How fmcg products failed in the eyes of consumers through history

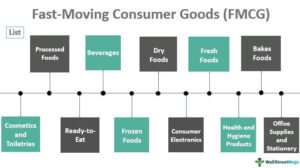

According to a survey by leading consulting firm McKinsey, more than 25% of total revenue and profits across industries comes from the launch of new products. But the bad news is more than 85% of new CPG products fail as per a leading research firm, Nielsen. While there are multiple reasons for failure, there are some common mistakes that organizations do when it comes to innovations.

More than three in four (76 per cent) new FMCG product launches fail in their first year, according to an analysis by Nielsen, but researchers there have identified four principles common to the few brands deemed “breakthrough innovation successes”.

Only 0.14% of all FMCG launches, 16,914 to be precise, from 2012 as evaluated by Nielsen are considered breakthrough innovations in the research firm’s re-port. The glib often ban-died about statistic of about how 80% of product launches fail now seems like the overstatement of the century. That’s just 23 launches culled from more than 80 FMCG categories including food, personal culled from more than 80 FMCG categories including food, personal care, household care, over-the-counter products.

Product

All good stories begin (and end?) with the Product that we are trying to sell. Getting the right product is half the problem solved. So how do we go about finding the right product, here is how:

Market Need: A good entrepreneur is able to identify a real or a latent need in the market. This Need or Market Void is large enough to validate a business case but not big enough to invite competition the very next day. This market need is either not addressed currently or there is a huge gap in the consumer behavior and the current products catering that market. Let us take an example here of healthy snacks. With the growing consciousness about health hazards of some of the traditional and popular snacks available in the market, there is a clear and growing need for healthy snacks in the market. The products currently available in the market however are either too fancy (nutri-bars, makhana, soy sticks, etc.) for Indian palate or too expensive.

None of them have therefore created any big dent in the existing snack products market. Before anyone argues about the success of some of the healthy snacks brands and their ARR, let us go back to the fact that we are a country of 1.3 billion people, even if 0.001% of the population experiments with any product one time, it gives a decent topline for a brief period. But is that success long lasting or has that really addressed and capitalised the potential market, probably NO.

Taste: India is a taste driven market. If your product doesn’t taste well, you may lace it with gold, but it will still not sell. Finding the right product taste, doing as many market trials as possible with it and inducing ‘on the spot’ purchases, is the only way you can be sure of your product’s acceptance. To me, the purchase is the proof of concept. A purchase without trial is an ‘experimental purchase’ but a purchase after trial is an ‘experiential purchase’. When 50% or more of the consumers who try your product, end up buying it on the spot, you can be sure that you have found a winning product.

Why do majority of new products fail?

So many things contribute to new product failure: bad design, poor user experience, sloppy implementation, feature creep, and lack of quality control. Microsoft alone has several examples of how poor execution affected their product’s performance on the market.

What could the reasons be for such a high level of failures?

It can of course be several but I will focus on one of them, maybe the most important one – the research.

First we need to understand how our brain works. Studies from psychology and neuroscience indicate that a majority of our decisions are made by our automatic and mainly subconscious mind.

According to HBS professor Gerald Zaltman, 95% of what drives actual consumer behaviour is unconscious.

People can´t articulate what drives their behaviour because they don´t have full access to those mental hidden processes.

Based on above we know that “self reporting” questions in traditional methods are not good enough for prediction it ´s is only individual opinions. This is basically telling us not to relay too much on them when launching a new product. There is always a gap in what people say and what the do and you don´t know why.

This type of question works in recall and recognition but most likely not for prediction.

Having said this we need to understand why do companies use flawed methods of research when launching new products?

Many marketers continue to ask for traditional methods of research because they are quick, easy and cheap to use. There may also be an element of tradition within in the organisation to use them. There is most likely also a certain amount of herd behaviour here as people see others using traditional methods and automatically assume they must provide value and generate insights. One other reason is that Research Agencies is promoting the traditional methods and it is not in their interest to invest in and/or suggest new ways of doing research.

