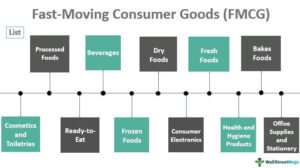

How fmcg retailers can Easily Calculate and Improve Retail Profit Margins

Businesses in the retail industry use several metrics to assess their success and performance.

One of these essential metrics is retail margin, also called gross margin, which demonstrates how much profit a business earns on each sale.

Understanding this metric and how to calculate can help you develop effective sales and pricing strategies to ensure your business operates efficiently. In this article, we discuss retail margin, its uses and how to calculate it, and offer several tips you can use.

What Is Retail Margin? (With Steps and Tips to Calculate It)

What is retail margin?

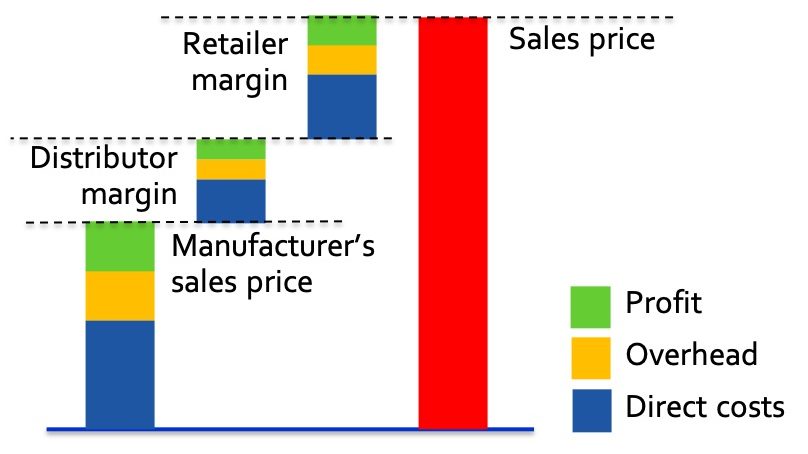

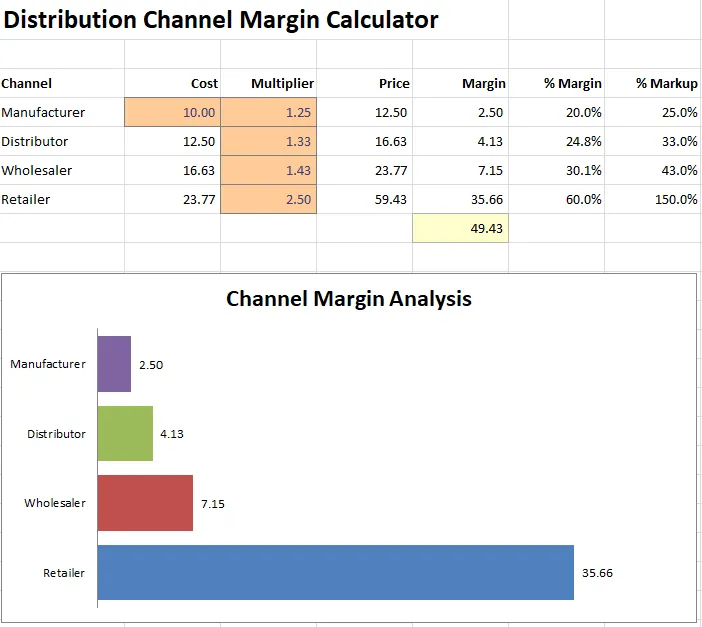

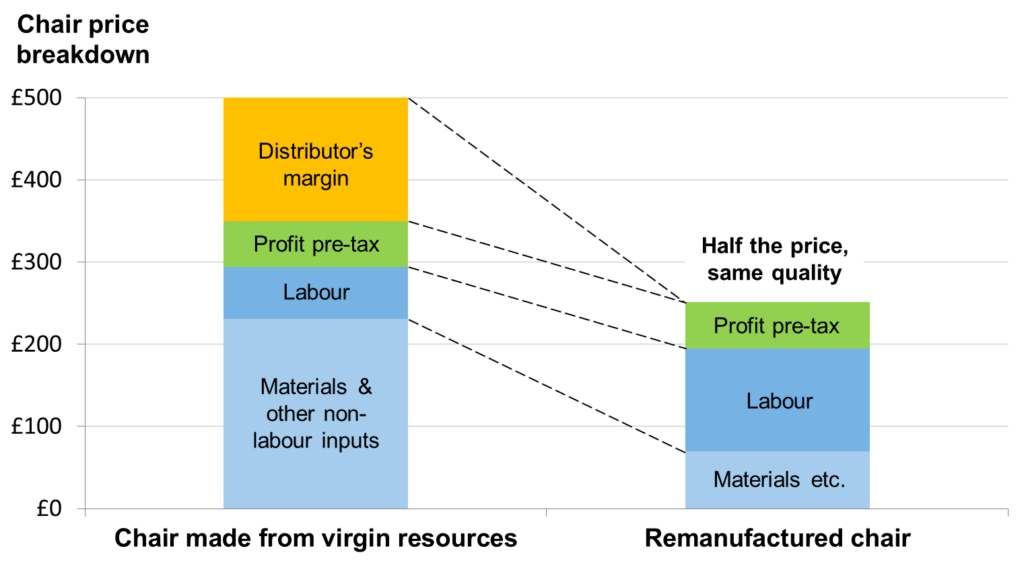

The retail margin is the difference between the price that a business pays to acquire a product and the price it sells that item to customers. This measurement tells the business how much it profits it earns from its sales of particular products. Besides looking at individual products, a business can also determine the retail margin of its overall sales during a specific period. To calculate retail margin, you can use the following formula:

Retail margin = [(retail price – cost of product) / retail price] x 100

This concept is related to retail markup. Retail markup is the amount that a business adds to an item’s price when selling it. Some businesses implement a flat markup on the retail prices of all their products to ensure profits. To calculate retail markup, you can use the following formula:

