How fmcg company salesmen avoid criminal offenses for bright future you must know

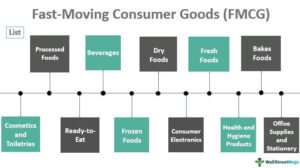

What is a FMCG background?

How Can a Salesman be booked for fraud?

Employee Theft in the Retail System

The retail system is the setting where consumers purchase various types of products. As shown in recent times, the success of our economic system is tied to the success of the retail system. When individuals buy more in the retail system, our economic system is stronger. While consumers drive the success of the retail system, employees steer the direction of the retail system.

The key to success for retail stores lies in having employees able to perform assigned tasks. One problem that retail outlets face is employee theft. Indeed, internal theft has been “linked to 30% of U.S. business failures”

Several different varieties of employee theft in retail settings occur.

Here are some examples.

Overcharging: Employees charge customers more than they should have.Shortchanging: Employees do not give customers all of their change and pocket the difference.

Coupon stuffing:

Employees steal coupons and use them later.

Credits for nonexistent returns:

Employees give credit for returns to collaborators.

Theft of production supplies and raw materials: Employees steal items used to produce goods in

retail settings.

Embezzlement:

Employees steal money from an account to which they have access.

Over-ordering supplies: Employees order more supplies than are needed and keep the supplies

that were not needed.

Theft of credit card information:

Employees steal customers’ credit card information.

Theft of goods: Employees steal the items the retail setting is trying to sell.

Theft of money from the cash register: Employees take money out of the register.

Sweetheart deals: Employees give friends and family members unauthorized discounts.

Crimes in the Hospitality and Entertainment Industry.

In considering crimes in the restaurant industry, two broad categories of crime can be highlighted:

crimes by the restaurant against consumers and crimes by workers against the restaurant. In her review of crimes by businesses, Hazel Croall (1989) identified four types of crimes committed by restaurants against consumers:

(1) adulterating food

(2) failing to keep the restaurant as clean as required by standards

(3) using false advertising to describe goods and prices

(4) selling food at a smaller amount than advertised (short weighting). Restaurants appeared to be over-represented in “hygiene” offenses in her study.

In terms of crimes by workers against the restaurant, patterns similar to those of employee theft in retail settings are found. Surveys of 103 restaurant employees found that their most common offenses included eating the restaurant’s food without paying for it, giving food and/or beverages away, selling food at a lower price than it was supposed to be sold for, and taking items for personal

use (Ghiselli & Ismail, 1998).

Three fourths of respondents were found committing some type of employee deviance. Stealing from the cash register is an additional type of crime that can occur in restaurants.

In one case, a waitress-manager stole $60,000 from her restaurant’s cash register over a 2-year time span (Schaefer, 2003).

What is HR compliance Definition checklist best practices and key issues?

What does HR compliance mean?

How does HR protect the company?

Business impacts of fraud – what are the effects of fraud?

Range of fraud attacks – where are merchants most vulnerable?

prevalent fraud attacks, each affecting more than 3 in 10 merchants globally.

Payment acceptance and partners –how are merchants being paid?

Fraud prevention strategies –How are merchants addressing the issue of eCommerce fraud?

Business impact of fraud:key fndings

How eCommerce fraud is affecting merchants, how fraud management KPIs and investments have changed over the past year, and where merchants have been successful in thwarting fraud attacks and mitigating harmful impacts?

Fraud costs and KPIs continue to rise For the second year in a row, merchants reported across-the-board increases in multiple key indicators that measure the extent to which fraud is impacting eCommerce. From more revenue being lost to fraud to more eCommerce orders being rejected as

fraudulent to increasing chargebacks and disputes, the average fgures merchants reported for every key indicator tracked in the survey increased over the past year globally.

How Do Sales Managers Steal? Top Fraudulent Schemes

the most common (and not that common) fraudulent schemes sales managers use and we’ll tell you how you can finally catch the thief.