Value for Money: Indian consumers are not stingy, they are not careless, they just want “Value for Money”. Going back to the consumer trials, your product may be very tasty, it may actually fulfill an actual need in the consumer’s mind, but if it is not value for money, they will still not buy it. And what good is a product that the consumers don’t want to buy? Most start-ups try to go cost-up to determine their selling price. It should be the other way around. You should first try to find the right price at which that product will be accepted by the customer segment you are targeting, and then work backwards on each of the cost parameters to find at what scale will they become feasible. For example, you can price a Nutri-bar as a premium product and still be able to sell it, but if you price a healthy Namkeen at a steep premium, you may fail to attract even a fraction of your potential customer segment. On the other hand, if you price a healthy Namkeen at a 15-20% premium to normal namkeen, you may be able to create a dent in the market. This product is saleable, affordable and just needs scaling up to become viable. Isn’t that what all VC & PE funding available for?

Premium Products: There is a big misconception that only premium products can be sold by start-ups. There are only so many premium customers and there is a whole bunch of people who are not premium. If you can find the right economics, tapping the customers who are not in the premium segment can open flood gates of orders for you. But then to succeed in this segment, you have to have the combination of taste and value for money. There is a fortune at the bottom of the pyramid, but you have to be really innovative and affordable to make it big there.

Too many products & variants: Most start-ups try to hit the market with too many products or product variants. They believe that they can target all kinds of customers and their taste palates if they do so. One could however not be more wrong. We have to understand that most of the existing big brands started with 1 or 2 simple products. As they grew, reached more and more customers, their distribution muscles strengthened and their risk taking abilities increased, they built the product portfolios that we see today. Despite all their experience and strengths, they still have a high failure rate when it comes to new product launches. So when they can’t get it right so often, why would you want to try your luck this way and divide the little kitty of resources over so many products. My recommendation, start with the bare minimum product portfolio (1 is good, 2 or 3 is more than enough). Make sure these are absolutely smash hit products, and then go with these products with your full might in the market.

There are thousand other factors to consider when it comes to finding the right product, but if you are able to find the right mix of these 5 factors, you will be able to identify and address the other factors by yourself.

Rural consumers demand branded products mainly because of increase in disposable income and literacy level. Rural families do not like to cut their expenditure.However, their basic needs and aspirations are not hugely different. The issue is that it takes a long time to study and understand those needs.

Indian companies fail to respond to changing needs of rural consumer

While findings convey a shift in rural consumption patterns, Indian businesses are still using conventional marketing channels, such as celebrity endorsed advertisements, to reach these consumers,” the report said.

It noted that rural consumers are better networked and proactively seek information through multiple sources. Additionally, women and children now play a more empowered role in purchasing decisions and travel further to buy goods and services.

“Being present is not sufficient to be competitive. To succeed, companies must extend from physical touchpoints to experience-led ‘trust points’,” Dawar said.

As per the report, while many business believe consumers make most planned purchases on special occasions, more than half (55%) of the respondents said they make such purchases as the need arises.

Likewise, while many companies underestimate the importance of customer service in rural markets, almost half (49%) of respondents consider high-quality customer services to be an important factor when making purchases.

“To meet the changing needs of the rural consumers, companies will need to adapt their product portfolio, their value propositions and their go-to-market strategies

What arethe problems of rural marketing?

1. Lack of Proper Communication 2. Low Literacy Level 3. Distribution Problems 4. Highly Dispersed and Thinly Populated Markets 5. Different Religions, Languages, Cultures, Social Customs and Traditions 6. Lower per Capita Income

7. Seasonal Demand 8. Problem of Transportation in Rural Areas 9. Warehousing 10. Availability of Appropriate Media 11. Village Structure 12. People and Underdeveloped Market

13. Many Languages and Dialects 14. Market Organisation and Staff 15. Logistics, Storage, Handling and Transport 16. Product Portioning 17. Hierarchy of Markets 18. Lack of Bank and Credit Facilities

19. Regional Differences 20. Negligence of Consumer Research 21. Brand of Product 22. Problems of Market Segmentation in Rural Markets 23. Problems of Packaging in Rural Market 24. Multiple Tiers, Higher Costs and Administrative Problems

25. Non Availability of Dealers 26. Scope for Manufacturer’s Own Outlets Limited; Greater Dependence on Dealers Inescapable.