Markup = [(retail price – cost of product) / cost of product] x 100

What is retail profit margin?

Retail profit margin is the measure of your business’ profitability, that is your capacity to earn money. It represents the percentage of overall revenue that constitutes profit.

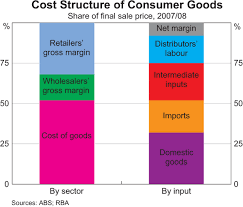

Retail profit margin takes into account the initial cost of goods and expenses a business has to pay to produce and sell a product. More importantly, it demonstrates the portion of each revenue dollar that is actually earned.

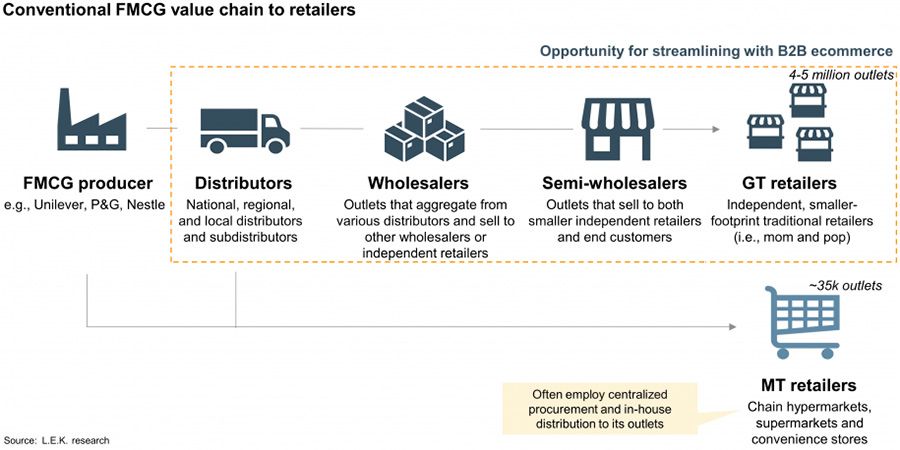

Gross margin in FMCG varies from 5% to 50% generally depending on the product. General products like soaps and other related products have thin margins whereas products like tampons, sanitary napkins and other related products have higher margins. Average gross margin comes between 15% to 20% usually.

Net profit depends on your expenses incurred and investment. Lesser the expenses higher the net profit.

Key here is better inventory management which will yield better profits with relatively less investment.

Uses for retail margin

Businesses want to optimize their retail margins because the higher the margin, the more profits they earn on each sale. They use the retail margin for two primary purposes.

Determining what goods to sell

Businesses can use the retail margin of specific products to determine whether to sell them in their stores. They might use this measurement to compare several similar items they’re considering stocking. Similarly, a business can use retail margins to assess its options for purchasing particular goods from several vendors or suppliers.

