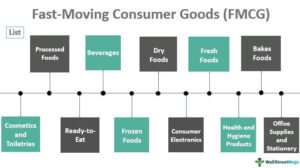

How top billionare brands went pauper newbie fmcg company must know

How did it happen that prominent people who were rich and then became poor?

Indians who went from Riches to Rags

Amitabh Bachchan

1. Medical Expenses due to disability or illness

2. Job Loss / PayCuts

3. Poor / Excess Use of Credit on car, home,luxury /Student Loan

4. Divorce / Separation / Home Utility

5. Unexpected Expenses / Natural Calamity / Foreclosure

List of 100+Bankrupt Companies.

Companies that filed for bankruptcy in 2022 so far

Companies that filed for bankruptcy in 2021

Companies that filed for bankruptcy in 2020

Companies that filed for bankruptcy in 2019

Companies that filed for bankruptcy in 2018

Companies that filed for bankruptcy in 2017

Are there any billionaires who became poor?

Vijay Mallya.

We all know that he is the “King of good times”.

Vijay Mallya was the wealthiest liquor baron and owned the now-out-of-business Kingfisher Airlines, as well. He was reportedly worth around $1.5 billion at one point but lost his fortune in large part due to massive debts and lavish spending.

He owes over Rs 7,000 crore to 17 banks. SBI is leading the legal battle in the Supreme Court and Debt Recovery Tribunal against liquor baron.

How Mallya became Mallya

1983 | After his father’s death, Mallya becomes UB group chairman at 28.

1999 | Launches Kingfisher Strong, which changes beer consumption nationally, is still the largest selling brand.

2002 | Nominated to Rajya Sabha.

2005 | Launches Kingfisher AirlinesNSE -11.11 % (KFA). Buys Shaw Wallace, gaining whisky brands such as Royal Challenge.

2006 | Buys Herbertsons, makers of Bagpiper whisky and Romanov vodka.

2007 | Buys F1 team Spyker, renames it Force India. Acquires Air Deccan. Buys British whisky maker Whyte and Mackay for £595m.

2008 | Buys IPL team Royal Challengers Bangalore for $111.6m. UB City comes up in Bangalore.

2012 | KFA staff strike work for nonpayment of salaries, income-tax dept freezes KFA accounts, airline grounds flights. In Oct, govt suspends KFA licence. British alcoholic beverages firm Diageo agrees to buy a majority stake in United Spirits.

2013 | Diageo acquires 27% stake in USL for Rs 6,500 crore, but KFA lenders do not get any funds.

2014 | United Bank identifies United Breweries Holdings as wilful defaulter.

2015 | Diageo asks Mallya to step down as chairman of the Indian liquor firm but he refuses.

2016 | Banks move debt recovery tribunal, which restrains Mallya from accessing Rs 515 crore he was to receive from Diageo as a settlement after agreeing to quit.

What we can learn from Vijay Mallya?

We can learn from him that becoming a billionaire from zero is possible and Becoming zero from a billionaire is not impossible.

Do you know people who lost everything they had and became poor but didn’t give up?

What is your opinion on people who grew up rich but became poor?

So, they chose to always say yes to their kids, since they could afford it

But now that the kids are grown up, the kids have zero ability to self-soothe when experiencing negative emotions

And expect everyone around them to provide them instant relief

Only to repeatedly learn there is no cheap ticket in life

So, they shift the responsibility back onto their rich parents

Who continue the same pattern of saying yes and provide a short-cut for their kids

Only for their kids to waste that short-cut as well

And blame their parents for their own failure.

The Fall Of Satyam Computers

Satyam Computers, back in the ‘90s, used to be a highly successful IT firm which ultimately collapsed and shut down in 2015. Among many reasons for the collapse was the former Chairman and CEO of Satyam Computer Services, Ramalinga Raju, stepping down from his role after his admission that he embezzled the company of Rs 7,140 crore.

Raju resigned from the Satyam board after the Satyam Scandal, admitting to falsifying revenues, margins and over Rs 5,000 crore of cash balances as the company.

He confessed to an accounting fraud to the tune of Rs 7,000 crore or $1.5 billion and resigned from the Satyam board on 7 January 2009. Satyam was purchased by Tech Mahindra in April 2009 and renamed Mahindra Satyam.