More than three in four new FMCG product launches fail in their first year, according to an analysis by Nielsen. Why?

The question arising is of course how this can be possible and also how manufacturers can afford it in today´s highly competitive environment requiring instant distribution and shelf space as well as big budgets spent on advertising and promotion in order to drive consumer demand.

We can assume the majority of the manufactures have conducted some type of research in the process from mapping out behaviours and needs to idea and concept ending up in an appealing packaging design. Traditional methods as focus groups/personal interviews as well as quantitative surveys are most likely used in various degree depending on the size of the category and the brand. The research/testing must have shown favourable or more likely “interpreted” favourable results in order to justify a launch and yet the level of failures is very high.

One could always argue that several of the launches are actions just to be in line with competition as well as proving for the Retailer being proactive and acting as a forerunner in the Category. But still I believe the level of failures could be lower and success rate higher.

Know about the problems of rural marketing in India.

Rural marketing is a process which starts with a decision to produce a saleable farm commodity and it involves all the aspects of market structure or system, both functional and institutional, based on technical and economic considerations, and includes pre- and post-harvest operations, assembling, grading, storage, transportation and distribution

Rural retail markets as an integral part of the Indian consumer market, suffer from the similar problems of national market.

The problem arise basically out of the peculiar dynamics of the rural market of India the uniqueness of the rural consumer, the uniqueness of the structure of the rural market, and the peculiarities of the distributional infrastructure in the rural areas. These are special to the rural market; and these require unique handling.

Why are failure rates of new products high? What are the success factors for new products?

Put it simply, the majority of products are not needed.

You put a piece of diamond into a forest – no one will care. No one will pay you.

If you make a product, you must find the matching pair of customers.

Products don’t fail.

Founders fail

A brief timeline:

Product is born as a helpless baby.

Founder tries to take care of it.

Realises baby is blind (product needs development)

Founder tries to adjust – but it’s his first baby and he’s stressed the hell out.

Baby starts to walk. But then a playground bully pushes the baby over and out of sight (new market entrant).

At some point, the founder can’t afford to feed the baby (funding/cash runs out).

Baby dies. Founder mourns briefly. Then goes into hiding.

What are some examples of failed products? What went wrong?

The most important factor being :

- Lack of planning

- Lack of capital adequacy

- Lack of research by promoters

- Lack of technical know how

- Lack of efficient labour and professionals

- Lack of motivation to stay put.

Why do fmcg products fail?

Over Promise, Under Deliver

Not solving the right problems

Complexity of use

Perceived value lesser than the price

Wrong positioning

Bad marketing

Prevalent bugs

A new product can fail on the market because it does not create real value and therefore cannot find customers. Or a new product can fail internally because development, implementation and marketing do not function perfectly. The idea can be good and perfect, but if the innovation process doesn’t work, it will die. On the other hand, an idea can only be mediocre, but if it is implemented and marketed with the utmost commitment and passion, it can become a great innovation.

What are some examples of failed products? What went wrong?

Lots of products fail all the time. I imagine that there are more product failures than products that succeed. And even successful companies have product failures, like Apple’s Newton, Google’s Wave, Microsoft’s Zune, or Amazon’s Fire Phone. More often than not, the reason for product failure is simple: the product did not adequately solve their customers needs.

Why New Products and New Services fail?

Most of the innovations are driven by competition and not by consumers.