Spot the Differences

This is a classic scheme of double deception that works when paying for services in cash. Sales manager deliberately drives up prices during negotiations with customers. In his company the deal is carried out at face value, and he pockets the difference between the real price and the amount of money he gets from the client. As you understand, joke’s both on the client and on the company that provided the service through that manager.

Closing the deal, manager prepares two sets of documents, one for the customer, and the other for the company’s accountant. Those documents look almost the same – with one tiny difference (I bet you can guess, which one). To type different prices, manager creates his own 1C account in advance or brazenly uses the company’s account (if that’s the case, there is always a risk to be caught during audits).

Swap in 60 seconds

This way of earning dirty money is similar to the one we’ve described above. The difference is that the manager doesn’t even need to create his own 1C account. All he has to do is replace the current price in the program with a higher price, get money from the buyer and then change the price back.

A client that sells auto parts told us about this scheme. Sales manager in his store constantly changed prices and pocketed the difference. That being said, the appetite of the sales manager can grow, but the number of clients that will be ready to buy auto parts at such prices will inevitably decrease.

Unite and conquer

This is another way to steal a tasty piece of the so-called company cake (which works when paying for services in cash and with retail customers). The manager diligently works for around a month, sells merchandise, ships it, makes new deals, gives customers the documents, accepts payment in cash. Meanwhile, none of the transactions is officially carried out through accountants.

At the end of the month the manager prepares documents that depict only one wholesale transaction. As you understand, the price for wholesale clients is usually more profitable, which means that the manager collects this “lucrative client’s” discount for himself.

“Selling at cost price”

It’s a very primitive stealing scheme when the manager buys the goods “for himself” (as in with a big discount) and then resells them to the client. As a result, the buyer gets the product either at the store price or at a slightly lower price.

The company doesn’t bear significant losses, but the result is still the same: the manager pocketed the difference, which makes him a thief.

Chinese Market

This scheme is relevant in stores with a wide range of products. It works when the sales manager is quite cocky and the customer doesn’t really know what he wants to buy.

Manager sells cheap Chinese products, but on the paper it’s described as expensive. He tries to find a decent knockoff, because the client may ask questions if the product breaks too soon and, as a result, the lie may be exposed.

Kickbacks

There are several types of Kickbacks.

Double kickback. It’s possible when the transaction involves a manager on both sides. Let’s suppose your company sells some type of service for $1000. The manager on the buyer’s side puts the price of $1100, and the sales manager indicates the price of $900 (a supposed discount). As a result, both managers pocket $100 each.

Discount. Sales manager negotiates a good discount for his customer, having previously agreed with the customer that he will receive interest from it. Such scheme is popular between companies with long-term relationships.

Cutting. When purchasing an item, the supply manager asks the purchasing manager to describe in the invoice an item with similar characteristics (that are difficult to compare), but much more expensive. Managers split the difference between the real and the stated price.

Simulation. Sales manager makes a deal and waits for cash payment. Then he says that partners demand a kickback. At the same time, manager claims that the clients only want to communicate with him since they already trust him. The company doesn’t want to lose neither profit nor clients, so they agree to pay kickback.

Unfortunately, kickbacks are an integral part of business processes of many former USSR countries. And it doesn’t look like the situation will change any time soon. But it’s one thing when the company management knows about the upcoming spending plus it may somehow benefit the company, and it’s another thing when the money settle in the sales manager’s pocket.

Leaking client base

Sometimes managers don’t need to steal money from the cash register or by receiving kickbacks – they can make money on the client base. Unscrupulous manager can sell contacts to competitors. “Advanced” fraud can even poach clients to his own “grey” firm.

How can you identify a stealing employee?

There are a lot of “traditional” methods to identify a fraud. You can listen to rumors (there is a possibility there will be someone in the company who knows about the manager’s exploits), control prices (by monitoring employees’ expenses), pay attention to detail (special attention to the employees’ quality of life or where they hold meetings, for example).

We’ve described the story how a dirty sales manager was caught in one of our client cases.