On 11 May 2015, within a month of being convicted, Ramalinga Raju and all others who were found guilty were granted bail by a special court in Hyderabad. The bail amount for R. Raju and his brother was set at Rs 10,00,000/- and the other convicts was set at Rs 50,000/- only.

Big-name USA brands that disappeared in the last decade.

Who are some rich people/celebrities who became poor due to their reckless spending?

Among the most famous celebs Boxing great Mike tyson and academy award winning actor nicolas cage blew up their hard earned fortune by spending recklessly.

My thoughts make me rich every day of my life

Are there any inspirational people who were rich but because of some unfortunte events became poor and had to work their way back up ?

We see many people going broke these days. But when life knocks you down you can choose to get back up. Many celebrities and entrepreneurs have gone broke but have risen again because of their will and hardwork.

These people truly inspire everyone and show anything is possible.

1. HENRY FORD

D.O.B: July 30, 1863

Founder of Ford Motors

Bankruptcy year: 1903.

Today his net worth is $188 billion.

2. DONALD TRUMP

D.O.B: June 14, 1946

He is a real estate developer

Bankruptcy year: 1990

Today his net worth is $4 billion.

3. WALT DISNEY

D.O.B: December 5, 1901

Founder of Disney

Bankruptcy year : 1921

Today his net worth is $5 billion.

4. MC HAMMER

D.O.B: March 30, 1962

He is a rapper

Bankruptcy year : 1996

Today his net worth is $ 33 million.

5. STAN LEE

D.O.B : December 28, 1922

Founder of Marvel

Bankruptcy year : 2000

Today his net worth is $ 200 million.

All these people are truly inspirational who were knocked down by life but they all worked their way up and look where they are today!

15 Big Companies That Went Broke.

The rise and fall of Nirav Modi

NEW DELHI: When he opened his eponymous boutique at Marina Bay Sands last year, the Indian jeweller Nirav Modi was at the height of his success.

Hollywood stars such as Naomi Watts and Kate Winslet have donned his creations on the red carpet and Bollywood actress Priyanka Chopra, star of American hit series Quantico, was his global brand ambassador.

He was well connected and just last month was included in a group photograph with Indian Prime Minister Narendra Modi and the country’s other top businessmen in Davos. The two are not related.

Now, the jeweller’s meteoric rise has been matched by his fall from grace.

Late last month, the Central Bureau of Investigations (CBI) began probing the 47-year-old’s involvement in what could potentially be the biggest bank fraud case in India.

CBI officers are looking into how credit amounting to about $1.8 billion was fraudulently acquired from state-run Punjab National Bank (PNB) for over seven years by companies belonging to Mr Modi as well as his uncle Mehul Choksi.

At least a dozen people, six from the bank and six more from firms run by the two men, have been arrested so far.

The authorities have raided Mr Modi’s home as well as offices, and seized a number of his luxury cars, including a Rolls-Royce and a Porsche.

The CBI has approached Interpol to locate the jeweller, who left India on Jan 1 and has not been seen since.

But Mr Modi, in a Feb 16 letter to PNB, denied all the allegations swirling around him.

“The matter is being described as India’s largest banking fraud. This is far from the truth. Nirav Modi Group ran a legitimate luxury brand business and the brand had become India’s foremost global luxury brand, standing side by side with some of the biggest jewellery brands in the world,” he wrote in the letter published in the Indian media.

He added: “Your (PNB) actions have destroyed my brand and the business and have now restricted your ability to recover all the dues leaving a trail of unpaid debts. Whatever may be the consequences I face for my actions, the haste was, in my humble submission, unwarranted.”

Mr Modi, who grew up in Antwerp, Belgium, comes from a family of diamond traders from Palanpur city in the state of Gujarat. His late grandfather Keshavlal Modi left Gujarat and moved to Singapore to set up a diamond trade business. From Singapore, he moved the family to Malaysia and then to Antwerp, the world’s largest diamond trading centre.

He went to University of Pennsylvania’s Wharton School to study finance but left midway to work for his uncle, the owner of Gitanjali Gems, which is now also under investigation.

The Nirav Modi website describes how dinner conversations at his household revolved around the “four C’s” — cut, colour, clarity and carat.

After 10 years with his uncle, Mr Modi set up Firestar Diamond and in 2010 turned to designing jewellery. Over the past seven years, he successfully built up a luxury diamond empire with a string of outlets around the world, including in the United States and China. His company was said to be worth $2.3bn.