What does this mean? It means that most of the launches that you see in the market by different brands come out because a similar product is doing well by one brand and consumers take a back seat. Eg. if one shampoo brand launches a new variant say apple cider vinegar shampoo and it does well, other brands quickly respond to it and launch their versions trying to cash-in its success which don’t do well in most of the cases. The reason is simple; consumers buy into a proposition in which product is just one part of the entire mix. You need to make your proposition attractive enough for the consumers to make them switch and give them them a reason to choose you over others.

Thinking that Innovation is only about a new and unique product

A great innovation doesn’t necessarily need to be a great differentiated product with new technology, ingredients or benefits. It can either be a simply be a “me too” product in a different packaging format or at a new price point (eg. launch of Chik shampoo in a sachet) or simply marketed differently. Fair and Handsome, a fairness cream for men, is a great example of this. It was not a new product that men started using. It was based on a simple insight that men use fairness creams secretly and the only fairness cream that existed at the time of launch of Fair and Handsome were the ones marketed for women. So, it just grabbed pre-existing opportunity that everyone else had missed. So, even with a very unique and differentiated product, you might not succeed if you are not solving a consumer need in a better way than others.

Prioritizing short-term gains over long-term business growth

A lot of companies in the FMCG space lack the patience and financial appetite to see innovations through their natural life-cycle. Breakthrough innovations take reasonable time to develop as well as market and most large firms are not allowed that. Let me give you an example – a Food company might know that people want to try new products but to develop that in a new format, which is tasty enough, meets local food safety standards, and is profitable at a particular price point requires a lot of time and effort. It’s a longer term cycle than current businesses which are oriented quarterly and at best annually.” The result – Lots of varianting and incremental innovations focused on short term gains.

“Innovation Workshop” culture

In a lot of organizations, innovation is just an objective to be ticked off the To-Do list after an exclusive annual workshop on an off-site location which become a mere employee engagement activity. Innovation is an all-inclusive, constant, often arduous process and requires to be a part of your regular work schedule.

Having said that, think of the greatest marketing innovation of this century — the IPL. The Indian Premier League, which is the offspring of cricket (among the leading obsessions of the country). Another great example of breakthrough innovations is reality shows. In both the cases, it wasn’t a new product. Cricket was being played from several decades and reality TV was as old as a music program “Meri Awaaz Suno” telecasted in 1996 and for a long time there were only music reality shows – Saregama, Indian Idol etc. But then some caught the real insight of these shows “People like watching real stuff” and then we all are witness to the popularity of shows like KBC, Roadies and Big Boss.

The four rules for breakthrough new product innovation success

Choice: get the right innovation – make the right choice of innovation to pursue by walking in the shoes of the consumer to uncover key demand-driven insights. Ask questions like, why don’t people use a category? What causes them stress, confusion, inconvenience or compromise?

Process: get the innovation right – have the right organisational framework and processes to shape the chosen innovation into a market-ready offer that has relevance, differentiation and superiority; organisational culture must also allow weak innovation ideas to be filtered out before launch.

Marketing: get the activation strategy right – creative marketing has to be original and has to tell the story of the innovation.

Togetherness: get everyone right behind you – breakthrough success is the product of organisational togetherness, from top to bottom.

Of the 12,000 products analysed, just seven met Nielsen’s testing criteria for “breakthrough innovation success”. Each product had to have generated a minimum of £10m in first year sales, maintained at least 85 per cent of those sales in the second year and had to be deemed distinctive in the category by the researchers.

.

Weak launch or poorly executed launch

Most new products require a reasonable degree of promotional support to build brand awareness and to access distribution channels and retailers. With a limited launch budget or a poorly executed launch, then the success of a new product is less likely.

Adverse media attention

Occasionally a new product may attract adverse media attention, usually related to deficiencies in the product design, price level, or early use problems experienced by consumers. If this occurs, in today’s Internet connected world it becomes difficult to achieve new product success.

