lifestyle.”

According to Guillot, “Retailers of all sizes and stages of growth can focus on their unique brand positioning as a way to differentiate from their competitors and increase perceived value.”

Key takeaways:

- Find ways to increase the perceived value of your brand. You can do this by focusing on the emotional and lifestyle values that your merchandise can offer.

- For example, can your products make people feel better about themselves? Can they elevate the lifestyle of your customers? Brands that are able to these things can often charge a premium for their products.

3. Streamline your operations and reduce operating expenses

“Retailers often focus on pricing strategies when searching for ways to increase profits, but most should try to start with streamlining operations,” says Krista Fabregas, a retail analyst at FitSmallBusiness.com

“First, cut overtime and excess staffing as much as possible, then focus on areas of waste. Minimize supply: spend as little as possible, and ditch the fancy printed shopping bags, tissue fill, and excess packaging wherever possible. If you’re not using an efficient point-of-sale to tie inventory, sales, and marketing under one system, consider making a switch to a low-cost system. This makes your entire store and staff run more efficiently.”

Another great way to streamline your operations is to automate specific tasks in your business. By putting repetitive activities on autopilot, you can reduce the time, manpower, and operating expenses required to run your business.

Go through all the tasks that you and your employees complete day-to-day, and see if you can automate any of them. Are there cumbersome activities that are eating chunks of your time? Do you have to re-enter any data or perform certain steps more than once? Look for solutions that can take care of them for you.

Data entry isn’t the only thing you can automate. These days, there’s (usually) an app for most of the tedious administrative tasks in your store.

If you regularly make appointments with customers, for example, consider using an app such as Timely, which streamlines bookings and sales, and even sends automatic appointment reminders to your customers. Do you spend a lot of time managing employee shifts? Check out Deputy, which lets you and your staff coordinate schedules from your mobile devices and sends shift changes and notifications for you.

Key takeaways:

- Lower your overhead by reducing wasteful spending and by using less expensive supplies (as long as you don’t compromise quality).

- Automate repetitive tasks to save time and further reduce your expenses.

4. Increase your average order value

Increasing the basket size or average order value (AOV) from shoppers already in your store is a great way to improve your profits. You’ve already invested in getting them to your location; now go and find ways to maximize their spend.

Start with upselling and cross-selling. As Matthew de Noronha, Head of SEO at Eastside Co., puts it, “someone who makes a purchase from you has already been qualified. They have engaged with your brand and, while it may sound obvious, they are significantly more receptive to offers and product advertising. For that reason, it makes complete sense to encourage them to spend more.”

Start by finding products likely to be purchased together. Then, after a user has committed to purchasing a product, encourage increased spending by recommending relevant items.

Check out what apparel retailer Francesca is doing. Most of the brand’s product pages have a “Complete Your Look” section containing products that complement the item being viewed. This encourages shoppers to add items to their cart, increasing their AOV.

Strategic product placement in-store can also increase AOV. Adam Watson, director of Decorelo, recommends putting “your most profitable products in the shop window and in the best area customers naturally go to in the store so as many eyeballs see them as possible.” Doing so will help you sell your most profitable items, contributing more to your bottom line.

Another tactic is to “put your best sellers and upsells near the counter for impulse buys to increase average order value,” says Adam.

Key takeaways:

- Increase basket size through suggestive selling.

- Find your most profitable products and position them high-traffic areas of your store.

- Promote impulse buys at the checkout counter.

5. Implement clever purchasing practices

Whether you’re at a trade show looking at new products or at the negotiating table with your suppliers, make sure you’re always finding ways to lower costs.

Think about the final cost

One of the best ways to do this, according to business coach Lindsay Anvik, is to “approach products by factoring in the final cost (i.e., wholesale cost, taxes, shipping, etc.). Once you have that final figure, ask yourself, ‘Would I pay X for this?’. If you wouldn’t, you need to find a way to lower the cost or move on from the product.”

Ask for vendor discounts or offers

Lindsay also recommends asking for discounts (e.g., free shipping) or other offers (e.g., throwing in a couple of extra products for free). This works particularly well when you’re buying in bulk.