His creations featured in auction houses Sotheby’s and Christie’s catalogues, with one 88-carat diamond necklace selling for $8 million in Hong Kong in 2012, according to the Nirav Modi website.

A soft-spoken and small-built man, Mr Modi is married to Ami, an American citizen who is also under investigation. They have three children. He has denied that his wife and brother Neeshal, a Belgian national who is married to the niece of India’s richest man, are involved in the fraud.

Some in the trade, however, are not surprised by Mr Modi’s predicament because there have been whispers about the health of his business for some time.

“He was doing extremely well. But in the last three to four years there were murmurs that the group has overdrawn. This diamond trade is such that it takes you to heights or puts you down. Many people have gone from rich to poor,” said K K Sharma, former executive director of the Indian Diamond Institute.

Mr Modi, who once boasted of having a hundred outlets by 2025, has now seen his Indian stores, including the one in Chanakyapuri luxury mall in central Delhi, shuttered.

It all began in 2010; The Security and Exchange Board of India (SEBI) probe found that two Sahara firms; Indian Real State Corporation and Sahara Housing Investment Corporation collected money through illegal bonds. SEBI restricted the promoters and directors of Sahara group companies. After two years on August 31st 2012, Supreme Court ordered Sahara to return 24,000 crore and 15% interest to its millions of investors within three months. However, on December 5 2012, Supreme Court allowed Sahara to pay whole amount in three instalments-5,120 crore immediately, 10,000 crore in January 2013 and remaining amount by February 2013.

Amidst high drama, Sahara India Chief Subrata Roy was finally arrested on February 28, two days after Supreme Court ordered his arrest over the delay in payment of 20,000 crore to his company’s investors. We bring to you the all ups and downs of Sahara boss Subrata Roy.Also Read – IPO-Bound OYO Becomes EBITDA Positive. DETAILS

Amidst high drama, Sahara India Chief Subrata Roy was finally arrested on February 28, two days after Supreme Court ordered his arrest over the delay in payment of 20,000 crore to his company’s investors. We bring to you the all ups and downs of Sahara boss Subrata Roy.Also Read – IPO-Bound OYO Becomes EBITDA Positive. DETAILS

65 years old Subrata Roy is one of India’s most flamboyant and enigmatic business tycoons. He founded Sahara Group in 1978 with chit funds with initial asset base of just Rs.2000. But now he is the chairman of the Sahara India Pariwar; the group, worth 682bn rupees ($11bn; £6.6bn), has businesses ranging from finance, housing, manufacturing, aviation and the media. It also has interests overseas – it owns New York’s landmark Plaza Hotel and London’s iconic Grosvenor House. Apart from this his group also sponsors the Indian hockey team and owns a stake in Formula One racing team, Force India. Also Read – NDTV Shares Trades 5% Up In Afternoon Trade For 2nd Day After Adani’s Takeover Bid

Apart from business Subrata Roy also draws media attention because of colourful lifestyle. He counts Bollywood superstar Amitabh Bachchan among his friends and former British Prime Minister Tony Blair. At the wedding of Mr Roy’s two sons in 2004, it is said to have cost $128 million, one of the most expensive ever. Over 10,000 guests were invited – a veritable A-list of India’s power set, including business moguls, Bollywood idols, cricket stars and fashionistas – were airlifted to Lucknow by special chartered planes. Then Prime Minister Atal Bihari Vajpayee attended the wedding

The Man Behind Sahara

The managing worker and Chairman of Sahara India Pariwar, Subrata Roy, had a run-in with the law enforcement agencies back in 2014. On 26 February 2014, the Supreme Court of India ordered the detention of Roy for failing to appear before it in connection with a legal dispute with Market Regulator – SEBI.

Roy was held in custody in the Tihar Jail, Delhi and is now out on parole since May 2016. Since then he has been successful in getting his bail extended on various grounds. As of 31 January 2019, Sahara still had to pay Rs 10,621 crore to meet its total liability.

10 Business Companies That Failed To Innovate,Resulting In closure.

Who is the richest person to lose it all?

Anil Ambani : At the time of death of Dhirubhai Ambani; his younger son Anil Dhirubhai Ambani was known as a dashing billionaire ;who had all leadership qualities. Well, he also happened to be world’s sixth richest tycoon (net worth $45 billion)

Business : His business interests were spread across India- telecom, natural gas and petroleum sector ,energy sector and entertainment sector. Anil Ambani was also known for his high profile life style. He hobnobbed with political elite and business elite of India along with Tina Ambani, his philanthropist wife .