Aggressive competitor actions

Virtually all new products are designed to take market share away from established competitors. Therefore, some form of competitor reaction should be expected. In some cases competitors will increase their level of promotion, reduced prices, leverage retail relationships to discourage their partners from supporting a new product from a competitor, or even launch a similar product themselves.

All of these initiatives are designed to protect their market share and try to have the new product to be as unsuccessful as possible.

Poor pricing or cost structure

New products may suffer from a poor pricing and cost structure. Sometimes companies will design products with many features in an attempt to bring something new to the market. As a result, these products are often more costly to produce, but the firm expects the marketplace to have a willingness to pay more for a better product. This may or may not be the case and this product strategy may be quite successful, or be perceived as poor value in the market.

In line with this concern, an expensive development process, along with an expensive launch, may necessitate the need to charge a higher price – which again may or may not be accepted by the marketplace.

Weak supporting brand equity

As we know, new products launched under a strong brand have a greater likelihood of success. This is because the brand has existing customer following and loyalty. These consumers are more likely to trial the new products produced by a brand that they trust and like. Obviously the reverse will apply – weak brands do not have the same degree of customer loyalty or brand awareness, and are therefore less likely to generate strong sales due to their brand support.

Small target market

In today’s marketing world, market segments are fragmenting and a number of companies now pursue niche markets. While niche markets provide a suitable and possibly attractive market if there is no or little competition, they have the danger of being relatively small. Clearly a small target market will generate less sales volume and is less financially viable as a consequence.

No clear market need or perceived product benefits

For new-to-the-world products, they have the extra concern of whether their benefits/features are actually meeting a market need. By their very nature, this classification of new products (brand-new inventions) are something new to the marketplace and provide a different solution to an established need and sometimes a solution to need it does not yet exist in the minds of the consumer.

Therefore, if the company misreads this situation, then their level of sales is likely to be disappointing. This is relatively common with backyard inventors who think that their new invention is the next big thing.

Poor internal marketing

Service companies in particular rely on internal staff – such as retail staff and call center staff and various other customer contact personnel. Usually they are the sales or fulfillment part of the overall launch and marketing process of the new product. Surprisingly, without an internal marketing program to convince the staff members of the benefits of the new product for their customers, many of them will be reluctant to sell, or help switch customers to, the new product.

Weak sales for size of company

When we discuss a product failure, it needs to be considered in conjunction with the overall size of company. For example, take a large company like Coca-Cola. If they were to bring a new product to market, some sort of beverage, and that only generated $1 million per year profit (which is good money for the average company) a company the size of Coca-Cola would deem this new product a failure and would probably look to discontinue it.

Existing product cannibalization

A risk associated with a product line extension is that it may simply cannibalize an existing product. So in essence, while the new product may be successful, because it could take significant sales away from an established product the overall new product could be deemed a failure by management. This is because the company has invested time and money into bringing new product to market, yet no additional profitability has been delivered to the bottom line.

However, of course, there are companies who believe in the importance of cannibalizing their own products – primarily as a competitive defensive measure – an example here is 3M.

Insufficient time for success

Because new product success relies upon consumers being willing to switch and trial new products and then become a repeat and loyal purchaser, there are several steps phases involved in the customer’s journey. This process obviously takes time. Some companies are willing to wait and invest in a new product, whereas others seek and expect almost instant success in the marketplace.

What can you do to improve your success rate in new launches?

My recommendation to you is to start looking into new research methods addressing the subconscious mind! There are a number of research techniques that can access or offer insights about how the automatic and subconscious mind responds to new products/designs. These are generally referred as to implicit or indirect research techniques as they don´t rely on direct, deliberate, controlled or intentional self-reporting. It could be techniques like EEG, Eye-Tracking, Biometrics or Implicit Association Testing to mention a few.

At Straylight we have been working with these techniques for more than 5 years and our clients are convinced in the benefits, especially when used in combination with observations and explicit research.

