How to profit in Top Money Making FMCG Companies In Stock Trading Today

How has FMCG Become Part Of Our Life?

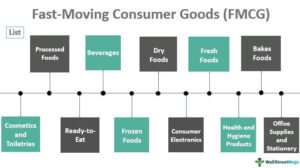

FMCGs have a short shelf life because of high consumer demand (e.g., soft drinks and confections) or because they are perishable (e.g., meat, dairy products, and baked goods). These goods are purchased frequently, are consumed rapidly, are priced low, and are sold in large quantities. They also have a high turnover when they’re on the shelf at the store.

- Fast-moving consumers goods are nondurable products that sell quickly at relatively low cost.

- FMCGs have low profit margins, but they account for more than half of all consumer spending.

- Examples of FMCGs include milk, gum, fruit and vegetables, toilet paper, soda, beer, and over-the-counter drugs like aspirin.

- FMCGs account for more than half of all consumer spending, but they tend to be low-involvement purchases. Consumers are more likely to show off a durable good such as a new car or beautifully designed smartphone than a new energy drink they picked up for $2.50 at the convenience store.

- FMCG sector is defensive in nature with less impact of the economic situations on the revenues unlike other sectors like Auto, infrastructure & capital goods. The key driver to the demand is the rise in income of population. The growth may come by increase in the quantity of consumption or by increase in the quality (premiumization) of products. Another secondary factor is the extent of marketing done by the companies which also influences the demand for the brand. Key strengths of incumbents is the distribution set up and advertising budget. The deep distribution helps companies to reach to the remote locations and spend large amount in advertising to keep competition away.

- One idea is to buy specific stocks of key FMCG companies in proportion to their weights in the index like Sensex. Another idea is to gain exposure via investing in funds like Nippon India Consumption, BNP Paribas India Consumption, ICICI Pru Bharat Consumption, Mirae Asset Great Consumer.

- You can use the MoneyWorks4me Nifty FMCG Index Screener for shortlisting the top performing companies. For example, using the MoneyWorks4me’s screener we first shortlist the fundamentally strong companies (Identified by the ‘Green’ colour code) and then look for companies that have shown a strong profit growth in the last five years. We arrive at the following list of companies:

1. What is the full form of FMCG?

A: The full form of FMCG is Fast Moving Consumer Goods. These goods are usually consumer goods with short shelf life like soft drinks, dairy products, frozen goods, and medicines.

2. What is a sector fund?

A: Sector funds are similar to mutual funds or investment funds, but these belong to only a single industrial sector.

3. Is it beneficial to invest in the FMCG sector fund?

A: Although the FMCG sector fund is often considered a high-risk investment, it can prove beneficial to invest in the FMCG sector fund. The FMCG sector fund produces good returns as these companies usually record an excellent profit margin. Even if you are not looking to trade in the FMCG sector fund, it generally produces good dividends.

4. What is CAGR?

A: The full form of CAGR is the Compounded Annual Growth Rate. By evaluating the CAGR, you can quickly evaluate the best investment portfolios and identify the Best Sector Funds for investment.

5. Why is CAGR important in FMCG funds?

A: The CAGR will help you evaluate the FMCG industry’s performance, which is necessary when planning to diversify your portfolio of a sector fund. If the CAGR of the FMCG is 17% and above, then you can consider this as robust returns, and it is suitable for investment.

6. What is long term capital appreciation?

A: Long term Capital appreciation is the rise in stocks price when held for a more extended period. If you are investing in a particular sector fund, it is essential to evaluate its long-term capital appreciation. Preferably the price of the stocks should rise in five years, and you can earn good returns.

7. Are there additional risks in sector funds?

A: The sector funds are considered riskier than mutual funds as there is no chance of moving away from the particular sector if it stops performing. Usually, the minimum time for investment in a sector fund to mature is three years, and if the stock stops performing, you cannot move away from the particular sector. Sector funds are usually more volatile than diversified Equity Funds, wherein you can invest in stocks of different sectors. Since you will be investing only in a single sector, you will have no option but to stay with your particular industrial sector choice.