Loss : But, the bad decisions coupled with adverse market conditions turned tides against him. He went through a number of business mishaps. His major businesses got involved in legal cases or controversies.

Bankruptcy : Finally, during a major legal trial; Anil Ambani declared himself as bankrupt. Nevertheless, his mother Kokila Ben Ambani ji persuaded her elder son Mukesh Ambani to bail his younger brother out.

The 10 biggest retail bankruptcies of 2020

What is the best story of a rich person going broke and then becoming rich again?

What is the difference between bankruptcy and insolvency?

Bankruptcy is a legal status and insolvency is a situation. If an organisation is insolvent, it means the entity is incapable of paying the debts. If an entity or person is declared bankrupt, then the debts must be paid off by restructuring the payment process with the help of the Government or by selling assets.

What Is Liquidation?

If the resolution mechanism fails, it amounts to a liquidation process (in the case of corporates) and bankruptcy process (in the case of individuals). Insolvency happens in the case of individuals and companies, whereas bankruptcy takes place in the case of individuals only.

What is an example of liquidation?

BILLIONAIRES THAT WENT FROM RICHES TO RAGS

As time passes, things change. It doesn’t matter how rich or poor you are, your condition will eventually change. We’ve seen the less fortunate working hard and changing their financial status, and we’ve also seen business tycoons ruining their lives with their ill-informed decisions.

Jocelyn Wildenstein

Jocelyn Wildenstein, also known as “Catwoman,” spent $1 million on lavish purchases and $5,000 phone bills every month. In May 2018, the socialite filed for bankruptcy, claiming that she had $0 in her bank account.

Jocelyn Wildenstein, nicknamed “Catwoman” since she was obsessed with plastic surgery to get feline facial features, has sought bankruptcy protection under the Chapter 11 bankruptcy code, claiming that the balance on her Citibank account is $0.

The filing states that the 77-year-old Manhattanite receives no more than $900 a month from Social Security. She claims that some of her expenses are now paid for by her friends and family.

Although Jocelyn Wildenstein is on a tight budget, she owns some expensive properties. She was once called the “Bride of Wildenstein” for owning three adjoining apartments on floor 51 of the Trump World Tower that were together worth $11.75 million.

There are other underwater assets, such as a $38,000 debt that was owed to Chase Auto Finance for a 2006 Bentley, worth $35,000 now. So, she has a total of $16.4 million in assets and $6.4 million in liabilities.

Bernie Madoff

Bernard “Bernie” Madoff developed the largest Ponzi scheme in history, defrauding thousands of investors for billions of dollars over a period of at least 17 years. He was sentenced to federal prison for a maximum of 150 years in 2009.

Since Madoff was a well-reputed financier; several investors trusted him with their money and handed him their savings. He falsely promised consistent profits in return. Madoff’s investors lost approximately $65 billion, and his fraud went undetected for decades.

In December 2008, he was arrested and accused of 11 counts of fraud, perjury, theft, and money laundering. The court sentenced Madoff to 150 years in prison for his pyramid scheme that was so extensive that even today, only a small number of his victims have recovered all their losses.

As of 2020, approximately $3.2 billion has been returned to Madoff’s victims by the US Department of Justice.

Another reason Madoff remained unnoticed for so long is due to his financial background and involvement. In 1960, he launched his own market-maker firm and played a leading role in launching the NASDAQ stock market.

In addition, he served on the board of the National Association of Securities Dealers and provided recommendations to the Securities and Exchange Commission. Therefore, people easily believed that what he was doing was right.

However, things began to worsen when his investors demanded a total payout of $7 billion, and he only had $200 to $300 million to give. (Source)

Elizabeth Holmes

Elizabeth Holmes once held a net worth of $5 billion and was a prominent Silicon Valley figure. She had a blood-testing company, Theranos, valued at $9 billion. Later, it was revealed that Theranos’ blood tests were highly inaccurate. In June 2018, she was charged with wire fraud and has a current net worth of $0.

According to Forbes, Elizabeth Holmes had a net worth of $4.5 billion, making her the richest self-made woman. Today Forbes lowers its estimate of her net worth to zero.