Setting the prices of goods for sale

Businesses also often use retail margins to determine how to set the prices of the products they sell. Setting the right selling price is crucial because it helps the business maintain its operations. When deciding the selling price, a business wants to ensure that it’s attractive to customers, covers the business’s costs of acquiring or producing the item and results in a profit. As mentioned, the higher the retail margin, the higher the profit on each sale. If a business has a desired retail margin, it can use it to determine an appropriate selling price.

What is retail margin?

Related: Markup vs. Margin: Definitions, Differences and Examples

Uses for retail margin

Businesses want to optimize their retail margins because the higher the margin, the more profits they earn on each sale. They use the retail margin for two primary purposes.

How to calculate retail margin

You can use the following simple steps to calculate retail margin.

1. Identify the retail price

The retail price represents the price at which a business sells a product to customers. If a business wants to determine the retail margin of its overall sales, it instead determines the total sales revenue from a specific period. For example:

Bagels wants to determine the retail margin of its canned coffee drinks. It currently sells these drinks for 3.50 each.

2. Identify the cost of goods sold (COGS)

The next step in calculating retail margin is to identify how much the business paid to acquire or manufacture the product it’s evaluating. This measure is called the cost of goods sold (COGS). Similarly, a business looking at its overall retail margin would identify its total cost of goods sold during the specific period it’s examining.

Bernie’s Bagels purchases its canned coffee drinks in bulk from a supplier. It determines that the cost of goods sold for each canned of coffee is 1.15.

Related: How To Calculate the Cost of Goods Sold

3. Subtract COGS from the retail price

A business can determine its retail margin for a product by subtracting the item’s COGS from its retail price. When calculating the retail margin for overall sales, the business would subtract its total COGS during that period from its total sales revenues during the specified period.

Bagels now knows the retail price for its canned coffee drinks (3.50) and the cost of goods sold (2.10). By subtracting COGS from the retail price, the store determines it has a retail margin of 1.40 on its canned coffees.

4. Determine the retail margin percentage

A business can add more context to its calculation by turning it into a percentage. After determining the retail margin, it divides it by the retail price then multiples that result by 100. This step allows the business to compare the retail margins of different products it sells or against competitors’ retail margins.

Determining what goods to sell

Businesses can use the retail margin of specific products to determine whether to sell them in their stores. They might use this measurement to compare several similar items they’re considering stocking. Similarly, a business can use retail margins to assess its options for purchasing particular goods from several vendors or suppliers. For example:

Heather owns a boutique and is considering selling either handmade soaps or bath bombs. A local vendor is willing to sell the soaps to her shop for 3.65 each and the bath bombs for 2.50 each. Because the boutique can acquire the bath bombs at a lower price, it might allow Heather to make more profit on each sale than with the soaps.

Setting the prices of goods for sale

Businesses also often use retail margins to determine how to set the prices of the products they sell. Setting the right selling price is crucial because it helps the business maintain its operations. When deciding the selling price, a business wants to ensure that it’s attractive to customers, covers the business’s costs of acquiring or producing the item and results in a profit. As mentioned, the higher the retail margin, the higher the profit on each sale. If a business has a desired retail margin, it can use it to determine an appropriate selling price.

Determine the retail margin percentage

A business can add more context to its calculation by turning it into a percentage. After determining the retail margin, it divides it by the retail price then multiples that result by 100. This step allows the business to compare the retail margins of different products it sells or against competitors’ retail margins.

What is a good retail profit margin?

Right after how much it costs to open a store, the most commonly asked question by startup retailers is, “What’s a profit margin that I should aim for?”

What constitutes a good retail profit margin varies by industry and products sold. Industries with minimal overhead costs, such as ecommerce or thrift shop, typically have higher profit margins. Building supply and distribution retailers tend to have the strongest margins, as high as 6%, according to Investopedia. Here are some examples of industry margins from an NYU Stern study, with industries like banking, healthcare, and tech leading the way.

Consider your industry and its common costs: A teaching or consulting business will likely have higher profit margins than a retail business, which pays more overhead expenses, such as rent, payroll, and creation or procurement of inventory.

The 2 types of retail profit margin

There are two types of profit margin calculations that retailers should know about: gross profit margin and net profit margin.

1. What is gross profit margin?

Gross profit margin is a metric that indicates how efficiently your business—i.e., processes, systems, etc.—is operating.

Stable and consistent profit margins are a good sign that your business is doing well. If, however, your gross profit margins are significantly lower than your competitors, then you might need to re-evaluate your pricing and expenses.