We should mention that we have nothing against sales managers, and we truly believe that the vast majority of these professionals are honest people. However, if at least one out of ten managers turns out to be a thief, the company could suffer significant losses.

Employees are fine with deceiving customers and their own employers, because “that’s what everyone does” and they manage to get away with it? The company that has a monitoring system will be able to monitor and have control over everything that happens during working hours. Not only will you find the thief, but you will also be able to prove his guilt easily.

Classification of White Collar Crimes

Ad hoc crimes: In this category a person or the offender pursues his own individual objective having no face-to-face interaction with the Victim. E.g. Credit Card frauds, hacking, etc.

Bribery: When money, goods, services or any type of information is offered with intent to influence the action, opinion and decisions of the taker, constitutes Bribery.[4]

Embezzlement: When a person, who has been entrusted with the money or property, appropriates it for his or her own use.

Counterfeiting: Copies or imitates an item without having been authorized to do so.[5]

Forgery: When a person passes false instruments such as cheque.[6]

Tax-evasion: frequently used by middle class to have extra-unaccounted income.

Professional Crime: Crimes committed by Medical practitioners, Lawyers in course of their occupation.

Fraud: In a broadest sense, fraud means, an intentional deception made for personal gain or to damage another person or entity. Fraud is defined in both criminal as well as civil code.

“FRAUS OMNIA VITIATE”

“Fraud violates everything”

Under Indian Contract Act, 1872

Fraud’ defined.—‘Fraud’ means and includes any of the following acts committed by a party to a contract, or with his connivance, or by his agent1, with intent to deceive another party thereto or his agent, or to induce him to enter into the contract:

- the suggestion, as a fact, of that which is not true, by one who does not believe it to be true;

- the active concealment of a fact by one having knowledge or belief of the fact;

- a promise made without any intention of performing it;

- any other act fitted to deceive;

- Any such act or omission as the law specially declares to be fraudulent.[7]

Under Indian Penal Code, 1860

‘Fraudulently’ means, a person is said to do a thing fraudulently if he does that thing with intent to defraud but not otherwise.[8]

Corporate Crimes

A corporate crime or fraud occurs when a company or an entity deliberately changes and conceals sensitive information which then apparently makes it look healthier. Companies adopts various Modus-operandi to commit such corporate frauds, which may include misrepresentation in prospectus, manipulation of accounting records, debt hiding, etc.

Types of Corporate Fraud

Fraudulent Financial Statements

Employee Fraud

Vendor Fraud

Customer Fraud

Investment Scams

Bankruptcy Fraud

Misappropriation of Assets

Corruption

(Common element is Deceit and Trickery).

Financial Fraud includes,

Manipulation, falsification, alteration of accounting records.

Misrepresentation or intentional omission of amounts.

Misapplication of accounting principles.

Intentionally false, misleading or omitted disclosures.

Misappropriation of Assets includes,

Theft of tangible assets by internal or external parties.

Sales of proprietary information.

Causing improper payments.

Corruption includes,

Making or receiving improper payments.

Offering bribes to public or private officials.

Receiving bribes, kickbacks or other payments.

Aiding and abetting fraud by others.

A global review on retail theft.

56% of Small Businesses Have Dealt with Shoplifting This Year

Over half (56 percent) of small businesses in the retail sector say they have been victims of shoplifting in the past year, according to a new survey released by the US Chamber of Commerce.

Employee Sues Kroger after Mass Shooting

A Kroger employee who was shot the day a recently fired employee of a contracted sushi company inside of the store opened fire at a Collierville, Tennessee Kroger is suing the company for a total of $10 million.

Video Shows Thieves Attacking T-Mobile Store in Smash-and-Grab

Customers at a T-Mobile store in California were caught up in a smash-and-grab robbery that was captured on camera. The incident involved three thieves stealing phones worth thousands of dollars during business hours.

