Fast Moving Consumer Goods, Sales Post Covid.

FMCG INDUSTRY SALES... POST COVID.

Fast Moving Consumer Goods, Sales Post Covid.

We eagerly wait at the threshold of a dawn, for the brightest Sunrise on the economic horizon.

We will all wait unwittingly for a long haul with patience, in sync with body mind and soul.

We will wait for more jobs to come by and salaries be paid on time.

We will wait for production supply and demand to improve.

We will also wait to fulfill our targets, dreams and commitments.

The tide is bound to turn… and while its churning we wait.

The Endemic of the Corona Virus Will Come To An End.

Following extracts from blogs give us a hope to dream big, leapfrog ahead.

Read on…

Rest assured… the only way is the way forward.

In hindsight, COVID-19, lock downs, no travel, no sporting events, the list can go on and on….

And …It just seemed that all good news was BANNED by the mainstream media those days!

The truth is …the media must’ve missed perhaps the most important story of the year.

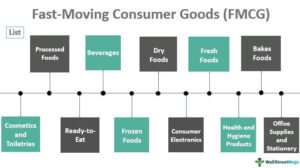

Fast-moving consumer goods (FMCG), also known as consumer packaged goods (CPG), are products that are sold quickly and at a relatively low cost.

The pandemic has taught the brand Manager to prepare for the unexpected.

The fear of contracting the virus by going out made brands to rethink, realign.

Online shopping platforms opened up their services to deliver 24*7 and people started hoarding daily essentials.

Many FMCG brands partnered with e-commerce platforms like Amazon, Dunzo, Flipkart, Grofers, Big Basket, etc to deliver within the comfort of consumers’ homes.

Click to read about Nifty Fmcg stock market.

During COVID ‘immunity’ became the buzzword in the FMCG industry. Marketers reverted by launching ready-to-eat meal options and immunity-based packaged goods.

Retail and Modern Trade devised ways to counter shortage due to supply with in house brands and Private labels.

The demand for Sanitizers, Health and Hygiene, Ready to Eat, Biscuits Ready Mix pouches grew beyond 300%.

Consumers Lapped on to any Product or brand available. Price, Date of Manufacture and Packing remained important, Panic buying and the will to experiment with new products and brands has further expanded the product category.

New Sku’s and variants to existing product mix became the way to satisfy the captive target audience. Brands and Private labels capitalized on the urge to spend and experiment.

Today the so called Private labels, Private brands or local brands have surged into the mainstream. Established brands under cross fire have begun to rework, reinvent and re brand their products.

FMCG Sales has revived in Indian hinterland while lagging and meandering in the Urban areas.Rural India still breathes life and hope into FMCG.

However, with COVID vaccine now a reality, consumer sentiment is already picking up and the economy is in revival mode, 2021 will augur well for small retailers to increase sales.

According to Nielsen India, after an unprecedented decline of -19% in the Jan-Mar quarter, FMCG industry displayed signs of recovery in Q3’20 with a 1.6% growth (versus Q3 ‘19).

In 2020, rural markets outperformed urban India and became critical for FMCG giants. Brands relied on rural markets to drive growth during the trying times. FMCG witnessed a double digit growth of 10.6% in Q3’20 in Rural India, while the bigger cities (>1 Lakh population including metros and Town Class 1) played catch-up.

Pre-Post Covid, with immunity being the ‘new normal’, new launches have been made in the health and hygiene basket including categories like hand sanitizers, floor cleaners, toilet cleaners, antiseptic liquids. These new launches contributed to 37% (in value) of all new launches in the COVID period (Nielsen India).

Top Strategies and Challenges for 2021.

The 2020 pandemic was an unexpected stress test for retail supply chains.

Sky-high demand for food and essential products stretched retail systems to the breaking point.

Adding to the pressure, non-essential stores were forced to close.

Those that remained open were required to implement social distancing rules that created long lines and reduced shopper access to stores.

The result was a historic shift by consumers to e-commerce and online ordering for store pickup.

This, too, added stress to the supply chain, especially in such areas as shipping, fulfillment and last-mile delivery.

However, e-commerce also offered a lifeline to retailers, one that enabled them to conduct business during a crisis.