Approximately 50% of Holmes’ wealth was derived from Theranos, the blood-testing company she developed in 2003 to revolutionize diagnostic tests. Shares of Theranos are not traded on any stock market; they were purchased by investors in 2014 at a price that implied a $9 billion valuation for the company.

Since then, Theranos has been accused of running inaccurate tests and has been under investigation by a variety of federal agencies. Moreover, Forbes has released a new, lower estimate of Theranos’ value as a result of new information showing Theranos’ annual revenue is below $100 million.

Theranos is more realistically valued at $800 million than $9 billion, based on Forbes‘ interviews with venture capitalists, industry experts, and analysts. According to VC Experts, a venture capital research firm, this credit is for the company’s intellectual property and the $724 million that it raised.

The investment also represents a generous multiple of Theranos’ revenue, according to an individual with knowledge about Theranos’ finances. Due to the low value of Holmes’ stake, the company is practically worthless. (Source)

Björgólfur Gudmundsson

Gudmundsson was once Iceland’s second-richest person, with a major stake in a bank called Landsbanki. His bank collapsed during the 2008 financial crisis and was purchased by the Icelandic government. He then filed bankruptcy, and Forbes reduced his net worth from $1.2 billion to $0.

The Icelandic former billionaire has gone through so much throughout his career as a brewers shipping executive, embezzler, and soccer team owner.

He started facing troubles in the mid-80s when his company, Hafskip, failed and he was sentenced to a year of imprisonment for embezzlement. After that, he went to Russia to regain his fortune. He and his son started operating a soft drink company. They turned it into a brewery and flourished once again.

However, Gudmundsson had a net worth of $1.2 billion in March 2008, but his company Landsbanki failed just after seven months. This ruined his billionaire status and was sunk to zero. By December, his net worth was reduced to $0. His company Hansa was in voluntary liquidation, and his football club was for sale.

In August 2009, he filed for bankruptcy, stating that he owed more than $500 million. Center for Economic Studies & Ifo Institute reported that this was the largest personal bankruptcy in history. During the hearing, he claimed he had an “almost complete lack of income.” (Source)

Eike Batista

In 2012, Brazilian businessman Eike Batista was the seventh-richest person in the world and the most wealthy person in Brazil. He had a net worth of $35 billion. In 2014, he lost all his fortune and owed a net $1.2 billion to creditors.

Eike Batista made a fortune from his father’s mining commodities which made him a multimillionaire income at the age of 23. Later, he launched his gold mining company which led to the creation of EBX Group.

In 2000, he had a net worth of $20 billion by operating eight gold mines in Canada and Brazil and a silver mine in Chile. He went on to create five more operating companies: MPX in energy, MMX, in mining, LLX in logistics, OGX in petroleum, and OSX for the offshore industry. All his companies flourished, making his net worth ballooned to $35 billion in 2012.

Among his five companies, the oil and gas business was his crown jewel. However, the oil production from the areas they had was much less than anticipated. This destroyed investor confidence and made it difficult for the company to pay its debts while financing new developments.

In 2013, the company was $5.1 billion in debt and filed for bankruptcy protection. Things became worse when Batista unloaded some of his stock before OGX went bankrupt to make a quick profit. Now he faces charges of insider trading for using confidential information for that profit.

Brazil has seized all of Batista’s assets and making him face the punishment of up to 13 years behind bars. Almost all of his business failed and four of his companies went bankrupt. (1, 2)

Allen Stanford

Stanford was convicted for the second biggest Ponzi scheme in US history and is currently serving a 110-year sentence. More than 18,000 investors lost $7 billion in the Ponzi scheme, and they have yet to receive compensation for their losses.

Robert Allen Stanford is an American former banker who, in 2012, was found guilty of fraud involving a Ponzi scheme involving $7 billion in securities fraud. Stanford perpetrated this fraud by grossly misinforming the 50,000 investors about how well their investments were handled.

About 18,000 of his investors have not yet been repaid. Stanford was accused of fraud by the Securities and Exchange Commission (SEC) and convicted in 2012.

Being America’s richest man, Stanford was sentenced to 110 years in prison in 2012 ruling and has been indicted by the Securities and Exchange Commission. Stanford has claimed repeatedly that he is innocent and a victim of a false investigation. (1, 2)

Patricia Kluge

Kluge invested a huge amount into a vineyard, which she gained from her high-profile divorce settlement. After the housing market crashed, Kluge lost all her money and filed for Chapter 7 bankruptcy.