Lindsay, for example, once helped her client “negotiate $2 off of every garment they ordered. The client was a top customer, paid on time and was easy to work with. The vendor was happy to give this discount because it didn’t hurt his bottom line too much. And because my client was a good customer, he was willing to negotiate to keep her happy.”

Increase order quantities

Let’s say you need to up your order quantities for a particular item to lower its price. In this case, you could look at your inventory data and determine if you can afford to order certain items in bulk. If not, would it be possible for you to consolidate orders for other items (or with other purchasers) to increase your buying power?

This is something that many large retailers have been doing for quite some time now. A few years ago, for example, Walmart sought out joint purchasers for raw materials, so they can consolidate purchases and get more buying clout.

Explore your options and run them by your suppliers to see if you can negotiate better deals. If they don’t budge, then check out other vendors to find out if they can offer you more favorable terms. (And make sure your existing suppliers are aware of this — they could end up giving you better rates.)

Key takeaways:

- Before finalizing an order, always consider the final cost by factoring in taxes, shipping expenses, and more.

- Don’t be afraid to ask your vendor to give you a discount or throw in a few extra units.

- “Buy with other stores,” says Lindsay. “Get together with another store owner (or owners) and buy together. This way you can ask for a bigger discount from wholesalers.

6. Increase your prices

Raising your prices will enable you to make more money on each sale, thus widening your margins and improving your bottom line. Many retailers, however, balk at the prospect of increasing their prices out of fear that they’ll lose customers.

We wish we could give you hard and fast rules when it comes to pricing, but the fact is, this decision depends on each company’s products, margins, and customers. The best thing to do is to look into your own business, run the numbers, and figure out your pricing sweet spot.

On top of considering basic pricing components like your costs and margins, look at external factors such as competitor pricing, the state of the economy, and the price sensitivity of your customers.

And consider what types of customers you want to attract. Do you want to sell to shoppers would take their business elsewhere just because they could get an item for less, or would you rather attract customers who don’t base their purchase decisions solely on price?

You’d be surprised to find that majority of consumers (though this may vary from one industry to the next) may actually belong to the latter group. A study by Defaqto has found that “55% of consumers would pay more for a better customer experience.

Take all these things into consideration; do the math, and once you come up with a price increase, test it on a few select products then gauge customer reaction and sales from there. If the results are positive, roll out the increase across all your products.

Be creative with your price increases

You may also want to consider implementing creative or psychological tactics when coming up with your prices, to make them more appealing. You can, for instance, incorporate tiered pricing into your strategy.

Check out what shoe retailer Footzyfolds did. To combat cheaper knock-offs of its merchandise (they were selling them for $25, while Target had them for $10) the store decided to revamp its prices — but not in the way you might think.

Instead of lowering prices across the board, Footzyfolds introduced a high-end category for their products. With the new pricing format, they lowered the price of their everyday products to $20 a pair, but introduced a new “Lux” category for $30 a pair.

Owner Sarah Caplan told the New York Times that this move helped them increase profits. “We actually have had the most interest in our higher-priced shoes,” she said to the publication and reported that after launching the high-end line in the summer of 2010, they saw revenues increase by 100%.

Key takeaways:

- If it makes sense for your business, go ahead and raise your prices. Krista recommends that you start with your top sellers. “Do you have a lot of competition, or do your products stand alone? If so, raise your prices on these products.”

- Be creative with your prices. Factor in psychology or use methods like tiered pricing.

- To learn more about tiered pricing and other strategies, check out our post on the secrets to irresistible pricing.

7. Optimize vendor relationships

Earlier in this post, we talked about negotiating better contracts with your suppliers to reduce the costs of goods and widen your margins. If you want to take things a step further, consider building stronger relationships by working more closely with them.

Engage in Joint Business Planning

Daniel Duty, co-founder and CEO of Conlego, says that retailers should engage in Joint Business Planning with vendors. “This is a collaborative tool whereby profit goals are agreed to, and initiatives are developed to help reach those goals. In other words, both sides help each other become more profitable,” he shares.

Reduce supply chain costs and inefficiencies

“The supply chain — or the process of getting a product from the factory to the store floor — is always full of inefficiencies and huge costs,” adds Daniel.

“Retailers should study their supply chain to figure out where there are unnecessary costs. For instance, shipping product in less than a full truckload is more costly than when it is full. Making many deliveries each week to a store is more expensive than just one. Retailers should ask their suppliers if they are doing anything that is adding to costs to the supply chain that could be stopped.”