If you’re a retailer that’s just starting up, don’t panic if your gross profit margins aren’t as high as expected. It’ll take time to get your pricing, sales, and operations aligned.

How to calculate gross profit margin

Gross profit margin is always represented as a percentage, and calculates your revenue minus the cost of products sold over a period of time.

Example: Your company’s total revenue is 25,000 for the quarter, and the cost of goods sold is 20,000. Your gross profit margin would be:

25,000 – 20,000 = 5,000

In Profit value, your gross profit margin is 5,000 for the quarter. To determine that as a percentage value, divide your gross margin amount by total revenue, and multiply by 100.

5,000 / 25,000 X 100 = 20% (gross profit margin)

2. What is net profit margin?

Net profit margin is a metric that measures how much of your business’ profit is generated from revenue. It tells you how much of your total sales revenue is profit and is defined as the percentage of revenue that becomes profit after all expenses are paid.

The higher your net profit margin is, the better it is for your business.

How to calculate net profit margin

*Net profit = Revenue (total sales earned by a business) – Expenses (total costs needed to operate the business)

Also represented by a percentage, net profit margin takes into account your revenue minus the cost of goods sold, operating expenses, interest, taxes, and other expenses.

Net profit margin is calculated by taking the total sales of your store over a period of time, subtracting total expenses, and then dividing that amount by total revenue.

Example: Your retail store generates 20,000 in sales for the quarter. Your product costs and operating expenses came out to 15,000, and your overheads costs amounted to 2,000.

Below is how you would get your net margin percentage:

20,000 – (15,000 + 2,000) = 3,000 (your net profit)

3,000 / 20,000 = 0.15

0.15 X 100 = 15% (your net profit margin)

What is the difference between gross profit margins and net profit margins?

The difference between gross profit margins and net profit margins lies in whether you want your calculation to consider all business expenses (net profit margin) or just the cost of goods sold (gross profit margin).

Put simply, your net profit margin takes into account how much profit you retain after tax for every dollar generated in revenue. Your gross profit margin takes into account how much profit you keep after subtracting the cost of goods sold.

No one metric is more important than the other. Both should be measured as they take into account different aspects of your business’ profitability.

How to improve profit margins

From revenue sources like new contracts to expenses such as utilities, it is important to track everything and not leave anything off the books. Doing so gives an accurate picture of your business’ profitability. Below are a few ways you can drive your profit margins.

Increase your prices: Making the decision to raise prices can be tough, especially when you’re competing with big box retailers. However, when executed well, raising prices can significantly improve your bottom line. Research competitor pricing, your costs and margins, as well as price sensitivity of your customers to figure out your sweet spot.

For example, if you run a small hardware store and you provide personalized instruction to customers, you can charge a little more than the giant home improvement store down the road that does not provide that same level of customer service.

Decrease expenses: Reducing expenses can be another viable option for increasing revenues. These typically include rent, utilities, phone bills, salaries, etc. Find opportunities for reducing costs, such as eliminating unnecessary overtime or excess packaging. Having an efficient retail POS that tracks your manpower and inventory in one system will help inform you on where you might be able to trim back.

For example, if you run a health food store, you might find that your customers prefer to bring their own reusable bags, allowing you to cut back on providing bags.

Remove low performing products: If you’re tracking the financial performance of each product, you’ll know which products have the lowest profit margins. Is there a product that is produced at a higher cost that isn’t selling as well as others? Brainstorm ways to improve their margins or consider cutting that dead weight.

For example, if you run a clothing store, you might consider removing seasonal styles such as sweaters from your racks and selling them online where customers from colder climates will still be able to find them.

Introduce new products: Launching new offerings can inject new life into your retail business. Doing so not only allows you to meet changing customer demand—it also taps into and rejuvenates an existing loyal customer base.

For example, if you run a garden center, introducing seasonal items such as holiday wreaths and plants can really generate excitement and sales among new and old customers.

Next steps for improving retail profit margins

If you want to calculate your profit margins accurately, keeping track of your expenses and the performance of your products is crucial—but it isn’t always easy, especially when done by hand.

Here’s what you can do to more accurately track your retail profit margins leveraging technology.

Tips for calculating retail margin

You can use the following tips as advice when calculating your retail margin.

Pay attention to other costs

While determining the retail margin is a helpful method of understanding your business’ profits, it doesn’t offer a complete representation of them. The retail margin subtracts the cost that you paid to acquire or produce the item you sold. This calculation doesn’t account for additional costs associated with selling that item, such as taxes.