Counterfeit Medications Taking Over the Internet

At this particularly dismal moment in digital history, the web’s most devious characters are not merely phishing scammers looking to con you into sharing your credit card info, but rather, more seemingly innocuous players: online pharmacies.

Retailers Are Adding More Security Guards to Stores

One night in April, thieves entered a Gristedes grocery store on Manhattan’s Upper East Side and bound two employees with zip ties at gunpoint before stealing thousands of dollars in goods. In response, they bulked up security.

Ex-Employee Scammed $1.3M from NJ Car Dealership

An Ocean County, New Jersey man has been accused of ripping off an auto dealership where he used to work, pocketing over one million dollars in a billing scheme.

What is a Sales Employment Agreement?

A sales employment agreement is a binding agreement between the employer (company/individual) who wishes to engage or employ an individual (prospective employee or prospective individual contractor) to act as sales representative for the employer.

A sales employment agreement is a ‘species from the ‘genus’ of ‘Employment Agreement’ i.e, a specialised category of employment agreement. To provide a brief understanding, an employment agreement is nothing but a contract describing the rights and obligations of the Employee and the Employer for the course of the employment.

Though an Employment Agreement is nowhere defined under Indian Contract Act, 1872 (“ICA”) but can still be interpreted by certain sections of the ICA; Code on Wages, 2019; Shops and Establishment Acts (State-specific); Payment of Gratuity Act, 1972; Articles of Indian Constitution etc.

The sales employment agreement is drafted to set out rights and duties or terms and conditions for both the parties before the initiation of the employment period by the sale representative. These ‘terms and conditions’ range from:

JD (Job Description);

Working hours;

CTC (Cost to the Company);

Commission/ Appraisal cycle or/and;

Fringe Benefits of the sales representative.

Who are the parties to the agreement?

The sales employment agreement will be executed between two parties:

The employer, and

The employee/individual contractor who will be appointed as the sales representative for the employer.

Note: The parties and the no. of people signing the agreement are different terminology, and can resonate between human resource manager, immediate supervisor, or the owner of the company depending upon the organisation structure and policies.

Before signing the agreement, the parties will need to satisfy the competency provisions provided under Section 11 of the Contract Act, 1872 and the establishment of a valid agreement is contingent on fulfilling the essentials of a valid contract.

Why is a sales employment agreement given its due importance?

The reason to have a sales employment agreement in place is quite similar to need for executing an employment agreement. As an employment contract is a legally enforceable document (condition precedent of getting it appropriately stamped in accordance with Section 17 r/w Section 2(14) of Indian Stamp Act, 1899) stipulating within it the foundation of an employer employee relationship. The sales employment agreement is also a bilateral agreement which becomes legally enforceable and provides damages in cases of breach of the ‘terms and conditions’ stipulated in the contract. In addition to recording the aforesaid legal intention, the sales employment agreements also recognize the rights, expectations, and obligations of both the employer and the employee and, hence providing clarity.

What purpose does this kind of agreement solve?

An employment agreement is drafted to tackle the issues of white-collar crimes and breach of contractual covenants. Today we are quickly moving towards a knowledge-based economy, in turn, giving rise to white-collar employees. This rise is coupled with complex set of disputes between the employees and employer ranging from:

At will termination;

Non-solicit and non-compete covenant breach;

Non-compete or breach of confidentiality post-termination.

To reduce the legal cost in case of a dispute, it is highly advisable to have an employment agreement in place. Hence the nature of work done by a sales representative involuntarily demands a sales employment agreement drafted and executed within the frames of law.

Important clauses that should be incorporated in such an agreement

Certain key clauses required under a sales employment agreement are mentioned as follows:

Job Specific Terms

Job Title: What will be the job title of the employee? Will the employee be called as a “Sales representative” or “Sales Manager” or “Sales Executive” or “Travelling Sales Executive”? Each terminology carries with itself different set of duties and roles assigned to the sales representative.