Kluge’s financial troubles began in 1999 when she established the Kluge Estate Winery and Vineyard on 960 acres near Albemarle with her third husband, William Moses. A few months after Kluge wines appeared on society tables, they headed to upscale restaurants as well.

Therefore, she decided to expand her business. She took out $65 million in loans and expanded the wine production. That was the beginning of the housing crisis. Buyers were not attracted to Vineyard Estates and its value plummeted.

Albemarle was put up for sale in 2009 by Kluge. It was initially listed as a $100 million property then was cut to $48 million in 2010 and then to $24 million. She then tried to sell other items to get rid of the loan but all her personal things including jewelry, art, furniture, etc. were only worth $15.1 million.

Since no buyer emerged for Albemarle in 2010, Kluge stopped making payments and was in default on nearly $24 million in Bank of America loans. Bank of America foreclosed on her home in January, and the estate was auctioned off in mid-February.

In the absence of an offer of more than $15 million, the bank took possession. The funds she raised were not sufficient to keep her from going bankrupt. Her vineyard job was even terminated by Trump after just a year. (1, 2)

Aubrey McClendon

McClendon was the co-founder of the oil gas company “Chesapeake Energy” and had a net worth of $1.2 billion. In 2016, he was charged with federal conspiracy charges over unfair manipulation of drilling bids. He had massive debts and a net worth of zero when he died.

On 2 March 2016, John Raymond, the CEO of the EMG (Energy and Minerals Group), sent a notice to all his investors that he would no longer be working with Aubrey McClendon. He turned his Chesapeake Energy company into the country’s second-biggest natural gas company.

He was, however, on the verge of a surprising fall. Federal prosecutors accused McClendon of rigging drilling bids, an antitrust violation, one day before Raymond sent out his memo. McClendon’s newly formed company, American Energy Partners, had poured more than $3 billion into EMG.

On 2 March, he went to his office and sent a few emails. He then leaped into his 2013 Chevy Tahoe without his security detail. He left American Energy’s headquarters in Oklahoma City and headed north.

Less than twenty minutes later at 78 miles per hour, he swerved out of the right lane, crossed the road, and hit a bridge abutment. He wasn’t wearing a seat belt and died right on the spot. (Source)

Sean Quinn

Quinn was the richest person in Ireland, but his bad investments made him lose most of his $2.8 billion fortune. In November 2011, he said that he had less than 55,000 pounds when he filed for bankruptcy.

In March 2008, Sean Quinn was the 164th richest person in the world, having a net worth of $6 billion. As of 2008, Quinn was the richest person in Ireland and the 12th richest in the UK.

Quinn was a self-made businessman who started a multi-billion pound business network by selling gravel that he quarried from his family’s farm in Derrylin.

In 2010, his entire business empire collapsed, and in 2011, he filed for bankruptcy.

According to RTE, the bank that called in his loans has a vendetta against him. However, IBRC said they were just attempting to recoup two billion euros the Quinn family owed them. Quinn was sentenced to jail in November 2012 for three counts of contempt of court. (1, 2)

As someone who is rich, if you became poor because of something, what would you do to start from scratch and become rich again?

Why?

Because you’d know how to….

Find a market or niche of motivated buyers (MOST IMPORTANT STEP)

Develop or source a product or service

Place your offer (product/service) online or offline

Persuade people with compelling copywriting or in-person sales skills to buy

And get sales coming in…

Finding a market of people who’ve gotten a painful problem in life, is the most important step in making a business work.

You can use this to find BUYERS in the market you’re researching.

Get to work.

Stop dicking around.

Top most festival Products FMCG consumers search today

World Wide Festive Trends Decoded What Indian festive consumers seek...

Read MoreHow right selection of FMCG Salesmen improves brand market share

How can FMCG Companies improve salesman’s technique in order to...

Read MoreHow most searched Fmcg sales and marketing words help newbie salesman

Why undestand FMCG sales management? Sales management is the process...

Read MoreHow Successful FMCG Salesman Starts his Day, a guide

How does one become a good sales executive in the...

Read More

Pingback: Undercutting in FMCG, Newly Launched Brands Survival Story

Pingback: Understanding Beauty Cosmetics Skin Care Products Routine