It helps to have a discussion with your vendors to see if there’s anything you can do to make things easier or more cost-effective.

That’s what photo digitization service ScanMyPhotos.com did. President and CEO Mitch Goldstone says that collaborating closely with their vendors enabled them to enhance their business processes. “We invite our vendors to think of us as a partner. The better we do, the better they do. The process is simple, just ask vendors to help improve your workflow.”

Mitch shares that they even invited one of their vendors, the United States Postal Service, to visit their headquarters. “We asked them to study our entire shipping operation and the technology that drives our fulfillment services. Many, many elements we thought helped streamline the business, were all wrong and the USPS marketing team became our best partner to reinvent everything.”

See if you can do the same thing in your business. Strengthen your relationships with vendors and determine how you can work better together. Doing so could help you identify ways to reduce product costs and operating expenses. Or, at the very least, it could improve your workflow and productivity.

Key takeaways:

- Have a collaborative relationship with your vendors. Engage in Joint Business Planning and figure out how you can both improve profitability.

- Identify inefficiencies in your supply chain and find ways to reduce them.

8. If you *must* discount your products, be smart about it.

While discounting typically goes against traditional advice on profitability, it could work to your advantage if you do it right.

Consider personalized offers

For instance, you could try to provide tailored offers. Remember that not all customers are wired the same way. Some people may need a 20% off incentive to convert, while others don’t really require a lot of convincing.

Instead of killing your profits with large, one-size-fits-all offers, identify how big of a discount is necessary to convert each customer.

Case in point: Online bicycle retailer BikeBerry.com. The e-tailer sought the help of big data company Retention Science to analyze customer behavior and gather intel on their customers’ past purchases, browsing history, and more. This allowed them to get to know their customers and figure out the most cost-effective way to convert each one.

They then created a series of email campaigns with five different discount offers tailored to each individual. Customers received one of the following offers in their inbox: Free Shipping (which is huge because shipping costs can run high for bikes and other accessories), 5% off, 10% off, 15% off, and $30 off new products.

The campaigns ran for two months and within that period, BikeBerry not only increased sales, but they were able to widen their profit margins by not offering discounts that are too big to customers who would convert at a lower threshold.

See if you can do something similar in your business. Instead of offering blanket discounts, go through the purchase histories of your customers, then personalize your offers based on their behavior and preferences. Doing so won’t just increase the chances of conversion (people are more likely to respond to an offer if it’s relevant to them), it’ll also help you maximize your margins.

Vend Tip

Are you a Vend user? This video shows you how you can track purchase histories and make tailored recommendations using our loyalty and customer management features. Check it out!

Time them right

Timing is also critical. As M. Pope Anthony, president and buyer at Anthony’s Ladies Apparel, notes, “there is a fine line between too soon and too late. If you hold on to items too long, you will eventually have to sell them at a much deeper discount.

Good historical information and experience are crucial. Being overstocked on old, undesirable inventory will tie up your dollars and prevent you from buying new products. Eventually, your volume will decline, rendering you with fewer margin dollars.

Be sensible about your discounts

“Profit margins can be improved through sensible couponing,” says Matthew. “I’ve worked with many retailers who see the increased number of orders from promotions and sales.

But Matthew stresses the importance of analyzing your promotions to ensure that they’re not harming your margins.

According to him, you need to ask key questions such as, “How many more orders has a promotion brought in (compared to the average number of sales)? How much revenue did your promotion bring in, and how does this compare to average after your overheads and the discount has been taken into account?”

He adds, “One effective way to find this out is through A/B testing, offer your promotion to half your users (either through emails, targeted ads, onsite, etc.). This test may need to be run a few times to become significant. But very quickly you’ll be able to compare the profit made between the two groups — identifying whether your promotions are actually cannibalizing your returns.”

Key takeaways

- Personalize offers so you’re not giving away too big of a discount to people who would convert at a lower threshold

- Test different types of promotions to see which ones are really making you money

9. Inspire your staff to do more

One way to boost your profits is to increase the output of your existing staff. No matter what type of store you’re running, there’s a good chance that your employees aren’t being as productive as they could be — and that’s not necessarily their fault.