Implicit Association Testing is a vital tool to use when launching new products revealing the subconscious response allowing you to understand how consumers value your new product in terms of Valence, Relevance, Emotions and Attributes without asking direct questions. IAT gives insight into associations and beliefs before processed by conscious thinking. This is valuable information allowing you to fine tune in the right direction.

When launching new products we always advise our clients to use Implicit Association Testing conducted in cooperation with our global partner Sentient Decision Science. It is a very powerful technique generating a high level of prediction.

What does it mean for a brand to fail, and how do you know when it happens?

It’s not an overnight process, unless a company like Enron or Wells Fargo does something so egregious that they destroy all trust in their brand overnight. Instead, it usually happens slowly, over a period of time, until one day customers suddenly feel like a stranger to the brand.

The “suddenly” part is almost always an internal perception within the organization. For customers, especially loyal ones, the failing of the brand is a gradual process, sort of like the end of a long romantic relationship when you wake up one morning and realize you no longer know the person lying next to you.

A failed brand manifests itself in many ways. It becomes outdated. It loses relevance in the market. Consumers get confused about or lose faith in what it stands for. When companies feel their brand cachet slipping away, they often copy what successful competitors are doing. But rather than standing out from the crowd, this “me too” approach makes the brand look like everyone else. When consumers can no longer perceive a brand’s unique value proposition, its failure is inevitable.

BUT WE’VE ALWAYS DONE IT THIS WAY…

Brands can fail for many reasons, most of which have to do with failure to keep up with a changing world. A world where new competitors and industry-changing technologies and concepts spring up every day. These five reasons sit at the top of our list.

Weak Competitive Analysis.

Most businesses pay attention to their competitors to some degree, but it’s usually in the areas of products, pricing, and promotional messaging. They will compare product features and benefits. They’ll track competitive pricing moves. They’ll look at their competitors’ web sites, social media pages, advertising and marketing collateral. All of which provides much useful data.

The issue is that companies with weak brands often overlook how competitors position themselves in the marketplace. When you don’t take the time to analyze competitors’ positioning, you don’t really know what you’re competing against. Understanding your competitors’ brand strategy doesn’t identify what your brand should be. But it does clarify what it should not be.

Rearview Mirror Syndrome.

Like human beings, brands can get stuck in their comfort zones. This typically occurs with companies that have a track record of success. Things have been good for a long time, profits and growth remain healthy, and the brand continues to be well received by the target market. Over time, the organization holds tighter and tighter onto what made them successful. If it ain’t broke, don’t fix it, right? (More on this later.)

When this happens, organizations start making decisions while looking through the rearview mirror rather than at what lies ahead. Management focuses on maintaining the status quo rather than looking at what is changing with customers or competitive business models. They don’t take time to analyze how the organization needs to respond these changes. What was once a vibrant, forward-looking brand soon gets left behind as the business gets stuck in the past.

Look at Kraft Heinz or other consumer packaged goods companies that are struggling against healthy, better-for-you competitors that reflect consumer changes in their diets. And while competitors are inventing ways to deliver more compelling value to customers, brand inactivity leads to the brand becoming out of date in a short period of time.

Complacency.

Complacency often goes hand in hand with the lack of competitor analysis. Only this time it’s not because the company isn’t looking at its competitors, they’re just looking in the wrong places. This typically happens in industries that haven’t undergone major changes in a long time. Competitors look at each other to see how they deliver value to the customers, and everyone is doing pretty much the same thing.

Next thing you know, some upstart, like Uber or Dollar Shave Club, swoops in and totally disrupts the industry with a new way of adding value to the customers. And nobody saw it coming because they weren’t looking in that direction. Netflix destroyed the video rental industry and Blockbuster was late in responding. If you were a video store owner with people still lining up to rent videos on a Saturday night, would you have seen it coming?

Failure to Innovate.