8. Why should I invest in sector funds?

A: Despite the risks involved, sector funds have been known to produce excellent returns. However, you will have to wait for 3-5 years for your investment to produce the desired results.

9. Are returns greater in these funds?

A: The returns of sector funds depend on the risk that you are prepared to take. Usually, the returns are higher in sector funds, especially if the particular sector starts performing better than expected. It is always a good idea to diversify your investment portfolio with some sector funds.

10. Why are risks more significant in FMCG sector funds?

A: The FMCG market is quite unpredictable, which makes investment in the FMCG sector riskier. Moreover, not all companies in this sector can perform equally well. Hence, it is better to diversify one’s portfolio of investments. As the funds are entirely dependent on the consumer, predicting the market’s outcome with absolute certainty is quite challenging.

11. How does consumption reflect on FMCG funds?

A: If the consumption increases, it is likely to improve the companies’ profit margin in this sector. Subsequently, as the CAGR will increase, it will improve the returns on investment. Thus, increased consumption will reflect positively on the FMCG sector funds..

Which FMCG is the best?

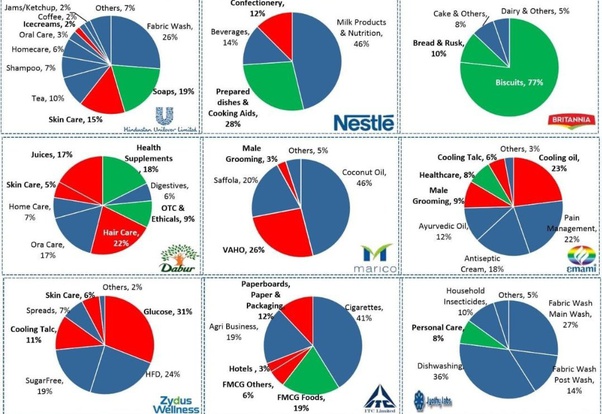

Top 10 FMCG Stocks to Buy in India – List of Best FMCG Shares to Buy.

| Rank | Stock Broker |

| 1 | Hindustan Unilever |

| 2 | Nestle |

| 3 | Britannia |

| 4 | Dabur |

| 5 | Godrej Consumer Products |

| 6 | Tata Consumer Products |

| 7 | Marico |

| 8 | Colgate-Palmolive |

| 9 | P&G Hygiene & Healthcare |

| 10 | Varun Beverages |

At present, the Top 10 FMCG Stocks present in the market are Hindustan Unilever Ltd., Nestle India Ltd., Britannia Industries Ltd., Dabur India Ltd., Godrej Consumer Products Ltd., Tata Consumer Products Ltd., Marico Ltd., Colgate-Palmolive (India) Ltd., P&G Hygiene & Healthcare Ltd., and Varun Beverages Ltd.

These companies are the business leaders in the FMCG sector in India and are progressing rapidly by increasing their reach all over the world.

These companies are the business leaders in the FMCG sector in India and are progressing rapidly by increasing their reach all over the world.

The benefit of investing in the stocks of these large Consumer Goods Enterprises is that there is always a guarantee of good returns.

The risk involved in the investment goes down multiple folds and since these companies have a good record of performing well even in the overseas markets.

Therefore, for any investors, they are the Best Consumer Goods Stocks to Buy. Hence, it is very important to learn more about these companies and their shares.

Is it good to buy FMCG shares?

Are FMCG names to be bought on declines?

It,s doubtful if anybody would buy them now because they do not have enough business catalysts.

The lockdowns might aid a certain amount of sales, but commodity prices as well as supply chain constraints are bound to bite them in terms of margins. They are unlikely to increase prices.

Against this backdrop, we think it is good short-term trade but it is not an investment at this point.