According to the Harvard Business Review, companies lose over 20% of their productive capacity to organizational drag — “the structures and processes that consume valuable time and prevent people from getting things done.”

As such, it’s important that you evaluate your store processes to ensure that they’re not slowing people down. The key is to come up with procedures that can easily be replicated and implemented by your staff even when you’re not around. (Hint: if you have the right technology as mentioned above, you’re off to a great start!)

Once you’ve tightened up your processes, you can work on empowering and training your team to level up their game. There’s no one right way to do this, as each retailer is different. But here are a few ideas:

- Set the right sales targets and motivate your team to meet (and beat) those goals.

- Identify the key traits of successful retail associates and develop those characteristics in your staff.

- Implement retail hiring and training best practices to boost performance, sales, and customer service.

- Help your team overcome their fear of selling.

- Educate your staff on suggestive selling.

- Train your staff to upsell and cross-sell.

- Train your staff to make a better first impression with customers.

Key takeaways:

- You could be losing staff productivity (and ultimately profits) to “organizational drag.”

- Prevent that by streamlining your procedures, eliminating red tape, and empowering your team to do more.

10. Identify and eliminate waste

Finding areas of waste in your business — and eliminating those wastes — can save money and add to your bottom line.

The world of lean manufacturing recognizes the 8 types of wastes that are costing businesses money. While the concept largely applies to manufacturers, retailers can also apply the concept to their operations.

Put it simply, the 8 types of wastes can be summarized using the acronym “D-O-W-N-T-I-M-E”:

D – Defects (defective products due to issues like quality control, poor handling, etc.)

O – Overproduction (ordering or making more merchandise than necessary)

W – Waiting (unplanned downtime, absences, unbalanced workloads, etc.)

N – Not utilizing talent (not fully leveraging the skills or potential of your team, having employees do the wrong tasks, etc.)

T – Transportation (unnecessary movements of products — e.g., unnecessary shipping, inefficient movement from one store to the next)

I – Inventory excess (surplus or dead stock sitting in your backroom)

M – Motion waste (unnecessary movements of people — e.g., inefficient store layout)

E – Excess processing (having to process, return, or repair products that don’t meet the customer’s needs)

Go through each of these components individually and see how they apply to your business. If these types of wastes are present, find ways to reduce or eliminate them.

11. Get more sales from your existing customers

Multiple studies have shown that selling to existing customers is more profitable than acquiring new ones. That’s why it’s incredibly important that you don’t neglect your current customers.

Nurture your relationships with them and continuously find ways to drive sales.

Our Bralette Club (OBC) does an excellent job here. OBC implements automated email campaigns to drive sales from customers who haven’t bought anything in a while.

OBC uses Marsello to automatically segment shoppers based on their behaviors. When a customer is considered “at risk” of not returning, OBC will automatically send a “We miss you” email containing a 15% discount.

Bottom line

You don’t always have to make drastic changes in your business to significantly improve your bottom line. As this post has shown, sometimes a simple tweak in your pricing or a phone call to your vendor can pave the way for wider margins.

Can you think of other tactics that can help retailers improve their profit margins? Let us know in the comments.

End Game : Fmcg Products.

Fmcg Companies pass on hefty margins to traders,retailers,wholesalers, Modern trade,General trade and distributors to increase width and depth of distibution and coverage of the brand.Wholeasle infilttration is a foregone conclusion.

The Fmcg trade usually accepts new brands and reliable products if margins are above average.Branding, product display space, freezer space, sku listing fees, product mapping,free sampling, wet sampling are many ways of enticing dealers to stock the brand without much investment on media and advertising.

New brands sometimes bulldoze through the competition with these attractive schemes and incentives for a perceived quicker return on investment…

Top most festival Products FMCG consumers search today

World Wide Festive Trends Decoded What Indian festive consumers seek...

Read MoreHow right selection of FMCG Salesmen improves brand market share

How can FMCG Companies improve salesman’s technique in order to...

Read MoreHow most searched Fmcg sales and marketing words help newbie salesman

Why undestand FMCG sales management? Sales management is the process...

Read MoreHow Successful FMCG Salesman Starts his Day, a guide

How does one become a good sales executive in the...

Read More