Job Description or Description of Duties: At times referred to as JD, the present clause shall describe positive and negative covenants imposed on the sales representative. One should be aware that it is not adequate, just to assign a title for the job, as title of an employee are at times reflective in nature. The titles portray rather than conveying what the duties of the employee comprises of.

Job description clause is synonymous of obligations imposed and come handy during disciplinary proceedings, termination, or while deciding the CTC in regard to the employee. The present clause provides references to the kind of employment sought after by the employee and the employer. Whether the sales representative is in working in temporary capacity i.e, commission based with no regular employee benefits (or fringe benefits) like paid leaves, or the employment is of permanent in nature with various benefits like gratuity, paid leaves etc granted to the employee.

Closest examples: As what all products/service the employee will the sales representative be dealing with or the method that sales representative should preach during sales pitch.

A way to spot a poorly drafted JD clause would be to look for the ‘open ended’ clause structure e.g, ‘the employee shall perform such duties and functions that the sales heads of the company shall bestow on him/her/they.’ In the quirk of looking gender neutral, the clause is open-ended in nature.

Certain loopholes that arise from the worded document.

What is the product or service that the company deals with?

What are the duties and functions of the employee? Will the employee be made to do clerical and unrelated sales work also?

What if the position of the sales head is vacant in the company? What is the recourse then or POA (Plan of Action)?

Will the employee report to both the ‘sales heads’ of the company? Who carries superiority in case of a dispute?

Unless the above-stated clause is cross-referenced with company policies or defined under a schedule, a poorly drafted employment agreement possesses all the essentials for baking a potential labour law dispute. This will then churn higher more legal cost along with maligning goodwill of the company.

Compensation or CTC: A sales representative compensation/cost to the company runs on two-fold mechanism:

Regular/base salary: This remuneration provides a sense of security to the sales representative. The minimum amount of income which the sales representative will net per cycle (as defined under the terms of the agreement or company policies) needs to be stipulated under the employment agreement. The present clause is generally stipulated on the precedent condition of meeting the monthly/quarterly/yearly quota of the company.

Commission or Bonuses: Few people who enter into ‘sales’ are charmed by the ‘no cap’ commission or bonus clauses in their employment agreements. The present clause should focus on the percentage (%) of income the employee would be able to encash on a given no. of sales confirmed. These clauses can be formulated to record if the commission or bonus provided will be on the basis of

No. of customer acquired from the sales or

No. of overhead/extra sales made in comparison to monthly/quarterly/yearly sales quota or

No. of services/sales made within a given time period in comparison to the colleagues’ performance etc.

References to Company Policies

A sales employment agreement cannot in itself be a complete and sole document to encompass the necessary information required by the employee to perform his/her functions. Hence it is considered necessary to contain a reference clause so that silence of certain terms and conditions do not give rise to a loophole waiting to be exploited.

Restrictive Covenants

Non-Compete and Non-Solicit clauses

Section 27 of the Indian Contract Act,1872 prima facie declares any agreement barring an individual’s fundamental freedom of right to trade and profession, guaranteed under Article 19(1)(g) as void, pro tata, except in the case specified in the exception. But the apex court in Niranjan Shankar Golikari vs the Century Spinning and Manufacturing Company Ltd. Ltd.(1967 AIR 1098) and various other precedents has allowed the enforceability of these negative covenants in the light of ‘public interest’, subject to the following principles:

Reasonable and necessary for the purpose of trade

Not excessively harsh or

Conscionable nature of these covenants

Under a sales employment agreement, it is advisable to include non-compete clauses which are drafted to look reasonable in nature and do not blatantly depict abuse of position by the employer. As courts have from time and again looked out for the interest of the employee who possess a lower bargaining powers during the execution of employment agreements. A non-compete clause under a sales agreement clause will act as deterrent for the sales representative to open up a shop just around the corner and exploit the trade secrets and skills acquired during his employment.