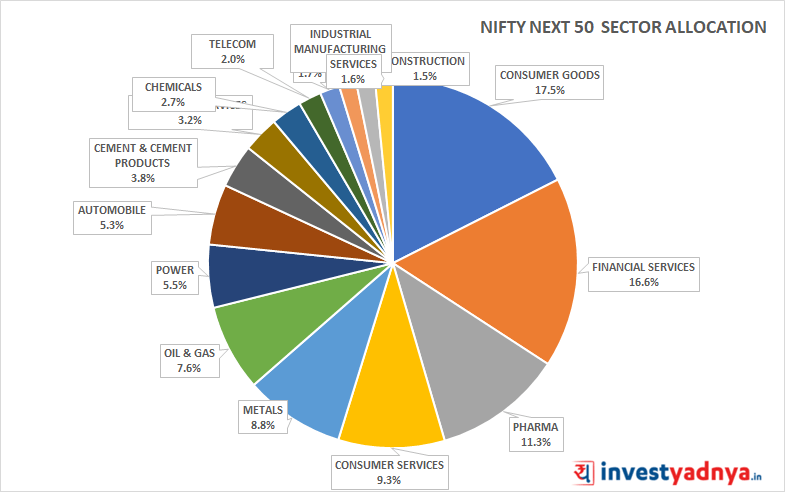

Nifty FMCG index Stocks | Company Weightage.

Here is The List of Nifty FMCG index Stocks and Their Companies weighatage before that take a look at Index. FMCG Index is designed to reflect the behavior and performance of FMCGs (Fast Moving Consumer Goods) which are non-durable, mass consumption products and available off the shelf.

Nifty FMCG Index

The FMCG Index comprises 15 stocks from the FMCG sector listed on the National Stock Exchange (NSE). The Index is computed using the free-float market capitalization method, wherein the level of the index reflects the total free-float market value of all the stocks in the index relative to a particular base market capitalization value.

- Base Date: January 01, 1996

- Base Value: 1000

- Launch Date: September 22, 1999

- No of Constituents: 15

Stock Lists of Nifty FMCG Index

so here is the list of companies in FMCG Index.

Company Name Industry Symbol Series Britannia Industries Ltd. CONSUMER GOODS BRITANNIA EQ Colgate Palmolive (India) Ltd. CONSUMER GOODS COLPAL EQ Dabur India Ltd. CONSUMER GOODS DABUR EQ Emami Ltd. CONSUMER GOODS EMAMILTD EQ Godrej Consumer Products Ltd. CONSUMER GOODS GODREJCP EQ Godrej Industries Ltd. CONSUMER GOODS GODREJIND EQ Hindustan Unilever Ltd. CONSUMER GOODS HINDUNILVR EQ ITC Ltd. CONSUMER GOODS ITC EQ Jubilant Foodworks Ltd. CONSUMER GOODS JUBLFOOD EQ Marico Ltd. CONSUMER GOODS MARICO EQ Nestle India Ltd. CONSUMER GOODS NESTLEIND EQ Procter & Gamble Hygiene & Health Care Ltd. CONSUMER GOODS PGHH EQ Tata Global Beverages Ltd. CONSUMER GOODS TATAGLOBAL EQ United Breweries Ltd. CONSUMER GOODS UBL EQ United Spirits Ltd. CONSUMER GOODS MCDOWELL-N EQ

best fmcg stocks in india 2021

Overview of the FMCG sector in India.

Fast Moving Consumer Goods (FMCG) is the 4th largest sector in the Indian economy. It is considered as a barometer of consumer demand in every country. This sector is mainly divided into three categories: Food & Beverages (19%), Healthcare (31%), Household & Personal care (50%). Growing awareness, easier access and changing lifestyles have been the key growth drivers for the sector.

The urban segment contributes around 55 percent in revenues of FMCG companies and 45% is contributed by the Rural segment. However, demand for quality goods and services have been going up in rural areas of India on the back of improved distribution channels of manufacturing companies and the COVID-19 led shutdown which had caused hoarding of essential goods in fear of timely supplies.

FMCG companies which relied on rural consumption were less affected post the first wave, but the second wave impacted rural areas which raises some near term concerns for such FMCG companies. Apart from this a major concern for these companies is rising key raw material prices (edibles oils, palm oil, tea etc).

Some big companies have tackled this by taking calibrated price hikes and some are focusing on protecting their volumes and margins but over the long term such high input prices are unlikely to sustain so we can expect better days ahead for the FMCG companies.