Most companies understand the need to innovate in today’s markets, but don’t know how. There’s a common myth that innovation consists of inventing new and better products, which is partly true. At a deeper level, innovation is the process of reinventing new and better ways to deliver value to your customers. This often involves solving problems for customers they can’t articulate or don’t even know they have. Figure that out and you will know what products or services are needed. Steven Jobs excelled at this and turned Apple into one of the most valuable brands in the world. When Apple launched the iPod, they dethroned long-time mobile music king Sony overnight.

Today’s markets change too quickly to wait until someone else disrupts the industry. Playing catchup to the new industry leader is a frustrating and difficult game. Today’s new motto is: if it ain’t broke, break it! Not just catch up to competition, but leapfrog them…

Failure to Monitor the Brand.

This may be the #1 reason brands fail. To many, “brand” is an ephemeral concept, hard to define and hard to pin down. So many companies don’t try to measure it. Yet, a brand has metrics that need to be measured and monitored just like sales, profits, operating costs and other key business metrics. Important brand metrics include:

- Brand awareness

- Brand perception

- Consumer confidence and trust in the brand

- Customer loyalty and engagement

- How a brand ranks versus competing brands and why

How do customers relate to your brand? Is it ho-hum or boo-yea!? Do consumers know exactly what your brand stands for and whether you deliver on that promise every time? If you can’t answer these questions, your brand may be in danger of slipping into irrelevance and taking your business with it.

Reasons for Failure of a New Product

Lack of product uniqueness:

Any product that does not satisfy a unique need of consumers, fails to dislodge more established brands available. Customers must comprehend the new product’s advantages. Unless sound communication strategies support the introduction of a new product, failure usually follows.

A product is likely to be perceived as unique if it satisfies a new function; if it satisfies an existing function in a new ways; if its price and performance give it an advantage over the competitive products. It should be distinctive in one way or the other.

Poor planning:

Companies must have a game-plan that carries them through every stage and aspect of product’s life. The plan is to care for consumers. Many forces are at work that alter consumer’s needs and wants for products; life- styles change populations, age and preferences change; similarly needs of industrial buyers are affected by changing business opportunities shortage of energy and material, technological advance and so on.

The market potential of the product and the nature of competition must be determined beforehand.

Poor timing:

The market success depends, to a large extent, on the ability of the company to launch the product at a time when consumer demand is at its highest. Though it may not always be desirable to be the first to enter the market, undue delay or un-opportune time may mean that the demand for the product demonstrated during consumer testing phase might vanish by the time the product is launched in commercialization period. Hence, appropriate time has its strategic importance in product success.

Misguided enthusiasm:

On several occasions, it so happens that there will be either an under-estimation of the strength of competitors or an over-estimation of one’s own capabilities resulting in over-optimistic calculations which will be shattered very soon by the actual product performance. This can happen when executives want to market a particular product because; it is tied with their personal ambitions in the company.

Product deficiencies:

Many a times, technical product deficiencies are the common cause of new product failure. Engineers and product technocrats are capable of giving the best laboratory products by over- engineering. This is a good so far as technical superiority is concerned over competitors.

However, an ‘over-engineered’ product costs a lot to the firm and finally to the consumers where competitors have an edge over the firm in question. Technical deficiencies are to be removed but too much should not cost much.

Reasons for Product Failure | Measures to prevent failure

Poor product quality: Obviously, a product, which is of poor quality, cannot be sold in the market.

Higher price: Another reason for the failure of certain products is the price factor. Higher production and distribution costs may lead to higher price. Such a product cannot be sold in a market consisting of middle and lower income buyers.

Poor timing: It is important that a product, to be successful, is introduced in the market at the correct time. If it is introduced at an unsuitable time it may turn out to be a failure.

Example: Publishers of textbooks usually bring out books in the beginning of the academic year.

Inherent defect: There may be an inherent defect in the product, which may affect its market potentialities. Such a product may not be preferred by the buyers even if the defect is rectified later.

Extent of competition: A monopolist may not have any difficulty in marketing his product. In the case of a market where there are a large number of sellers for a particular product, the buyer will have many alternatives. Therefore, in such a condition unless the marketer brings out the product to the satisfaction of the buyers, he cannot be successful.