Calcutta High Court in Embee Software Pvt. Ltd. vs Samir Kumar Shaw & Ors. (AIR 2012 Cal 141) had noted the need of non-solicit clause to protect clients’ information and held that “…acts of soliciting committed by former employees take such active form that it induces the customers of the former employer to break their contract with the former employer and enter into a contract with the former employee, or prevent other persons from entering into contracts with the former employer cannot be permitted”

Termination

It is said that termination of an employee is the hardest form of goodbye as it has the potential of boomeranging itself into a full-fledged court battle for wrongful termination. The underlying relationship between an employee and employer will set forth the need for establishing a proper termination procedure that complies with state and national regulations alongside principles of natural justice:

Nemo Judex In Causa Sua.

Audi Alteram Partem.

It becomes necessary for a termination clause in a sales employment agreement to contain clauses drafted in accordance with respective statutory regulations, e.g,

Delhi Shops and Establishment Act, 1954 guarantees 1 months’ notice period to an employee, employed or a period of 3 or more months in the present establishment.

Whereas in Bihar Shops and Establishment Act, 1953 guarantees 1 months’ notice period to an employee, employed for not less than 6 or more months in the present establishment

Sample Sales Employment Agreement

Sample Sales Representative Agreement

This Agreement for Sales Representative [“Agreement”] shall be executed on …………[date] of ……… [month & year] [company]

BETWEEN:

…………………………… [company] whose registered office is at ……………………………

[address, place] and registration no. is……………………………, represented

by ………………………………………………………………. [name, position] (hereinafter referred to as “the Employer”)

Mr./Ms. ……………., of legal age, ……………………….., Identification Number…………., registered address ……………, acting on his/her own behalf (hereafter shall be referred to as “Agent” or “Employee).

THE PARTIES AGREE AS FOLLOWS:

The Parties hereby in pursuant of the present agreement agree:

1 SERVICES

1.1 The Company shall engage Sales Representative to sell and promote as its authorized

……… [temporary or permanent] the following products or services of the Company, which may be changed by the Company for time to time:

……………………………………………………………………………………………………………………………………………………………………………………….(the “Products”).

1.2 The Company shall, be in its sole discretion, able to determine the sales price and terms of sale for the Products.

1.3 Sales Representative, except as directed by the Company, shall determine the method, details, and means of performing the services described above; however, the Employee agrees to devote a minimum of……………….hours per week to said services.

1.4 Sales Representative also shall periodically or at the Company’s request, submit documentation of the services performed by the Sales Representative on behalf of the Company pursuant to this Agreement. From time to time, the Company may also establish performance goals for Sales Representative, and the failure to reach such performance goals may be cause for termination of this Agreement.

2 TERRITORY

2.1 The Sales Representative will sell and promote the Products in the following geographical area, which may be changed from time to time by the Company:

…………………………………………………………………………………………..[parts of Indian territory where the Sales Representative will promote/sell the Products]

3 COMPENSATION

3.1 For services provided, the Company will pay Sales Representative the following commission percentage: ……. % of the Sales Representative’s invoiced sales price

3.2 Payment of the Commission by the Company to the Sales Representative shall be due

……….. days after receipt of payment by the Company of the underlying invoice.

4 LEAVE POLICY

4.1 The Employee is entitled to ………… (…….) days of paid casual leaves in a year and ……………._ (…………….) days of sick leave. In addition, the Employee will be entitled to ……………. (__) public holidays mentioned under the Leave Policy of the Employer.

4.2 The Employee may not carry forward or cash any holiday to the next holiday year. c. In the event that the Employee is absent from work due to sickness or injury, he/she will follow the Leave Policy and inform the designated person as soon as possible and will provide regular updates as to his/her recovery and as far as practicable will inform the designated person of the Employer of his/her expected date of return to work.

5 REPRESENTATION AND WARRANTIES

5.1 The Company has offered you employment relying on the representations and warranties made by you as set out below:

1. He/she has not been convicted for any offence and/or does not have any legal proceedings pending against him/her involving moral turpitude before any courts of law in the country and that he/she is not restricted by way of any order/directions from any statutory authorities to be employed with the Company.