When determining your desired retail margin, you may benefit from considering the various costs of operating your business. You want to ensure that your sales help cover these costs while still giving you a profit. Some of the additional costs to think about include:

-

Utilities and rent: If a business has a physical storefront, it likely needs to pay a monthly fee to own or lease it. Other costs associated with operating physical storefronts include utilities such as water and electricity.

-

Payroll: When employing individuals, the business needs to consider costs related to their wages and the associated taxes.

-

Administrative costs: Depending on the business, it may need to pay additional administrative costs to maintain its operations. For example, large retail businesses may need to have insurance or hire the services of legal professionals or accountants.

Be mindful about customers’ interests

While businesses often want high retail margins to help maximize profits, you need to ensure that the prices you set are still attractive to your customers. If you make your prices too high to achieve your desired retail margin, it could create risks. For example, customers may not feel comfortable with the higher price or find the same items for less from your competitors.

You can research and monitor customers’ behaviors to determine their price sensitivity to ensure you set effective selling prices. Businesses can also use marketing strategies to offset price sensitivities by highlighting what value customers receive from frequenting that business over others. If your business offers customers a particular advantage, it can encourage them to choose you despite the price differences.

Related: What Is a Pricing Strategy?

Consider stocking items with lower retail margins

In addition to selling items with high retail margins, you may find it effective to stock products with lower margins. These items can offer several benefits, such as attracting customers to your business or increasing the value of their sales. They can also create profits for your business when purchased in high quantities. Items with low margins often represent products that customers use or demand daily, considered necessity goods.

For example, a gas station has consistent demand. It may lower its gas prices to compete with a station down the road and attract customers. While the station may not make significant profits off its gas sales, it offers numerous products within its convenience store that it can sell at higher margins, such as soft drinks and snacks. After buying 20 worth of gas, a customer may add several convenience store items that bring their total to 40. The profits vary depending on the products’ costs and selling prices, but the purchase value increased due to those low-margin items.

Related: What Are Margins in Business?

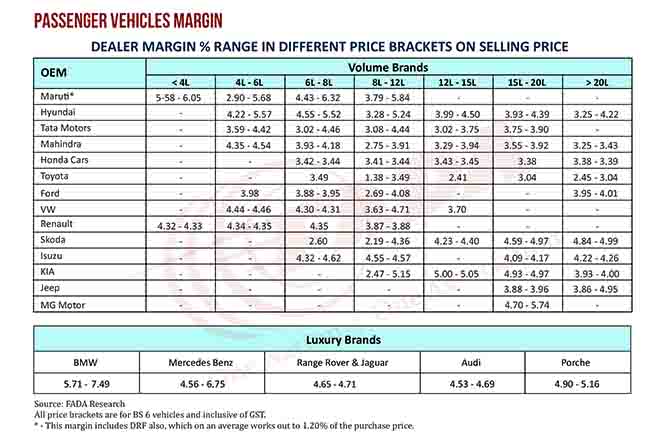

Review industry standards

You may find it helpful to research retail margin standards for your business type or model. For example, the typical or ideal margin for a grocery store might differ from a clothing retailer. Or the standard for physical storefronts might differ from e-commerce businesses. Identifying these standards can help you set retail margin goals for your business, allowing you to implement prices or strategies to achieve them. You can also use your research to assess your business’ margins and performance by using other businesses’ margins as benchmarks for making improvements or ensuring you stay competitive.

What is difference between markdown and markup?

What are Markup and Markdown Prices?

Businesses are in business to earn a profit or a financial benefit from the work or products being sold. If a business does not make a profit, it will not stay in business very long. Businesses use markup and markdown prices to influence their profit margin (the amount of profit they make).

Markup prices can be defined as the increase (by percentage) in the price of a product based on its original cost.

Markdown prices are the rate (markdown percentage) decrease in the selling price of a product from its original selling price. The term discount is a more common term to describe markdown prices. When companies offer sales (like 25% off, etc.) they are applying markdown prices to their products.

How do you calculate markup and markdown?

Markups

Many businesses buy their merchandise from wholesalers and resell. Since you don’t make the video games you sell, you need to buy them. To make a profit, you must sell the video games at a higher price than the original price at which you purchased them. The amount which you increase the price to cover the cost is known as markup. For example, if you buy a video game for 20, you must sell it at more than 20 to make a profit.