Lack of promotional measures: Popularizing the brand, particularly, in the introduction stage of a product is essential. Such a step will ensure repeated buying and bring long-term benefits for the marketer. Failure to do so will ‘prove to be disastrous for the product.

Faulty distribution policy: It is important that a product reaches the right market at the right time and at the right price. The faulty distribution policy of the marketer may lead to many problems, i.e., the goods may not be available when required, may lead to higher price and so on.

Unavailability of spare parts: In the case of durable goods like televisions sets, Air-conditioners, etc., and also in the case of two wheeler and cars, easy availability of spare parts is an important requirement. Unavailability of spares may frustrate the buyers. Such buyers would not recommend the product to their friends and relatives.

Poor after-sale service: The quality of after sale service is yet another important cause. Most marketers, particularly those marketing durables, two-wheeler, etc., are courteous while making sale. When the customer requires service later and approaches the seller, the latter may show indifference.

Imitation products: Last, but not the least, the presence of a number of imitation products in the market makes the genuine products vulnerable. An average buyer may not be able to distinguish between the genuine product and the fake one.

Measures to prevent product failures

The marketer shall ensure that the product he markets is in demand.

He can determine the price at which the retailers must sell the product to the buyers. This will prevent manipulation of the price.

Before launching the product, steps must be taker to ensure that there are no inherent defects.

All efforts must be made to popularize the brand name particularly in the introduction stage.

The marketer shall select the right distribution network so that there is no delay in the consumer getting the product.

It is also important to make available genuine spare parts in the market at fair prices.

The quality of after-sale service must conform to high standards.

In the case of consumer and industrial goods, it is beneficial to get the quality certified by the Indian standards Institution (ISI) and/or by the International Standards Organization (ISO).

The product may constantly be updated to incorporate all the features that the buyers expect in it. Taking the case of Maruti Udayog, the company has updated all its models over a period of time, which is probably one of the main reasons for its success.

Steps must be taken to eliminate duplicate goods in the market. This may be done by cautioning the buyers on spurious goods. The problem may also be legally approached.

Why new products fail

No product point-of-difference

For a new product to win initial trials and then ongoing repeat business, it needs to bring something new to the marketplace. Potential customers need an incentive – such as additional benefits or some form of variety – to be persuaded to try and buy a new product. Without any real point of difference, the new product is likely to fail.

Limited retailer support

Most retailers are pretty happy with their existing merchandising mix and also need to be persuaded that the new product has value for them and their customers. Many new products will fail because they do not obtain the necessary distribution and market coverage to be viable, due to lack of interest from most retailers.

Poor product design

Virtually all products that are put to development and launch sound good on paper. However, during the development phase when final design decisions are made at the product is actually developed and produced, this may not go exactly to plan. The end result is a poorly designed or poor quality product, which is unlikely to generate a large number of repeat sales.

Established customer loyalty in the market

The success of new products will rely upon existing consumers being willing to switch from their current purchases OR entering a market where there are a significant proportion of first-time customers without any established brand loyalty. In many cases, existing customer inertia – the unwillingness to switch brands – will limit the potential success of a new product. Clearly this phenomenon will vary by type of product – for example, many basic supermarket products are bought by consumers who follow simple habitual loyalty and are less likely to switch as a result.

Top most festival Products FMCG consumers search today

World Wide Festive Trends Decoded What Indian festive consumers seek...

Read MoreHow right selection of FMCG Salesmen improves brand market share

How can FMCG Companies improve salesman’s technique in order to...

Read MoreHow most searched Fmcg sales and marketing words help newbie salesman

Why undestand FMCG sales management? Sales management is the process...

Read MoreHow Successful FMCG Salesman Starts his Day, a guide

How does one become a good sales executive in the...

Read More

Pingback: Essential Cold room and Warehouse Vocabulary and Acronyms

Pingback: Top Trusted and Most Searched JobSites In Hongkong every day