2. He/she has carefully read and fully understands all the provisions of this Appointment Letter.

3. By entering into this Appointment Letter or performing any of the obligations under it, he/she will not be in breach of any court order or any express or implied terms of any contract or other obligation binding on you. Further you undertake to indemnify the Company against any such claims, costs, damages, liabilities, or expenses which the Company may incur if you are in breach of any such obligations.

4. In the performance of your obligations, he/she will not utilize or make available to the Company any confidential or proprietary information of any third party or violate any obligation with respect to such information; and

5. He/she has never been suspended, censured, or otherwise been subjected to any disciplinary action or other proceeding, litigation, or investigation by any state or governmental body or agency or any regulatory authority or self-regulatory organization.

6. He/she is fully aware of his obligations under this Agreement including, without limitation, the reasonableness of the length of time, scope and geographic coverage of these covenants, and g. the information/ documents submitted by him/her in relation with his employment with the Company are true, accurate and correct and not misleading in any manner.

6 CONFIDENTIAL INFORMATION

6.1 You understand that during the course of your tenure that you will have access to Confidential Information of the Company. You shall be obligated to use the Confidential Information only for the purpose of performing your duties. You shall at times, during the term of your employment and at all times, thereafter, keep confidential and secure the Confidential Information. The term “Confidential Information” as used in this Appointment Letter means any data, information, or knowledge about the Company or its customers, prospective customers, and/or suppliers that you have access to and is not generally known or available to the public and which is or should reasonably be understood to be confidential or proprietary information and will include but not be limited to:

a. the terms of this Agreement;

b. the Company’s business or operational plans or activities, existing or contemplated markets, advertising initiatives, methods of operation, products, or services;

c. the Company’s financial projections, including but not limited to, annual sales forecasts and targets and any computation(s) of the market share of customers and/or customer prospects;

d. the Company’s dealers, channel partners, suppliers, sellers, customers, prospective customers, or logistics data;

e. the Company’s customer, dealer, channel partner or supplier lists, cost of goods or services, profits and losses, budgeting, past or future sales, or financial information;

f. the account terms and pricing upon which the Company obtains products and services from its suppliers;

g. the terms and pricing of services rendered by the Company to its customers;

h. the Company’s existing or contemplated designs, technical systems, models or platforms, formulas, research, notes, or analytical data;

i. the Company’s employees, salaries, job related functions, duties or responsibilities; and

j. the Company’s Intellectual Property.

You accept and acknowledge that all application data, documents, written presentations, brochures, drawings, memoranda, notes, records, files, correspondence, manuals, models, specifications, computer programs, e-mail, electronic databases, maps, drawings, architectural renditions, models and all other writings or materials of any type including or embodying any Confidential Information shall be deemed Confidential Information and be subject to the same restrictions on disclosure applicable to Confidential Information pursuant to this agreement. You accept that this obligation to not disclose Confidential Information will remain in effect and survive the termination of this agreement.

7 Non- Solicitation of Customer and Vendors

7.1 You accept and agree that during the term of your employment with the Company and for [1 year] after the termination thereof, regardless of the reason for the employment termination, you will not, directly, or indirectly solicit or attempt to solicit any customer, prospective customer, supplier, representative, agent or business contact of the Company. You acknowledge that the above restrictions are considered reasonable for the legitimate protection of the Confidential Information, business, and goodwill of the Company.

8 Notice Period for Termination

8.1 If at all circumstances arise wherein you prefer to leave the employment with the Company, then you shall be under a strict obligation to submit a resignation providing a notice period of 1 (One) Month with your reporting manager and/or requisite salary in lieu thereof and follow the exit formalities as would be applicable as per the policies of the Company at that particular point of time. The Company may terminate your employment with a prior notice of 1 (One) Month to you and/or in lieu of salary thereof.