Why FMCG stocks are falling?

Why FMCG stocks are falling?

FMCG sales show signs of revival as Covid curbs ease.Relaxation of Covid restrictions led to a 15-20% increase in sales of fast-moving consumer goods (FMCG) across grocery stores in general trade and a 25-30% jump in supermarkets and standalone modern trade outlets in the past week from the month earlier, industry executives of large companies said.

Some shops have reopened and others have extended operating hours as curbs eased.

Rural demand for discretionary products from non-essential consumer goods to automobiles is expected to remain muted this fiscal despite record agricultural produce and good monsoon prediction due to a steep surge in Covid-19 cases in India’s villages, a new report has said.

Fmcg Multibagger Stocks.

Which are the potential multibagger stocks with strong fundamentals in the FMCG sector & available below Rs. 20?

Looks like you are setting some distinctly achievable target for yourself. less than 20 Rs companies are not known in the market. You can possibly find them through angel investing or private equity route.

Well known FMCG companies shares starts from around 200 Rs..

MULTIBAGGER at the same time the stocks which are affordable to small investors as well.

PENNY STOCKS which are having great fundamentals over the past 5 years.

Penny stocks are those stocks that trade at a very low market price and generally with a share price of 1 or 2 digits. These stocks have a very low market capitalization and typically under few Crores. These stocks would be very smaller cap companies.

Advantages – Penny stocks have a high potential of rewarding its shareholder. The returns are quite high if you are able to get a good penny stock. Many penny stocks have turned out to be multi-baggers for their investors.

Disadvantages – These stocks are quite risky as the percentage of a number of penny stocks outperforming the market are quite less. Many of the penny stocks become bankrupt and go out of the business.

Diversification – Don’t invest more than 10% of your entire capital and don’t invest in more than 5 penny stocks in your portfolio.

I have chosen the companies based on the below factors:

- There is almost no debts are very insignificant debts

- Profits Growth for past 3 years average is above 15%

- Sales Growth for past 3 years average is above 10%

- Average return on Equity for past 3 years average is above 15%

- High Promoter holding with very less pledged percentage.

- Earnings Per share is above 5

- Current Price which is less than Rs 99

Why FMCG Stocks Should Be Part Of Your Portfolio.

Potential Opportunities:

- India’s organised FMCG space is expected to grow at a pace of 14-15% YoY per annum for the next decade to the size of US$ 220 billion-US$ 240 billion. Consumption is expected to be driven by factors such as increasing income, rising urbanisation, nuclearisation, as well as growing work force. As per BCG, incomes are likely to rise by 70% by 2025; more than a third of the population is likely to reside in urban parts of the country; reducing household sizes due to nuclearisation is likely to add about 10 million households by 2020; about a 100 million of youth are expected to join the work force by 2020.

- Notwithstanding the slump caused due to macro factors like demonetisation and hiccups in the GST implementation – falling inflation and interest rate levels along with seventh pay commission hikes will continue to be positive for the sector over the long run. While traditionally, rural demand has outpaced urban demand, the same has not been the case in recent times as growth in both the markets has been similar. In fact, a good number of companies have begun refocusing on the urban markets.

- Going forward, GST will be beneficial for the FMCG industry as many important raw materials required in the food processing industry will be exempted from GST. Moreover, major FMCG products will have lower GST rates compared to their current tax rates.

- With the rise in disposable incomes, mid and high-income consumers in urban areas have shifted their purchase trend from essential to premium products. This could spell an opportunity for established FMCG firms to build on their existing brands and add value in return for higher margins.

Top most festival Products FMCG consumers search today

World Wide Festive Trends Decoded What Indian festive consumers seek...

Read MoreHow right selection of FMCG Salesmen improves brand market share

How can FMCG Companies improve salesman’s technique in order to...

Read MoreHow most searched Fmcg sales and marketing words help newbie salesman

Why undestand FMCG sales management? Sales management is the process...

Read MoreHow Successful FMCG Salesman Starts his Day, a guide

How does one become a good sales executive in the...

Read More