Retailers with advanced e-commerce and omni-commerce systems, or who could scale them quickly, registered booming revenue in 2020.

FMCG sector in India is expected to report a 4-5% volume growth in FY21, driven by rural areas that are expected to grow two percentage points ahead of the urban regions that are hit harder by COVID-19 pandemic.

Nestle India Ltd. is exploring options to sell directly to consumers as the pandemic forced people to turn to the internet to buy everything from staples to medicines. It is actively evaluating (direct-to-consumer) at the moment because of a wide portfolio across categories… and D2C could be a good platform.

Field sales professionals of an FMCG company act as a mouthpiece of the company as well as retailers and so play a crucial role in increasing market coverage effectiveness.

They provide relevant information to the FMCG management about the POS matters that affect consumer influence and simultaneously provide crucial information to the retailers about the product.

A report reveals that “60% of Fast Moving Consumer Goods (FMCG) sales can be influenced at the store level”—as published on nielsen.com. The data clearly shows how FMCG managers can channelize their field sales resources in influencing consumer decision.

The biggest impact in FMCG food is the shift among the consumers from loose and unbranded to trusting packed food and affordable brands in Tier II and III. There, people have come from loose to smaller packs and brands.

The demand in high end consumer products will grow as much now. There’ll be a tremendous increase in demand for branded FMCG products that are affordable, available in smaller packs and mainly cater to Tier II III cities. For the past two years Amul has been trying to reach towns with 10,000 populations and cover 15 to 20 bigger villages around those towns. Currently, working with 10,000 distributors, covering 50% of these 10,000 population towns in India.

Today’s young ‘woke’ consumers were already moving away from the excesses of consumerism and leaning towards sustainable conscious brands before the pandemic and lock downs hit their lives.

The all-round strain of the pandemic from volatile job markets and a possible looming global recession to health and environment concerns; along with the way lock downs were framed as health versus economy predicaments—as if one has to be sacrificed for the other—has left many questioning the very basis of our consumer-driven economy.

Consumers had to face economic stress which made them more discretionary in their consumption choices. Our virtual connects with over 450 consumers amidst the lock down made it clear that items which they do not deem to be too essential are unlikely to find a place in their shopping carts.

When a brand is perceived to have a strong Purpose, consumers were four times more likely to purchase from the brand and 95% of surveyed Indian consumers were likely to continue to support brands.

While newbie consumer goods makers such as Meatigo, Beardo and Bombay Shaving Company have mostly opted to sell directly to consumers online, most incumbents still sell more than 80% of their goods through traditional trades or distributors. ITC Ltd. is one large player that that set up a portal during the lockdown.

In the second wave, however, the narrative has shifted towards building brand equity, even as digital platforms remain a primary channel of communication.

“Brands want to contribute with empathy in the current scenario, and continue being in the customers’ minds without actually trying to sell a product. This way, brands will also build goodwill in the long run. So far, luxury retail had revolved around instant gratification and sales, and pivoting their business to post-pandemic life,”.

The pandemic offered brands the push they needed to pivot to more digital engagement. It was also viewed as an opportunity for brands to democratize from a business standpoint, while discovering ways to engage with customers.

Take-aways for 2021 and Beyond, Retailers have learned a great deal from the chaotic year of 2020. Based on those tough lessons, they are currently in the process of re-evaluating their retail supply chains and instituting changes that will deliver new levels of agility and responsiveness. A historic shift by consumers to e-commerce is motivating retailers to move towards buying products online as a safer alternative. Lets delve and dive into E Commerce in our next blog coming out soon.

We remain indebted to all Blogs used as reference and for perspective . Our Sincere Thank You To All From FMCG Sector.

Team DigitalGumma.

Top most festival Products FMCG consumers search today

World Wide Festive Trends Decoded What Indian festive consumers seek...

Read MoreHow right selection of FMCG Salesmen improves brand market share

How can FMCG Companies improve salesman’s technique in order to...

Read MoreHow most searched Fmcg sales and marketing words help newbie salesman

Why undestand FMCG sales management? Sales management is the process...

Read MoreHow Successful FMCG Salesman Starts his Day, a guide

How does one become a good sales executive in the...

Read More