AUTHORIZED SIGNATORY

…………………………..(name)

Place:

Date: XX-XX-XXXX

A Sales Representative Agreement carefully captures the employee-employer relationship in black and white ink. The need for such an agreement is always recommended, and more so in the post COVID-19 world. As the demand for promoting unique products in the FMCG or Consumer Durable or Industrial Raw Material or Investment Good sector rises, a carefully and well-drafted sales employment agreement helps the employee or employer reduce the legal risk attached to it.

Being formulated from the genus of “employment agreement” a lot of clauses present, shall be standardised in the sales employment agreement as well.

In the present manuscript, I have tried to bring together certain nuanced clauses and provide a rudimentary insight for the readers in regard to:

- Employee-Employer relationship.

- Purpose of such agreements.

- Job Description/JD clauses.

- Non-Solicit & Non-Compete clauses.

- Judicial and Legal standing for it.

- How a Sales Representative Employment Agreement looks like.

I would close the present manuscript by quoting my marketing professor that would be quite relatable for people connected to the sales industry:

“Sales is never a numbers’ game; it is always a people’s game. Hence, to win the market you must win the people first.”

What are the six major human resource control techniques?

What are some of the key regulations that human resources must manage compliance with?

What are the three most important legal issues in human resources management?

Workplace Discrimination Laws.

Wage and Hour Laws.

Employee Benefits Laws.

Immigration Laws.

Workplace Safety Laws.

Keep on top of payment trends, stay ahead of fraudsters

Every year, Cybersouce and the Merchant Risk Council compile the Global Fraud and Payments Report. Based on extensive research in key markets, it outlines the major trends in payments technology and fraud.

The nature of crime in lower-class occupations, in this chapter, attention

was given to the crimes occurring in the following systems.

Employee theft in the retail system.

Crimes in the entertainment service system. Fraud in the sales/service system and insurance

companies.

Several different varieties of employee theft in retail settings occur. Here are some examples: overcharging, shortchanging, coupon stuffing, credits for nonexistent returns, theft of production supplies and raw materials, embezzlement, over-ordering supplies, theft of credit card information, theft of goods, theft of money from the cash register, and sweetheart deals.

Employee theft prevention strategies include,

(a) importation strategies, (b) internal strategies, (c) technological strategies, (d) organizational culture strategies, and (e) awareness strategies.

In considering crimes in the restaurant industry, two broad categories can be highlighted: crimes by the restaurant against consumers and crimes by workers against the restaurant.

The most common types of home repair fraud are believed to be roof repair, asphalt paving or driveway sealing fraud, house painting fraud, termite and pest control fraud, and tree pruning and landscaping fraud.

Auto repair fraud includes billing for services not provided, unnecessary repairs, airbag fraud, and insurance fraud.

Insurance crimes are rarely studied for two reasons:

(1) They are hard to understand, and (2) people don’t typically know when they have been victimized by insurance crimes (Ericson & Doyle, 2006).

Four different categories of insurance crimes by workers in the insurance system exist:

(1) crimes by agents against the insurance company, (2) investment-focused crimes, (3) theft crimes against consumers,and (4) sales-directed crimes against consumers.

Tail Piece.

Fmcg Industry crimes are institutionalized in the industry by the practices and strategies encouraged among employees.

Top most festival Products FMCG consumers search today

World Wide Festive Trends Decoded What Indian festive consumers seek...

Read MoreHow right selection of FMCG Salesmen improves brand market share

How can FMCG Companies improve salesman’s technique in order to...

Read MoreHow most searched Fmcg sales and marketing words help newbie salesman

Why undestand FMCG sales management? Sales management is the process...

Read MoreHow Successful FMCG Salesman Starts his Day, a guide

How does one become a good sales executive in the...

Read More

Pingback: What is the Airline Catering Services industry in the world?

Pingback: How to control costs and make Food Catering Profitable

Pingback: How Gourmet Cooking means Top class Food with Flavour Smell of origin - DigitalGumma

Pingback: ASIN+MPN+Universal Product Code+Bar Code+Serial Number=SKU