The amount you increase the price by can be expressed as a percent of the purchase price. Increasing the price of an item by 25% is the same as selling it at 100% + 25% = 125% the price at which you purchased it. You can write this using decimals by saying that a markup of 25% is the same as 0.25 + 1 where 1 represents 100% of the purchase price and 0.25 is the 25% markup. In this example, the 25% which the price was increased is known as a markup rate. The selling price would be determined using the equation part = percent⋅whole.

- Part: selling price

- Percent: 1 + markup rate

- Whole: purchase price

Discussion Question

What does the 1 in the percent represent?

Substituting these values into the percent equation gives you the following formula for markups:

Example

You purchase a Nintendo 64 for 45 and plan to resell it for 63. What would the markup rate on this console be?

Use the formula above:

selling price = (1 + markup rate)⋅purchase price

- Selling Price: 63

- Markup Rate: x

- Purchase Price: 45

63=(1+x)⋅456345=1+x1.4=1+x0.4=x

The markup rate is 0.4. However, this formula gives us the percent as a decimal. You must convert 0.4 to a percent.

Answer: The markup rate is 40%.

Use the interactive below to explore how markup rates affect the sales price of a product.

Markdowns

A strategy that many businesses use to increase sales is to offer markdowns. A markdown can occur to bring in business, because a product can no longer be sold at its current price, etc. A markdown is an amount by which you decrease the selling price. The amount that you decrease the price by can be expressed as a percent of the selling price, known as the markdown rate.

The selling price would be determined using the equation: part = percent⋅whole.

- Percent: 1 – markdown rate

- Whole: original price

- Part: selling price

Substituting these values into the percent formula gives you the following formula for markdowns:

Example

You are selling a video game that you initially bought for 30. You decide to reduce the selling price to 21 in hopes to increase the likelihood of having someone buy it from you. What is the markdown rate on the game?

- Selling Price: 21

- Markdown Rate: x

- Original Price: 30

21=(1−x)⋅302130=1−x0.7=1−x−0.3=−x0.3=x

The markdown rate is 0.3. However, this formula gives us the percent as a decimal. What is the markdown rate written as a percentage?

Use the interactive below to explore how markdown rates affect the sales price of a product.

Consecutive Markdowns

Stores will often offer consecutive discounts from multiple promotions.

Example

A thrift store was selling an Atari 2600 for 80 before deciding to have a 40% off promotion. A customer comes in to buy the console and pays with a 10% off any one item coupon. The coupon states that the 10% off coupon applies after any in-store promotions. The customer expects to get 50% off overall and pay 40.00. Is the customer correct?

The customer may expect to get 50% off the original price. However, this is not the case. Consecutive markdowns occur one after the other rather than at the same time. To find the price that the customer will pay we must use the markdown formula twice.

selling price = (1−markdown rate)⋅original price

- Selling Price: x

- Markdown Rate: 40% or 0.4 as a decimal

- Original Price: 80

x=(1−0.4)⋅80x=80(0.6)x=48

Now apply the 10% off coupon.

selling price = (1−markdown rate)⋅original price

- Selling Price: x

- Markdown Rate: 10% or 0.1 as a decimal

- Original Price: 48

x=(1−0.1)⋅48x=48(0.9)x=43.20

Discussion Question

How did applying the discount after the promotion benefit the business?

When taking a percent of a percent, you can rewrite the formula as follows:

Use the interactive below to explore how consecutive markdown rates affect the sales price of a product.

What is the importance of markup and markdown?

Markdown – What is a markdown?

In finance, a markdown is a reduction in the price and value of an asset.

Markdowns are designed to increase sales, so they usually occur when a business can’t sell a product at its current price.

By reducing the price, a markdown makes a product or service more desirable for customers. After a markdown, each unit has a lower profit margin, but overall sales revenues are higher because more units are sold.

Markdowns and pricing

When setting a price for a particular good or service, it’s important to value the product accurately.

According to the theory of supply and demand, if the price of a commodity is too high, fewer units will sell. As such, if a business overestimates the market value of a product, it will struggle to make sales. On the other hand, if the price of the product is too low, it could become unprofitable.

Markups and markdowns are used when businesses under or overvalue a product. A markdown adjusts the price of a product to reflect the price consumers are actually willing to pay – it’s therefore the devaluation of a product.

If sales don’t increase after the first markdown, it might be necessary to continue marking down the price of a product until it sells at a profitable rate. There should be enough time between markdowns to sufficiently test the impact of the new price.

Types of markdown

As well as misvaluing a product, there are a few reasons why a company might use a markdown.

Clearance markdowns

If a retailer doesn’t plan on restocking an item, it could be more cost-efficient to sell the product at a reduced price than to pay for storage. By reducing the value of a product, clearance markdowns speed up sales and therefore get rid of excess inventory.

Damaged goods markdowns

If a unit of a product is damaged, it’s unlikely to sell for the same price as a non-damaged unit. It’s therefore common to reduce the price of any spoiled or defective goods.

Competitive markdowns

Also known as price-matching, competitive markdowns occur when a business reduces the price of a product to match its competitors’ prices. If two companies sell the same product at different prices, the company with the higher price is likely to sell less.

Example of a markdown

Markdowns are common in many industries and are frequently used in retail. For example, a clothes retailer produces a new line of jeans, which are sold for 50. After three months of poor sales, only 20 pairs of jeans have been sold for a total of 1,000.

The retailer reduces the price by 20% to 40. Three months later, 50 pairs of jeans have sold for a total of 2,000.

Although the clothes retailer makes less profit per pair of jeans, overall profits increase because more units are sold as a result of the more attractive price.

Markdown vs. discount

Markdowns and sales discounts are similar concepts, but there’s one important difference: a markdown is a reflection of value whereas a sales discount is not.

Both markdowns and sales discounts involve the reduction of price – but for different reasons. A markdown is an adjustment of price to reflect a lower market value, whereas a sales discount doesn’t change the valuation of a good or service.

Instead, discounts are reduced rates offered for specific reasons – such as seasonality, customer loyalty or demographics (such as discounts for students or pensioners).

Both markdowns and discounts can be temporary or permanent. If a product sells much better than expected after a markdown, the price might be adjusted again. This could be because the markdown was too much, or because of external factors such as an improving economy or a change in market trends.

Markdowns for brokers and investors

Although the term ‘markdown’ is usually used to refer to a reduction in price, it might also be used when talking about investment and brokerage. In this context, the markdown is the difference between the price the broker or investor pays for an asset and the price they sell it on for. This type of markdown might be considered commission.

Purpose of Markups and Markdowns

Why do companies markup their product before selling? Why do they sometimes markdown their products from the selling price that was initially set in place? The simple answer to both of these questions is, ”To make a profit.”

A company cannot sell a product for the same amount that it cost the company to obtain the product. The process of purchasing products to sell actually costs money. There is an expense involved in paying an employee to research and purchase products; there is another expense involved in storing products to be sold; there is another expense involved in paying employees to stock a store and sell products to customers. The owner of a company must cover all the expenses involved in the process of purchasing and selling products before he or she can claim any of the profit from that product. A business owner must be able to pay their own private bills as well; thus, without markup pricing, no businesses would be able to stay in business because they would not make any profit. It is the profitability of a company that determines its lifespan.

Look in the luxury item market.

Real estate, private jets, yachts, and exotic cars all have high markups.

But that doesn’t help make any business decisions. Why? Because each of these also have a high cost of doing business. You don’t sell a high number every day. And your marketing costs are much Hefner than a lower margin store like groceries.

So if all you are searching for products with high margins, assuming you will get rich, you are not ready to be a business person.

Tail Piece.

It takes a whole lot more than high margin products to make a business successful.

Top most festival Products FMCG consumers search today

World Wide Festive Trends Decoded What Indian festive consumers seek...

Read MoreHow right selection of FMCG Salesmen improves brand market share

How can FMCG Companies improve salesman’s technique in order to...

Read MoreHow most searched Fmcg sales and marketing words help newbie salesman

Why undestand FMCG sales management? Sales management is the process...

Read MoreHow Successful FMCG Salesman Starts his Day, a guide

How does one become a good sales executive in the...

Read More

Pingback: Guide to Bartenders' skills Tools Cocktails Liquor glassware

Pingback: Complete Guide: Baking Terms Commissary Kitchen Products

Pingback: All Time Kitchen Tools Guide and Chef's Language Dictionary

Pingback: Top most epic reasons with examples of FMCG product fails?

Pingback: Essential Cold room and Warehouse Vocabulary and Acronyms

I like the ideas in this article, but I would like to see further insight from you in time.

Hello! Thank You for your kind words. Please ideas that need focus in the article,